How Does the Forex Market Work? (Participants, Pricing & Execution)

The forex market sets the price of one currency against another. It runs 24 hours a day, five days a week. Banks, funds, companies, brokers, and traders all compete for liquidity. Their orders shape spreads, volatility, and execution quality.

This guide breaks down how forex works at the trade level. You will learn who the main participants are and what each one does. You will learn how currency prices form from bid and ask quotes, order flow, and liquidity. You will learn how trades execute, including market and limit orders, fills, and common sources of slippage. For key terminology, see what are pips in forex.

Key Takeaways

Key Takeaways

- In het kort: Forex is a decentralized market where prices come from live bid and ask quotes across many venues.

- In het kort: The main players are banks and liquidity providers, brokers, funds, corporates, and retail traders, each with different goals and time horizons.

- In het kort: Your tradable price is the spread, the difference between bid and ask, and it changes with liquidity and volatility.

- In het kort: Execution depends on order type, market orders prioritize speed, limit orders prioritize price.

- In het kort: Slippage happens when available liquidity changes between order send and fill, it increases in fast markets and around news.

- In het kort: You manage trade quality by watching spread, depth, and fill speed, and by trading liquid pairs and active sessions.

- In het kort: Use pips to measure price movement and costs, see what are pips in forex.

What Is the Forex Market (and What ‘How It Works’ Really Means)?

Definition: what the forex market is

The forex market is the global marketplace where you buy one currency and sell another.

People and institutions do this to move money across borders and manage currency risk. The core uses stay the same:

- Trade: importers and exporters convert currencies to pay invoices.

- Investment: funds convert currencies to buy foreign assets and repatriate returns.

- Hedging: businesses and investors lock in or reduce exposure to exchange rates.

- Speculation: traders take directional views to profit from price moves.

“How it works” means three things you can measure in your trading: who provides prices, how those prices form, and how your order gets executed.

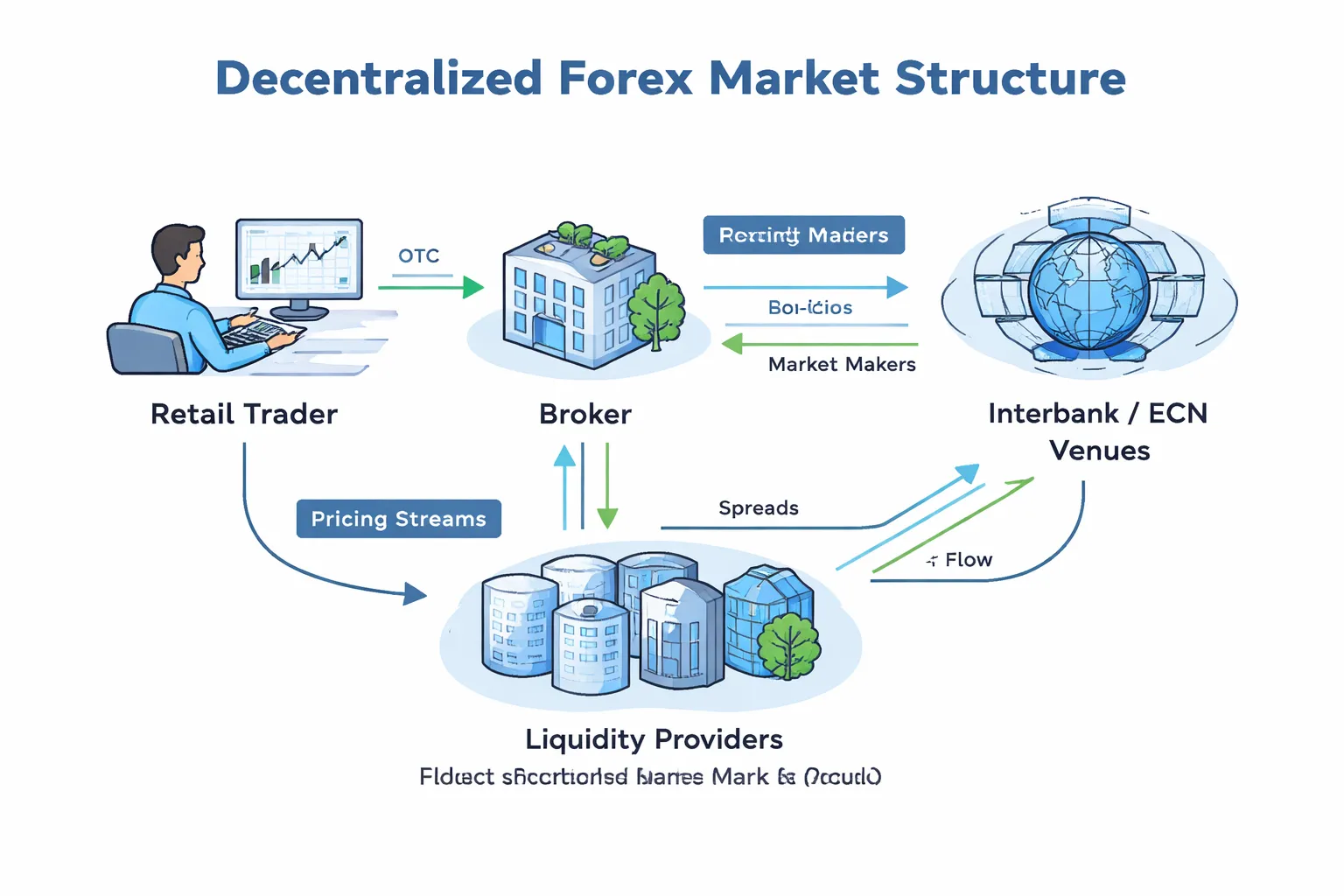

Decentralized structure: OTC, not a single exchange

Forex is an over-the-counter market. It has no central exchange for spot FX.

Banks, non-bank liquidity providers, and electronic venues stream quotes and trade with each other. That network creates the best available prices at any moment.

Retail traders typically do not access the interbank market directly. You trade through a broker that routes your order to liquidity providers or internalizes it, depending on the broker model and your account type.

Spot vs derivatives: why most retail “forex trades” are not currency delivery

Spot FX is the exchange of currencies with standard settlement, usually T+2. Large institutions use it to fund real payments and hedges.

Many retail forex positions do not involve physical delivery of currency. You usually trade a derivative that tracks FX prices, such as a CFD or a rolling spot contract. Your profit and loss comes from price changes, plus trading costs like spread and swaps, not from receiving banknotes.

Derivatives make leverage possible at small account sizes. Leverage magnifies both gains and losses, see forex leverage.

Market size: the world’s largest financial market

FX turnover sits in the trillions of US dollars per day. BIS surveys put average daily turnover above $7 trillion.

That size does not mean every pair trades with the same ease. Liquidity concentrates in major pairs and during overlapping sessions.

Liquidity: what it means in practice for you

Liquidity is the market’s ability to absorb orders without moving price much.

You see liquidity through execution conditions:

- Tight spreads: the gap between bid and ask stays small in active markets.

- Depth: more volume sits close to the current price, so larger orders fill with less slippage.

- Fast execution: prices update quickly and fills arrive with fewer partial fills or re-quotes.

When liquidity drops, spreads widen, depth thins, and slippage increases. You feel it most around major news, rollovers, and in thin sessions.

| Condition | What you typically see | What it does to your trade |

|---|---|---|

| High liquidity | Tighter spreads, stable quotes, better depth | Lower transaction cost, more reliable fills |

| Low liquidity | Wider spreads, jumpy quotes, thin depth | Higher cost, more slippage, less predictable execution |

Core Mechanics: Currency Pairs, Quotes, Pips, and Lots

Currency pairs: base and quote

Forex prices come in pairs. You always buy one currency and sell another.

The first currency is the base. The second is the quote.

Example: EUR/USD = 1.0850. It means 1 EUR costs 1.0850 USD.

- If EUR/USD rises, the euro strengthens against the dollar.

- If EUR/USD falls, the euro weakens against the dollar.

Bid, ask, and the spread

Your platform shows two prices.

- Bid, what you can sell the base currency for.

- Ask, what you can buy the base currency for.

The spread is ask minus bid. It exists because liquidity providers quote a buy and a sell price and need compensation for risk, inventory, and costs.

Example: EUR/USD 1.0849 bid and 1.0851 ask. The spread is 0.0002, or 2 pips.

Pips and pipettes: how price moves get measured

A pip is the standard unit of price change for most pairs.

- Most pairs: 1 pip = 0.0001.

- JPY pairs: 1 pip = 0.01.

A pipette is one tenth of a pip.

- Most pairs: 1 pipette = 0.00001.

- JPY pairs: 1 pipette = 0.001.

Example: USD/JPY moves from 150.20 to 150.35. That is 15 pips.

Lots, units, and why notional matters

Forex trade size gets quoted in lots. Lots translate into base currency units.

- Standard lot, 100,000 units of the base currency.

- Mini lot, 10,000 units.

- Micro lot, 1,000 units.

Notional value is your position size expressed in money terms. It drives your pip value and your profit and loss. Your deposit does not.

Example: You buy 1 micro lot of EUR/USD. That is 1,000 EUR. If EUR/USD is 1.0850, your notional is about $1,085.

Leverage can let you control that notional with a smaller margin deposit, but your P&L still moves on the full notional. See forex leverage explained.

Profit and loss basics: calculated in the quote currency

P&L starts in the quote currency because the quote currency prices the pair.

Formula: P&L (quote currency) = (Exit price minus Entry price) x Position size (base units).

Example: You buy 10,000 EUR of EUR/USD at 1.0850. You sell at 1.0870.

- Price change: 0.0020, or 20 pips.

- P&L: 0.0020 x 10,000 = 20 USD.

If your account currency is not USD, your platform converts that result at the current conversion rate.

Majors, minors, and exotics

- Majors, pairs with USD and deep liquidity, like EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, NZD/USD.

- Minors, major currencies without USD, like EUR/GBP, EUR/JPY, GBP/JPY.

- Exotics, a major currency versus an emerging market currency, like USD/TRY or USD/ZAR.

Exotics often cost more to trade. You typically see wider spreads, thinner depth, more slippage, and larger gaps around news and rollovers.

Who Participates in the Forex Market (and What Each One Does)?

Tier 1 Commercial and Investment Banks

Tier 1 banks sit at the core of spot FX liquidity. They quote two way prices, match client flow, and warehouse risk. Their dealing desks run books, manage inventory, and hedge exposure across spot, swaps, and options.

- Market making: They stream bid and ask prices to other banks, funds, and electronic venues. They tighten spreads in liquid pairs and widen them when risk rises.

- Client flow: They execute for corporates, asset managers, hedge funds, and other banks. They earn from spread, commissions, and internalization.

- Hedging books: They offset net positions using interbank liquidity, FX swaps, and options. They manage funding and roll risk through the forward curve.

Central Banks

Central banks shape FX through policy, communication, and balance sheet actions. They do not trade for profit. They trade to meet policy goals and manage reserves.

- Monetary policy: Rate decisions and guidance move expected yield differentials, which can reprice currency pairs fast.

- Interventions: Some buy or sell FX directly to slow moves or defend levels. Liquidity can thin out during intervention risk.

- Reserves management: They rebalance large portfolios of USD, EUR, JPY, GBP, and gold. These flows tend to occur through major banks.

- Fixing influence: Many institutions execute around fix windows, such as WM/Reuters. That concentrates volume and can widen spreads for a few minutes.

Corporations, Importers, and Exporters

Companies use FX to run the business. They pay suppliers, collect foreign revenue, and hedge currency risk tied to invoices and balance sheets.

- Cash flow hedging: They lock exchange rates on future receivables and payables using forwards and swaps.

- Operational exposure: They hedge margins when costs and sales sit in different currencies.

- Execution style: They often execute via banks using RFQ, algorithms, and fixing orders to reduce market impact.

Asset Managers and Pension Funds

These firms trade FX as part of portfolio management. They adjust currency exposure from global stocks, bonds, and alternatives. They focus on risk control, tracking error, and costs.

- Portfolio hedging: They hedge foreign asset exposure back to the base currency using forwards and FX swaps.

- Rebalancing flows: Month end and quarter end reweights can create predictable demand and supply in major pairs.

- Carry considerations: They may keep or reduce hedges based on forward points, hedging costs, and yield differentials.

Hedge Funds and Proprietary Trading Firms

These participants trade FX to generate returns. They take directional risk, relative value positions, or systematic exposure. They care about liquidity, financing, and execution speed.

- Macro bets: They position around growth, inflation, rates, and geopolitics, often using spot, forwards, and options.

- Relative value: They trade spreads across currencies, curves, and vol, and they exploit mispricings between venues.

- Systematic strategies: Trend, carry, value, and high frequency models drive repeatable order flow, often via algorithms.

Retail Brokers and Retail Traders

Retail traders access FX through brokers, usually via CFDs, spot FX margin, or spread betting, depending on jurisdiction. Your broker controls pricing source, execution method, and leverage limits.

- How access works: You trade on a platform that routes orders to a liquidity provider, internalizes them, or uses a hybrid model.

- Common constraints: Smaller account size, higher relative costs, and limited depth. You see this in wider spreads during news, slippage on stops, and gaps at rollover.

- Leverage impact: High leverage magnifies small price moves into large P&L swings. Read forex leverage mechanics before you size positions.

Payment Providers, Remittance Firms, and Bureaux de Change

These firms convert currencies for travel, commerce, and cross border transfers. They optimize for certainty and convenience, not tight spreads.

- Conversion needs: Card networks, remitters, and PSPs execute frequent small conversions and batch hedges with banks.

- Spread realities: You often pay a markup through a wider spread and fees. Rates can diverge from interbank prices, especially in cash and exotic currencies.

- Timing and liquidity: Off hours and low liquidity pairs increase the cost of conversion.

Prime Brokerage, Prime-of-Prime, and Liquidity Providers

This is the plumbing that moves bank liquidity into trading venues and retail platforms. It also sets who gets credit, what size they can trade, and at what cost.

- Liquidity providers: Banks and non bank market makers stream executable quotes. They manage risk and pull or widen quotes when volatility spikes.

- Prime brokerage: A prime broker provides credit intermediation and settlement. It lets funds trade with many dealers under one credit umbrella.

- Prime-of-prime: A PoP packages prime services for smaller brokers and funds that cannot access a prime broker directly. It adds a markup for credit, aggregation, and operations.

- How liquidity reaches retail: LPs quote to aggregators, the broker selects best bid and ask, then your order fills against that stream. Extra layers can mean higher spreads and more slippage when the market moves fast.

| Participant | Main goal | Typical impact on price |

|---|---|---|

| Tier 1 banks | Make markets, service clients, manage risk | Set tradable pricing, add depth in majors |

| Central banks | Policy and stability | Move expectations, can shift regimes |

| Corporates | Hedge business cash flows | Steady flow, often time based |

| Asset managers, pensions | Hedge and rebalance portfolios | Large scheduled flows, month end effects |

| Hedge funds, prop firms | Return seeking trades | Fast positioning, can amplify moves |

| Retail | Speculation and short term trading | Small per ticket, cost sensitive, execution varies by broker |

| PSPs, remittance, FX booths | Convert and transfer money | Price takers, higher spreads in practice |

| PB, PoP, LPs | Credit, routing, quoting | Determines access, spreads, and fill quality |

How Forex Prices Are Formed: Supply, Demand, and the Information Pipeline

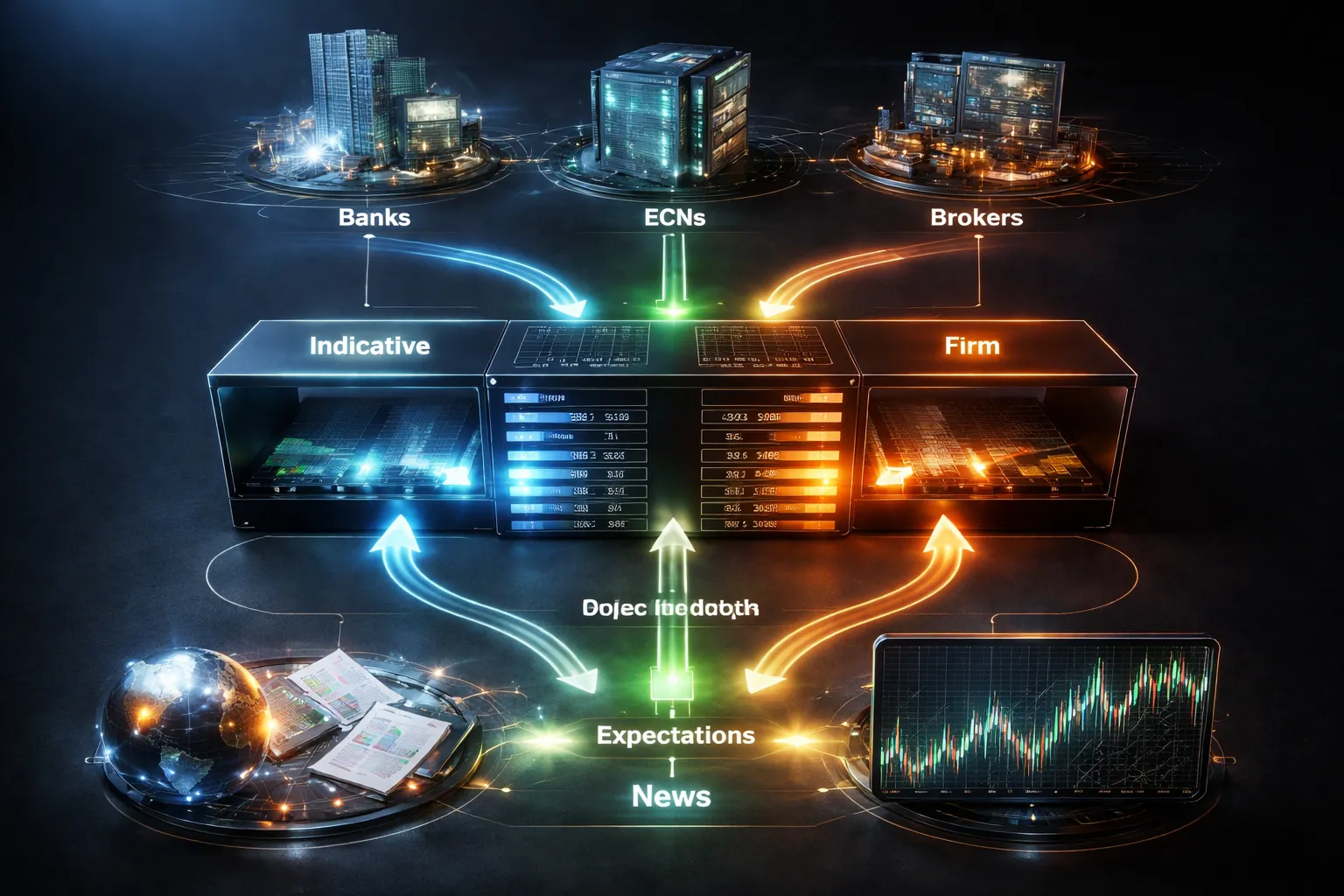

Interbank market and quoting, indicative vs firm

Forex has no single exchange. Prices form across many venues, banks, and non-bank market makers.

You will see two quote types.

- Indicative quotes. A price signal. It can update fast. It does not guarantee you can trade that price.

- Firm (tradable) quotes. A price with size. You can hit it or lift it, subject to credit limits and last look rules.

Quotes also differ by what they show.

- Top-of-book. Best bid and best ask only.

- Depth. Multiple price levels with available size. Depth matters when you trade larger tickets or during news.

Order flow and liquidity, why price moves and spreads widen

Price moves when aggressive orders consume available liquidity.

- A market buy lifts offers. Price ticks up until new offers appear.

- A market sell hits bids. Price ticks down until new bids appear.

Large orders rarely fill at one price. They sweep levels. You get slippage. The market maker may also widen the spread to control risk while it re-hedges.

Thin markets magnify this. Liquidity drops around rollovers, holidays, and session handoffs. Spreads widen because fewer firms want to quote tight prices with size. For more detail, see what forex liquidity is and why it matters.

Macro drivers, the core data pipeline

Macro sets the baseline for currency value. Traders price relative strength, relative inflation, and relative policy.

- Interest rates. Central bank policy rates and forward guidance drive expected returns and funding costs.

- Inflation expectations. CPI, PCE, breakevens, and wage growth shift rate expectations.

- Growth. GDP, PMIs, retail sales, industrial production, and credit data move forecasts.

- Employment. Payrolls, unemployment, participation, job openings, and wages feed central bank reaction functions.

- Trade and flows. Current account, terms of trade, and commodity export revenue matter, especially for AUD, CAD, NOK, NZD.

Most FX moves start as a repricing of the expected path of rates and growth, not as a reaction to a single headline.

Risk sentiment, safe havens and shifting correlations

Risk-on and risk-off regimes change which currencies traders buy for safety or yield.

- Safe havens. USD, JPY, CHF often gain when volatility spikes and funding becomes scarce.

- Risk-on. High beta and commodity-linked currencies can outperform when growth and liquidity look strong.

Correlations shift with the regime. A currency can trade like a rate product one month, then trade like an equity proxy the next. You must track what the market currently uses as its risk gauge, often equities, credit spreads, and volatility indexes.

Political and geopolitical factors, sudden repricing

Politics changes expected policy and capital flows. It also changes risk premia.

- Elections and policy shifts. Tax, spending, and regulation can change growth and inflation paths.

- Fiscal surprises. Unfunded spending plans can raise term premia and weaken a currency fast.

- Sanctions and capital controls. They break normal flow channels and can trap liquidity.

- Wars and energy shocks. They hit trade balances, inflation, and confidence at the same time.

Relative rates and carry, why differentials drive flows and when they unwind

FX is a relative market. You compare yields between two currencies.

Carry trades seek positive interest-rate differentials. You fund in a low-yield currency and buy a higher-yield currency.

- Carry works best when volatility stays low and the high-yield currency holds its value.

- Carry fails when volatility spikes, funding tightens, or the high-yield currency drops. Traders rush to cut leverage. The unwind can be fast.

Forward points reflect rate differentials. Your broker may show them as swap, rollover, or tom-next costs. These costs can dominate your result on longer holds.

Technical factors, levels and momentum still matter

Technical trading influences execution because many orders cluster at similar levels.

- Support and resistance. Traders place stops, limits, and option hedges near prior highs and lows.

- Momentum. Trend systems add in the direction of the move. They exit together when the trend breaks.

- Round numbers. Large resting interest often sits at big figures.

Even in macro-driven markets, technical levels can decide the path price takes to reach the macro fair value.

How news is priced in, expectations beat outcomes

Markets trade expectations, not headlines. A release moves price when it changes the expected future path of rates, growth, or risk.

- Consensus vs actual. The surprise matters, not the absolute number.

- Whisper numbers. Positioning often reflects unofficial expectations. Consensus can lag.

- Revisions. FX can react more to revisions than to the latest print.

- Forward guidance. A central bank can hike rates and still weaken its currency if it signals fewer hikes ahead.

Good news can drop a currency when the market already priced better news, when positioning is crowded, or when risk sentiment flips at the same time. Focus on the gap between what traders expected and what the data forces them to believe next.

Trading Sessions and Liquidity: When the Forex Market Moves Most

24-hour trading week, why FX runs almost nonstop

Forex trades over a global network of banks, brokers, funds, and firms. When one financial center closes, another is open. That is why pricing updates close to 24 hours per day from Monday to Friday.

Most retail platforms open late Sunday in the US and close late Friday in the US. Exact hours vary by broker and server time.

Weekends still matter. Trading slows, liquidity dries up, and many venues stop quoting. News can break while markets are closed. When trading reopens, price can gap. Stops can fill worse than expected.

Major sessions and typical liquidity patterns

- Sydney: Often the quietest major session. Liquidity builds after the weekend open. AUD and NZD pairs can move more here than EUR or GBP pairs.

- Tokyo: Stronger liquidity in JPY crosses and Asian currencies. Many EUR and GBP pairs slow unless a major headline hits.

- London: The main liquidity center for spot FX. Tight spreads and fast price discovery in EUR, GBP, and CHF pairs. Many daily highs and lows form here.

- New York: High activity in USD pairs. Volatility often spikes around US data and Fed communication. Liquidity can fade late in the session.

| Session | What tends to trade best | What to watch |

|---|---|---|

| Sydney | AUD, NZD pairs | Wider spreads, thinner depth after weekend open |

| Tokyo | JPY crosses | Range trading, sudden moves on regional headlines |

| London | EUR, GBP, CHF, majors | Fast breaks, high liquidity, strong follow-through |

| New York | USD pairs | US data spikes, liquidity drop late session |

Session overlaps and why London to New York leads

Liquidity peaks when major dealing desks overlap. You get more two-way flow, deeper order books, and tighter spreads.

The London to New York overlap often delivers the highest liquidity of the day. You also see more stop runs and faster reversals. Execution quality can improve from tighter spreads, but slippage can increase when price jumps through levels.

Market closures and holidays, thin liquidity and gap risk

Holidays reduce participation. Banks quote less size. Spreads widen. Price can move further on small orders. Breakouts fail more often.

- Expect thinner conditions on US bank holidays for USD pairs, UK holidays for GBP pairs, and Japan holidays for JPY pairs.

- Be careful with holding leveraged positions into long weekends. A reopen gap can bypass your stop.

- If you must trade, reduce size and widen your execution tolerance. Avoid market orders in thin periods.

Event risk windows and execution around major releases

Scheduled news concentrates risk into short windows. CPI, NFP, GDP, rate decisions, and press conferences can reprice a currency in seconds.

- Before the release: Liquidity often pulls back. Spreads can widen. Limit orders can sit unfilled.

- At the release: Price can gap between quotes. Market orders can fill far from your click price. Stops can slip.

- After the release: The first move can reverse. Then the market chooses a direction once liquidity returns.

If you trade news, plan your order type and your maximum loss first. Size down. Use limits when you need price control. Avoid tight stops that can trigger on a spread spike. If you need a refresher on execution risk, read what is slippage in forex.

Forex Products and Venues: Spot, Forwards, Futures, Options, CFDs

Spot FX (Cash)

Spot FX is the core market price you see quoted as a bid and ask. In the interbank market, spot settles on a T+2 convention for most major pairs. That means the actual exchange of currencies happens two business days after the trade date.

Most retail traders never take delivery. Your broker offsets your position in its own system. You close the trade before settlement. If you hold past the end of day, the position usually rolls forward and becomes an open exposure with a financing component.

Forwards and FX Swaps (OTC Hedging Tools)

A forward is an agreement today to exchange currencies on a future date at a fixed rate. Banks quote it as spot plus or minus forward points. Forward points come from interest rate differentials between the two currencies.

Corporates use forwards to lock costs and revenues. Importers hedge payables. Exporters hedge receivables. Asset managers hedge foreign holdings. They choose a tenor that matches cash flows, for example 1M, 3M, 6M, 1Y.

An FX swap pairs two exchanges. You buy spot and sell it forward, or sell spot and buy it forward. Institutions use swaps to roll hedges, manage funding, and bridge settlement dates.

- Tenors: Overnight, tomorrow next, 1W, 1M, 3M, 6M, 1Y, and custom dates.

- Roll dates: Many hedges roll on month ends, quarter ends, and IMM dates, because liquidity clusters there.

- Practical impact: Forward pricing reflects the rate differential. It is not a broker markup by default.

If you trade rolling spot, your daily rollover often mirrors the economics of forwards and swaps. See forex swap fees for how brokers apply it.

Currency Futures (Exchange Traded FX)

Currency futures trade on exchanges like CME. A futures contract standardizes the pair, contract size, tick size, and expiry. You trade through a central order book, not a bank quote stream.

- Margining: You post initial margin. Your P&L settles daily through variation margin. This reduces counterparty risk compared with bilateral OTC trades.

- Transparency: You can see exchange volume and time and sales. You get clearer price discovery.

- Tradeoffs: You must manage expiry and roll. Some pairs have less liquidity than spot.

FX Options (Calls, Puts, Volatility)

An FX option gives you the right, not the obligation, to buy or sell a currency pair at a set strike on or before a set date. A call benefits from an upside move in the pair. A put benefits from a downside move.

Options price depends heavily on implied volatility. Higher implied volatility usually means higher premiums. Volatility also varies by tenor and strike, so the market can price crash risk and event risk into specific parts of the surface.

- Common use: Hedging tail risk. You define your maximum loss as the premium paid.

- Common use: Protecting a forward hedge. You keep upside while limiting downside.

- Trading note: Options bring Greeks. Delta can change fast around big moves, so hedges can drift.

CFDs and Rolling Spot (How Many Retail Accounts Trade FX)

Many retail forex accounts trade CFDs or a rolling spot contract. You do not own currency. You hold a leveraged position with your broker. Pricing often references an underlying spot feed, but execution happens inside the broker model.

- Jurisdiction matters: Product labeling and leverage caps vary by regulator. Your protections and negative balance rules also vary.

- Costs: You pay spread and sometimes commission. If you hold overnight, you pay or receive financing, often shown as swap or rollover.

- Risk: You face broker credit risk and execution rules. Read the order policy and how they handle stops in fast markets.

NDFs (Non Deliverable Forwards) for Restricted Currencies

NDFs exist for currencies where onshore delivery is restricted or hard to access. Instead of exchanging the currencies, the parties settle the profit or loss in a convertible currency, often USD, based on a fixing rate.

- Why they exist: Capital controls, limited convertibility, and onshore market access limits.

- Who uses them: Multinationals and funds hedging exposure to restricted markets, and banks facilitating that hedge.

- Key detail: Settlement depends on the fixing methodology and the contract terms. That fixing becomes a major risk point.

| Product | Main venue | Typical users | Key practical point |

|---|---|---|---|

| Spot | OTC | Banks, funds, brokers | T+2 convention, retail usually closes or rolls |

| Forwards, swaps | OTC | Corporates, banks, asset managers | Price driven by rate differentials and roll dates |

| Futures | Exchange | Funds, hedgers, active traders | Central book, daily margining, manage expiry |

| Options | OTC and exchange | Hedgers, volatility traders | Premium and implied volatility drive cost and behavior |

| CFDs, rolling spot | Broker platform | Retail | Leverage, financing, and broker execution rules matter |

| NDFs | OTC | Hedgers in restricted currencies | Cash settlement vs fixing, no physical delivery |

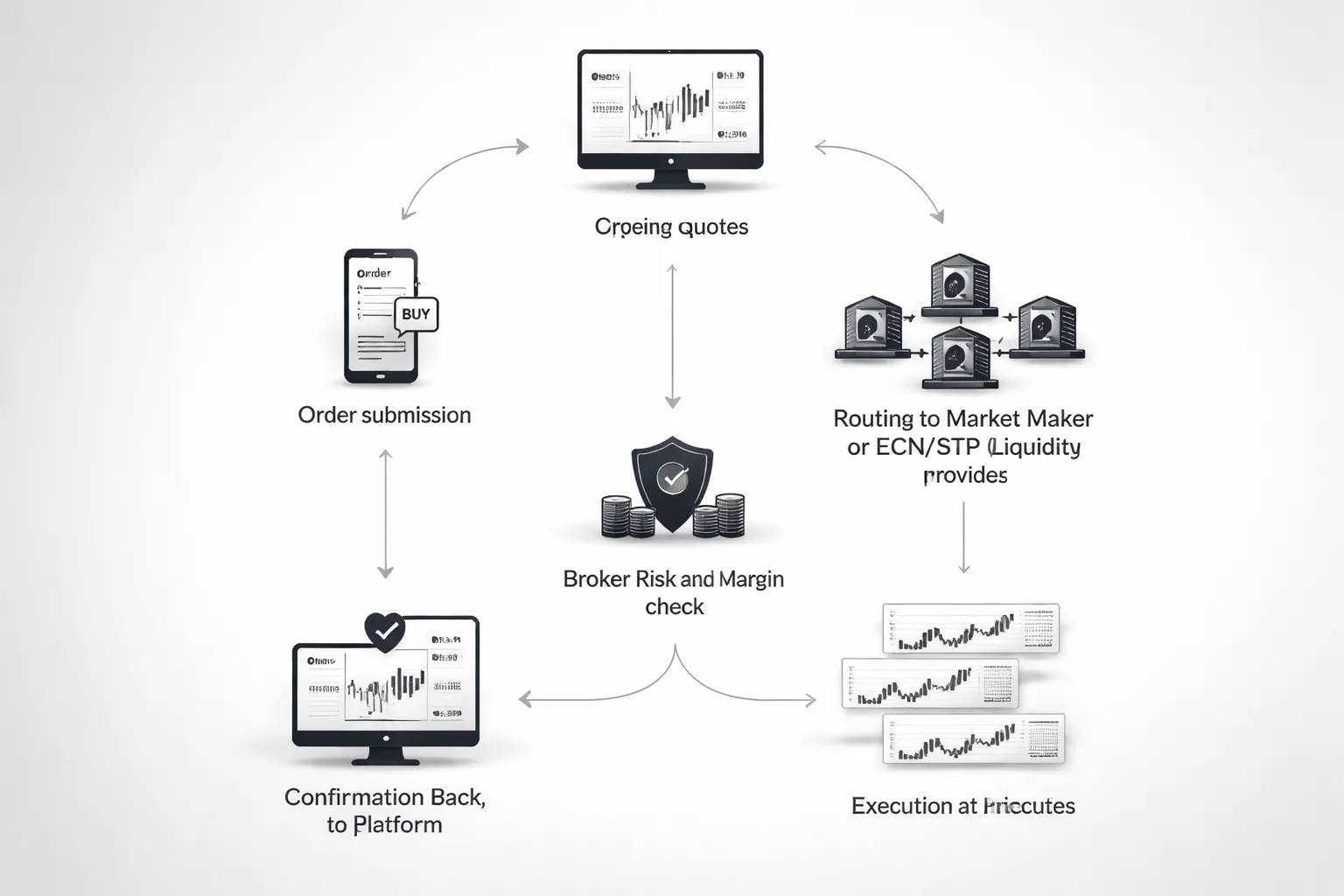

How Execution Works: From Your Order to a Fill

Order lifecycle, from quote to fill

Your platform shows a quote. You see bid and ask. You see the available size, if your broker displays depth.

You submit an order. The platform checks basics first. Margin availability. Trading hours. Minimum distance for stops, if your broker enforces it.

The broker routes your order. Routing depends on the execution model. A market maker can internalize it. An ECN or STP broker can send it to one or more liquidity providers.

Execution happens when your order matches available liquidity at a price. If liquidity sits across multiple price levels, you can get more than one fill.

You receive confirmation. Your platform updates the position, average price, and any attached stops and limits. Your account balance and used margin change.

Order types and when to use each

- Market order. You buy or sell at the best available price now. Use it when you need certainty of entry and you accept slippage risk.

- Limit order. You set your price or better. Use it to control entry price, often in ranging markets. You may not get filled.

- Stop order. You trigger a market order when price hits your stop level. Use it for breakout entries or to exit a losing trade. You can slip in fast moves.

- Stop-limit order. You trigger a limit order when price hits the stop level. Use it when you must cap the worst fill price. You can miss the trade in gaps or spikes.

- Trailing stop. Your stop follows price by a set distance. Use it to protect gains while letting a trend run. It can get hit by noise in volatile pairs.

- OCO, one cancels the other. You place two linked orders, usually a breakout buy stop and sell stop, or a take profit and stop loss pair. Use it to automate “either way” scenarios and avoid double exposure.

Execution models, market maker vs ECN or STP

Market maker, dealing desk. The broker sets the price stream and can take the other side of your trade. This can mean stable fills in small size and fixed or wider spreads at times. It can also create a conflict, since your loss can be their gain if they internalize risk.

ECN or STP. The broker routes orders to external liquidity. Pricing often reflects a tighter raw spread plus a commission. You may see variable spreads and more slippage during news. Conflicts can reduce, but they do not disappear, since the broker still controls routing, markups, and rules.

| Model | Typical pricing | What you gain | What to watch |

|---|---|---|---|

| Market maker | Spread only or spread plus markup | Simple costs, often smooth execution in small size | Requotes, execution rules, stop distance, conflict risk |

| ECN or STP | Raw spread plus commission | More transparent price formation, access to external liquidity | Variable spreads, partial fills, commissions, routing quality |

Slippage and requotes, causes and how to reduce impact

Slippage happens when the fill price differs from the price you saw. It usually shows up on market orders and stop orders. Fast markets, thin liquidity, and quote updates cause it.

Requotes happen when the broker rejects your requested price and offers a new one. This appears more often with some dealing desk setups and during volatility.

- Trade liquid sessions for the pair, not dead hours.

- Avoid major news releases if your strategy cannot handle price jumps.

- Use limit orders when price matters more than getting filled.

- Use stop-limit if you prefer a missed trade over a bad fill.

- Reduce size when the spread widens or depth looks thin.

- Track slippage in your journal, by pair, session, and order type.

Partial fills and liquidity depth

Liquidity sits in layers. One price level only has so much size. If your order exceeds what is available at the top of book, the rest fills lower or higher.

Your platform may show this as multiple fills and an average entry price. This matters most when you trade larger size, trade less liquid pairs, or trade during volatile windows. Pair choice plays a big role, especially across majors, minors, and exotics.

Position sizing affects execution quality. If you need a refresher on sizing mechanics, use this guide on lot size in forex.

Latency and platform considerations

Latency is the delay between your click and the broker receiving your order, then sending a fill back. A few milliseconds can matter for some strategies. It matters less for longer-term trading.

- Scalping and news trading. Sensitive to latency, spread spikes, and slippage.

- Day trading. Moderate sensitivity, depends on entry method and stop distance.

- Swing trading. Low sensitivity, execution quality still matters in gaps and thin periods.

- Use a VPS close to your broker’s server if you run EAs or trade short timeframes.

- Use wired internet and stable hardware. Avoid browser tabs and background load during active trading.

- Know your platform’s order handling, including “fill or kill” and maximum deviation settings, if available.

Best execution and why spread-only is not the full cost

Best execution means you aim for the best available outcome, not just the tightest quoted spread. Your true trading cost includes what you pay and what you lose in execution.

- Spread. The visible bid-ask gap.

- Commission. Common on ECN style accounts.

- Slippage. Positive or negative, often negative for market and stop orders.

- Requotes and rejects. Hidden cost through missed entries and exits.

- Financing and rollover. Costs accumulate on positions held overnight.

You can compare brokers more accurately when you track average spread plus average slippage plus commission, by pair and by session. A broker that advertises low spreads can still be expensive if fills slip or rejects increase during the times you trade.

Leverage, Margin, and Risk: Why Forex Can Move Your Account Fast

Leverage explained, notional exposure vs account equity

Leverage lets you control a large position with a small deposit.

Your profit and loss comes from the full position size, not your cash balance.

Notional exposure is the value of the position you control. Account equity is your balance plus open P&L.

Example. You buy 1 standard lot EUR/USD, about 100,000 EUR notional. A 0.50% move against you is about 500 USD. That loss hits your equity even if you posted far less as margin.

Margin mechanics: initial margin, maintenance margin, free margin, margin level

Margin is the broker’s collateral requirement. It is not a trading cost.

- Initial margin. What you must have to open a position. Often expressed as a percent, like 2% or 3.33%.

- Used margin. The margin locked to support your open trades.

- Equity. Balance plus unrealized P&L.

- Free margin. Equity minus used margin. This is your buffer for losses and new trades.

- Maintenance margin. The minimum equity level the broker requires to keep positions open.

- Margin level. Equity divided by used margin, shown as a percent.

| Item | Simple formula | Why it matters |

|---|---|---|

| Equity | Balance + open P&L | Losses reduce it in real time |

| Free margin | Equity - used margin | When it hits zero, you lose flexibility |

| Margin level | (Equity / used margin) x 100 | Triggers margin call and liquidation rules |

Margin calls and liquidation: why it can happen quickly

Brokers manage risk with thresholds. These thresholds vary by broker and regulator.

- Margin call. A warning state. The platform blocks new trades or asks you to add funds.

- Stop-out / liquidation. The broker closes positions to reduce exposure.

Liquidation happens fast because losses reduce equity, and equity drives margin level. High leverage means a small price move can push your margin level through the stop-out line.

Correlated trades accelerate this. If you hold EUR/USD and GBP/USD long, one USD move can hit both positions at once.

Position sizing basics: risk per trade, pip value, stop distance

Start with a fixed risk per trade. Use a percentage of equity, not a gut feel.

- Pick risk per trade, like 0.5% or 1% of equity.

- Set a stop-loss distance in pips based on your setup.

- Convert pips to money with pip value.

- Size the position so the stop equals your risk budget.

Position size equals risk amount divided by (stop in pips times pip value per unit).

Example. Equity 10,000 USD. Risk 1% equals 100 USD. Stop 25 pips. If 1 mini lot (10,000 units) equals about 1 USD per pip on many USD-quoted majors, then risk per mini lot is about 25 USD. You can trade about 4 mini lots to risk about 100 USD.

This keeps leverage as an output, not the starting point. If you need a deeper refresher, see what forex trading is.

Volatility and gap risk: why stops are not always guaranteed

A stop-loss is an order, not a guarantee.

During fast markets, price can jump past your stop. The fill can land worse than your stop price. That is slippage.

- News spikes. Rate decisions, CPI, jobs data, central bank remarks.

- Session gaps. Weekends, holidays, low-liquidity opens.

- Thin books. Off-hours trading and minor pairs.

Gap risk matters more when your margin buffer is small. A single bad fill can take equity under maintenance margin and trigger forced closes.

Risk-of-ruin thinking: win rate alone is not a strategy

A high win rate can still blow up your account.

You need positive expectancy and controlled drawdowns.

- Expectancy. Your average win times win rate minus your average loss times loss rate.

- Risk-of-ruin. The chance you hit a drawdown that ends your ability to trade.

- Key drivers. Risk per trade, win rate, win-to-loss size, and losing streak length.

Keep your risk per trade small enough to survive normal losing streaks. Large position sizes turn routine volatility into a margin event.

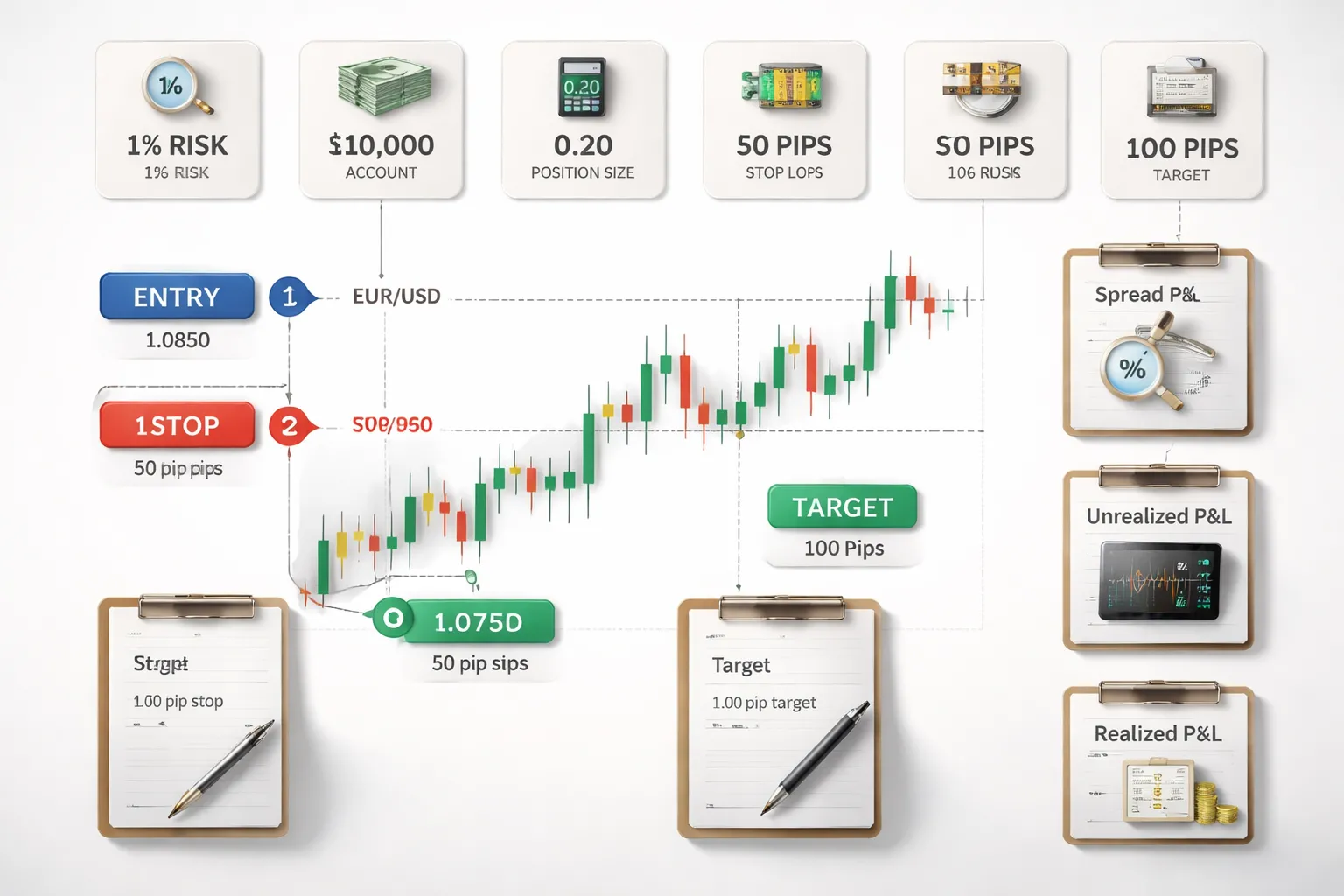

Putting It Together: A Step-by-Step Example of a Forex Trade

Example setup, choose a pair and define a thesis

Pair: EUR/USD.

Account currency: USD.

Account size: $10,000.

Risk per trade: 1% or $100.

Macro thesis: You expect EUR to weaken versus USD because the market prices higher US rates for longer.

Technical trigger: Price retests prior support, now resistance, and prints a bearish rejection on the 1H chart.

- You write down the thesis in one sentence.

- You define what would prove you wrong.

- You decide your stop location before you look at position size.

Choose an entry method, limit vs market, then set stop and target

Planned entry: Sell EUR/USD at 1.0850.

Stop-loss: 1.0900. Your stop distance is 50 pips.

Target: 1.0750. Your target distance is 100 pips.

Reward-to-risk: 100 pips to 50 pips, or 2R.

- Market order: You enter now. You accept slippage in fast moves.

- Limit order: You try to enter at your price. You accept the risk of no fill.

Pick one based on your plan. If your edge needs a specific price, use a limit. If your edge needs participation now, use a market order.

Calculate position size, pip value, stop distance, risk amount

Your sizing starts with dollars at risk, not lot size.

| Input | Value |

|---|---|

| Account size | $10,000 |

| Risk per trade | 1% |

| Risk amount | $100 |

| Stop distance | 50 pips |

| Pip value (EUR/USD, 1 standard lot) | $10 per pip |

Risk per 1 standard lot: 50 pips x $10 = $500.

Position size: $100 / $500 = 0.20 lots.

At 0.20 lots, your pip value is about $2 per pip. If price hits your stop, you lose about $100, plus any spread and slippage.

If you need help on pairs where the quote currency is not your account currency, use a pip value calculator.

What happens after entry, spread impact, unrealized P&L, swap

Assume the quote is 1.0850 bid and 1.0852 ask. The spread is 2 pips.

- You sell at the bid. Your position starts down by the spread.

- At 0.20 lots, 2 pips costs about $4 at entry.

Unrealized P&L: It updates tick by tick. It depends on the current bid and ask, not the last traded price.

If price moves in your favor: A 10 pip move equals about $20 at $2 per pip.

If you hold overnight: Your broker applies swap, also called rollover. It can be a charge or a credit. It depends on the pair, your direction, and the broker’s rate schedule.

Closing the trade, execution, realized P&L, post-trade review checklist

Scenario A, target hit: Price trades down to 1.0750 and your take-profit fills.

- Gross gain: 100 pips x $2 per pip = $200.

- Net gain: about $200 minus spread costs, minus any slippage, minus any swap.

Scenario B, stop hit: Price trades up to 1.0900 and your stop fills.

- Gross loss: 50 pips x $2 per pip = $100.

- Net loss: about $100 plus spread costs, plus any slippage, plus any swap if held overnight.

Post-trade review checklist:

- Did you follow your entry rule, or did you chase?

- Did you size from risk, or from conviction?

- Did spread and slippage match your assumptions?

- Did you move the stop, and why?

- Was the exit planned, or emotional?

- Log: pair, session, news context, entry, stop, target, size, result in R, screenshot.

- One fix for next time, one thing to keep.

Pros and Cons of the Forex Market (For Traders and Hedgers)

Advantages

- Liquidity. Major pairs trade with deep order flow in active sessions. You can usually enter and exit without large price gaps. Liquidity drops around roll, holidays, and outside London and New York.

- Accessibility. You can trade small sizes and scale up. Most brokers offer micro lots and low account minimums. Low barriers do not mean low risk.

- 24/5 market. FX runs from the Asia open to the New York close. You can choose a session that fits your schedule, or trade around specific macro releases.

- Diverse strategies. You can trade trends, ranges, breakouts, relative value, and carry. You can also run systematic rules because pricing updates fast and data is continuous.

- Hedging utility. If you earn, pay, or invest in another currency, FX lets you hedge the exchange-rate risk. You can hedge with spot, forwards, or options, depending on access and constraints.

Disadvantages

- Leverage magnifies errors. Small moves can create large P and L swings. Over-sizing turns normal volatility into a margin call. Many retail accounts lose money because they run leverage they cannot absorb.

- Pricing and execution are complex. You do not trade on one central exchange. Quotes vary by broker and liquidity source. Your fill depends on order type, available liquidity, and market speed. Slippage can hit during news or thin conditions. Read what slippage is in forex if you rely on stops.

- Variable costs. Your cost is spread plus commission, then swaps if you hold overnight. Costs widen in illiquid windows and around high-impact releases. A strategy that works on a tight spread can fail when spreads double.

- High sensitivity to news shocks. CPI, jobs, central bank decisions, and geopolitical headlines can move price fast. Stops can fill worse than expected, or not at the level you modeled.

Pros and cons for hedgers

- Pro. You can reduce uncertainty in cash flows and margins. A hedge can turn an unknown future rate into a known range or fixed rate.

- Con. Hedges have carry and transaction costs. Poor sizing can create basis risk, then your hedge and exposure do not offset. Some hedges also reduce upside if your business benefits from favorable FX moves.

Who forex is, and isn’t, suitable for

| Fits you if you need | Does not fit you if you need |

|---|---|

| Short to medium-term trading with tight risk limits and frequent review | Set-and-forget positions without monitoring during active market hours |

| Liquid markets for tactical entries, exits, and hedges | Guaranteed fills at your stop price in fast markets |

| Clear rules, measured position sizing, and tolerance for drawdowns | High leverage to “make it back” after losses |

| A schedule aligned with one main session, Asia, London, or New York | Trading every session while sleeping, working, or distracted |

| Hedging a real currency exposure, revenue, costs, assets, or liabilities | Trading as a substitute for long-term investing goals |

Rule of thumb. Match product to purpose. Use spot for short-term trading and simple hedges. Use forwards or options when you must lock a future rate or cap risk over a set horizon.

Safety, Regulation, and Choosing a Broker (E-E-A-T Checklist)

Regulation basics, jurisdiction matters

Forex has no single global regulator. Your protection depends on where your broker is licensed and which rules apply to your account. A broker can market globally while holding a license in a different country. Check the exact legal entity on your account application and statements.

- Top tier regulators. Examples include the FCA (UK), ASIC (Australia), IIROC and CIRO related frameworks (Canada), MAS (Singapore), JFSA (Japan), CFTC and NFA (US), and major EU regulators under MiFID rules.

- Offshore regulators. Some jurisdictions offer lighter oversight. That can mean fewer client protections and weaker enforcement.

- Product rules vary. Leverage limits, marketing rules, and whether CFDs are allowed depend on the regulator. Your broker may offer different conditions based on where you live.

Client protections you should verify

- Segregation of client funds. Your broker should hold client money separate from its own operating funds. Segregation reduces misuse risk, it does not eliminate failure risk.

- Negative balance protection. Some regions require it for retail clients. It caps losses at your deposited amount in extreme moves. It often does not apply to professional classifications.

- Clear risk disclosures. Look for plain language on leverage, margin calls, stop execution, gaps, and how the broker prices and hedges.

- Complaints process. Regulated brokers publish escalation steps and an external dispute channel, such as an ombudsman scheme, depending on jurisdiction.

Broker due diligence, execution, costs, and reliability

- Execution model. Know if your broker runs a dealing desk, matches internally, or routes to external liquidity. Execution quality affects slippage, rejected orders, and fill speed. See what is slippage in forex for practical examples and how to reduce it.

- Pricing and markups. Separate the raw spread from any commission. Confirm whether spreads are variable or fixed and how often spreads widen in volatile periods.

- Swap and financing transparency. Overnight funding can dominate your costs on longer holds. Check where the broker publishes swap rates, how often it updates them, and whether it charges extra markups.

- Order types and protections. Confirm stop loss behavior during gaps and whether guaranteed stops exist, plus any extra fees and minimum distance rules.

- Platform stability. Look for uptime history, server locations, and whether the broker publishes execution statistics. Test with a demo and a small live account.

- Deposits and withdrawals. Confirm supported rails, fees, typical processing times, and whether withdrawals go back to the original funding source.

- Support quality. You want fast, documented answers on margin, swaps, and trade disputes. Save transcripts and ticket numbers.

Red flags that should stop you

- Unrealistic performance claims. Promises of fixed returns, low risk, or guaranteed profits.

- Bonuses with strings. Withdrawal limits tied to trading volume targets or unclear terms. Many regulated regions restrict these offers for a reason.

- Withdrawal friction. Repeated delays, changing requirements, pressure to keep funds in the account, or fees that appear only at withdrawal.

- Opaque ownership. No clear legal entity, address, or license number, or a license that does not match the entity holding your account.

- Price and execution disputes. Frequent re-quotes, canceled profits, or vague explanations that rely on broad “abuse” clauses.

Counterparty risk, the market is not your broker

The forex market is a network of banks, liquidity providers, and trading venues. Your retail trade usually happens inside your broker’s system. That means your true counterparty is often the broker, not the interbank market.

- Your fill depends on the broker. The broker sets margin rules, may internalize flow, and controls how stops and limits execute on its platform.

- Conflicts can exist. A broker can profit from spreads, commissions, and sometimes client losses if it does not hedge. Regulation and disclosures matter because incentives matter.

- Failure risk is real. Even with segregation, a broker can fail. Favor strong oversight, clean audits, and a long operating history.

E-E-A-T broker checklist

| What to check | What good looks like |

| License and entity | License number matches the exact legal entity on your account. Regulator register confirms status. |

| Client money rules | Segregated accounts, clear custody details, and written policy on how funds get held and moved. |

| Negative balance protection | Explicit retail protection in your jurisdiction, with clear exceptions and scope. |

| Execution and slippage | Defined execution model, published policies, realistic disclosures, and stable fills in live testing. |

| Total trading costs | Transparent spreads, commissions, and swaps, with examples and a place to verify daily rates. |

| Operational reliability | Platform uptime history, clear incident handling, and responsive support with written records. |

| Funding and withdrawals | Normal processing times, clear fee schedule, and no pressure tactics when you withdraw. |

FAQ

What are the main participants in the forex market?

Banks and liquidity providers quote prices and take risk. Brokers route your orders. Hedge funds and asset managers trade for return. Corporations hedge cash flows. Central banks manage reserves and policy. Retail traders trade via brokers using leveraged accounts.

How does a currency pair quote work?

A pair shows one currency priced in another. EUR/USD at 1.0850 means 1 euro costs 1.0850 US dollars. The first currency is the base. The second is the quote. If the rate rises, the base strengthens versus the quote.

What moves forex prices?

Order flow and expectations move price. Watch rates, inflation, growth, and central bank guidance. Track data releases, auctions, and risk sentiment. Liquidity changes around session opens, closes, and news. Price also reacts to positioning and stop orders near key levels.

What are bid, ask, and spread?

The bid is the price you sell at. The ask is the price you buy at. The spread is the difference. Spreads widen when liquidity drops or volatility jumps. Your broker may add a markup, charge a commission, or both.

What is a pip and how do you value it?

A pip is a standard price increment. Most pairs use 0.0001. JPY pairs use 0.01. Pip value depends on pair, lot size, and your account currency. Use a calculator or formula before you trade to size risk.

How do forex orders get executed?

Market orders fill at the best available price. Limit orders fill at your price or better. Stop orders trigger after price trades through your level. You can get slippage in fast markets. Execution quality depends on routing, liquidity, and your broker rules.

What is leverage and margin in forex?

Leverage lets you control a larger position with a smaller deposit. Margin is the amount your broker locks as collateral. If losses reduce your equity, you can face a margin call or stop-out. Use position sizing and hard stops to limit damage.

What are swaps or rollover fees?

Swaps are overnight financing charges or credits. They depend on the pair, your direction, and your broker markup. Brokers apply them at a set daily time, often with a triple charge once per week. Check the broker swap table before holding trades.

When is the forex market open?

Forex runs 24 hours during the business week, from the Asia session through London and New York. Liquidity peaks during London and the London New York overlap. Spreads often widen at daily rollover and during holidays. See forex market hours for session timing.

Can brokers manipulate forex prices?

Brokers do not control the interbank market, but your broker controls your feed and execution. Risks include requotes, asymmetrical slippage, and stop hunting claims. Judge with data, trade logs, and fill statistics. Compare quotes across venues before blaming manipulation.

What costs do you pay to trade forex?

You pay the spread and sometimes a commission. You may pay swaps for holding overnight. You can also pay conversion fees if your account currency differs. Measure total cost in pips per trade. Verify daily rates in your platform and statements.

Conclusion

Conclusion

Forex works through a network of banks, venues, and brokers that stream quotes and match orders. Price comes from the best bid and ask available at that moment. Your results depend on execution quality, liquidity, and total trading cost.

- Trade when the market is liquid. Spreads tighten, slippage drops, and fills improve.

- Track your real cost. Log spread, commission, swaps, and slippage in pips per trade.

- Verify execution. Compare requested price vs fill price, record latency, and review reject rates.

- Pick the right product. Match your strategy to spot, futures, or options. Use this guide on spot forex vs futures vs options if you need a clear comparison.

Final tip. Run a simple execution audit for your next 50 trades. If your average slippage and effective spread rise during news or thin hours, change when you trade before you change what you trade.

-

- Tier 1 Commercial and Investment Banks

- Central Banks

- Corporations, Importers, and Exporters

- Asset Managers and Pension Funds

- Hedge Funds and Proprietary Trading Firms

- Retail Brokers and Retail Traders

- Payment Providers, Remittance Firms, and Bureaux de Change

- Prime Brokerage, Prime-of-Prime, and Liquidity Providers

-

- Interbank market and quoting, indicative vs firm

- Order flow and liquidity, why price moves and spreads widen

- Macro drivers, the core data pipeline

- Risk sentiment, safe havens and shifting correlations

- Political and geopolitical factors, sudden repricing

- Relative rates and carry, why differentials drive flows and when they unwind

- Technical factors, levels and momentum still matter

- How news is priced in, expectations beat outcomes

-

- Leverage explained, notional exposure vs account equity

- Margin mechanics: initial margin, maintenance margin, free margin, margin level

- Margin calls and liquidation: why it can happen quickly

- Position sizing basics: risk per trade, pip value, stop distance

- Volatility and gap risk: why stops are not always guaranteed

- Risk-of-ruin thinking: win rate alone is not a strategy

-

- Example setup, choose a pair and define a thesis

- Choose an entry method, limit vs market, then set stop and target

- Calculate position size, pip value, stop distance, risk amount

- What happens after entry, spread impact, unrealized P&L, swap

- Closing the trade, execution, realized P&L, post-trade review checklist

-

- What are the main participants in the forex market?

- How does a currency pair quote work?

- What moves forex prices?

- What are bid, ask, and spread?

- What is a pip and how do you value it?

- How do forex orders get executed?

- What is leverage and margin in forex?

- What are swaps or rollover fees?

- When is the forex market open?

- Can brokers manipulate forex prices?

- What costs do you pay to trade forex?

-

- Tier 1 Commercial and Investment Banks

- Central Banks

- Corporations, Importers, and Exporters

- Asset Managers and Pension Funds

- Hedge Funds and Proprietary Trading Firms

- Retail Brokers and Retail Traders

- Payment Providers, Remittance Firms, and Bureaux de Change

- Prime Brokerage, Prime-of-Prime, and Liquidity Providers

-

- Interbank market and quoting, indicative vs firm

- Order flow and liquidity, why price moves and spreads widen

- Macro drivers, the core data pipeline

- Risk sentiment, safe havens and shifting correlations

- Political and geopolitical factors, sudden repricing

- Relative rates and carry, why differentials drive flows and when they unwind

- Technical factors, levels and momentum still matter

- How news is priced in, expectations beat outcomes

-

- Leverage explained, notional exposure vs account equity

- Margin mechanics: initial margin, maintenance margin, free margin, margin level

- Margin calls and liquidation: why it can happen quickly

- Position sizing basics: risk per trade, pip value, stop distance

- Volatility and gap risk: why stops are not always guaranteed

- Risk-of-ruin thinking: win rate alone is not a strategy

-

- Example setup, choose a pair and define a thesis

- Choose an entry method, limit vs market, then set stop and target

- Calculate position size, pip value, stop distance, risk amount

- What happens after entry, spread impact, unrealized P&L, swap

- Closing the trade, execution, realized P&L, post-trade review checklist

-

- What are the main participants in the forex market?

- How does a currency pair quote work?

- What moves forex prices?

- What are bid, ask, and spread?

- What is a pip and how do you value it?

- How do forex orders get executed?

- What is leverage and margin in forex?

- What are swaps or rollover fees?

- When is the forex market open?

- Can brokers manipulate forex prices?

- What costs do you pay to trade forex?