Spot Forex vs Futures vs Options: What’s the Difference?

You can trade currencies three main ways. Spot forex, currency futures, and FX options. Each market handles pricing, execution, margin, and risk in a different way. Those differences change your costs and your control.

This guide breaks down the essentials. You will learn how each product works, where it trades, and what you actually buy or sell. You will see how contract size, expirations, and settlement affect a trade. You will also compare leverage and margin rules, typical fees, and price transparency. You will understand who sits on the other side of your trade and what that means for fills and slippage.

If you need a base refresher before comparing products, start with what is forex trading.

Key Takeaways

Key Takeaways

- In het kort: Spot forex is an OTC market with no expirations; futures trade on exchanges with fixed contract specs and expiry; options add a premium and defined downside for buyers.

- Spot forex gives you flexible position sizing and many currency pairs, but pricing and execution quality depend on your broker and liquidity providers.

- Futures give you centralized price discovery, exchange matching, and standard margin rules, but you must manage expirations, roll costs, and fixed contract sizes.

- Options let you cap risk as a buyer and design payoffs, but time decay and implied volatility can work against you.

- Leverage differs by product and jurisdiction; your real risk comes from position size and volatility, not the headline leverage number.

- Costs show up in different places; spot often in the spread, futures in commissions and exchange fees, options in premium and wider spreads on less liquid strikes.

- Slippage and fills depend on liquidity and order type; futures often offer clearer depth, spot varies by venue and execution model.

- Pick spot forex if you want tight sizing control, 24 hour access during the week, and no contract roll. Learn position sizing first, use this guide on lot size.

- Pick futures if you want exchange regulation, transparent pricing, and a standardized product, and you can handle expirations and contract sizing.

- Pick options if you need defined risk as a buyer, you trade around events, or you want a specific payoff, and you accept premium cost and time decay.

Spot Forex vs Futures vs Options: a quick overview of what each product is

Spot forex explained

Spot forex is the cash FX market. You trade currency pairs like EUR/USD or USD/JPY. You buy one currency and sell the other at the current quote.

Most spot forex trading runs over-the-counter (OTC). You place orders with a broker. Pricing comes from the broker’s liquidity providers, then routes to your platform.

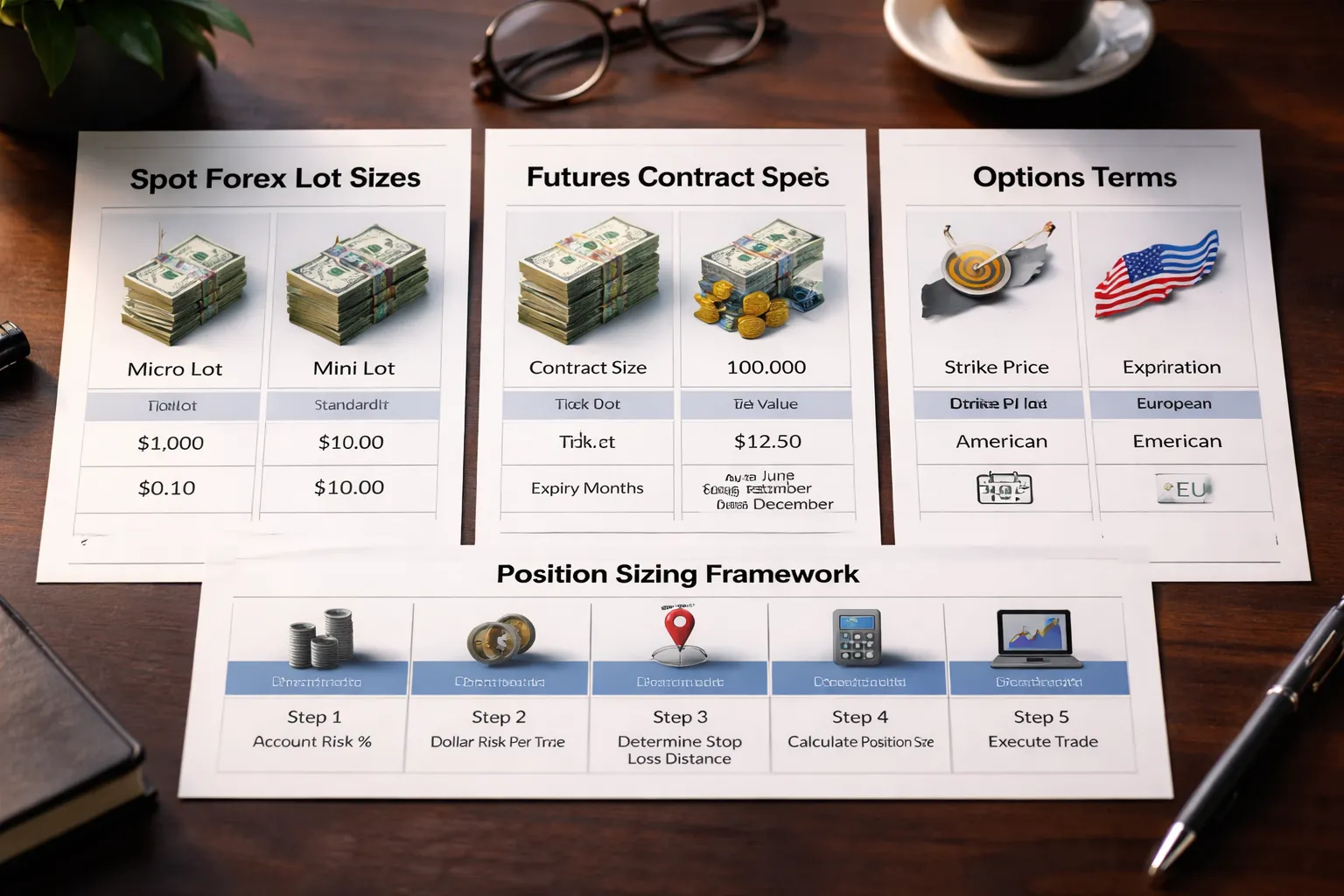

- Contract unit: lots. A standard lot is typically 100,000 units of the base currency, a mini is 10,000, a micro is 1,000.

- Margin trading: you post margin to control a larger position. Leverage magnifies gains and losses.

- Settlement: spot settlement is typically T+2, but retail platforms roll positions each day. You may pay or receive swap, also called rollover.

- Trading access: near 24 hours a day during the week. No contract expiry.

Currency futures explained

Currency futures are standardized FX contracts listed on an exchange. You trade a set contract size with fixed terms and a defined expiry month.

You trade through a futures broker. The exchange publishes the order book. A clearinghouse stands between buyers and sellers and manages margin.

- Standardized contracts: fixed size and tick value. Example: a EUR futures contract represents a set amount of euros.

- Exchange and clearing: you get centralized matching, clearing, and daily mark-to-market.

- Expirations: contracts expire. You must close, roll to a new month, or hold into delivery rules.

- Margin: you post initial and maintenance margin. Your account updates each day based on settlement price.

Currency options explained

Currency options give you the right, not the obligation, to buy or sell a currency at a set strike price before or at expiration.

- Calls and puts: a call benefits from the underlying rising, a put benefits from the underlying falling.

- Premium: you pay a premium to buy an option. As a buyer, your max loss is the premium.

- Expiries: options lose time value as expiration approaches. Time decay speeds up near expiry.

- Greeks: delta estimates price sensitivity, gamma measures delta change, theta measures time decay, vega measures sensitivity to volatility.

Options trade on exchanges in many markets, and also OTC in institutional FX. Terms vary by venue. Exchange-listed options use standardized expiries and clearing.

How each instrument gives you currency exposure

| Product | What moves your P&L | Payoff shape |

|---|---|---|

| Spot forex | Price change in the pair, plus swap if you hold overnight. Spreads and commissions reduce net results. | Linear. Your P&L rises and falls point for point with the pair, scaled by your position size. |

| Currency futures | Price change times contract tick value. Fees and bid-ask spread matter. Daily settlement updates margin. | Linear. Similar to spot, but with fixed contract sizing and an expiry to manage. |

| Currency options | Underlying price, implied volatility, time to expiry, and interest rate inputs. Premium paid or received drives risk. | Non-linear. Buyers have capped downside and open-ended upside on the right side of the strike. Sellers face the opposite. |

All three track the same core drivers, interest rate differentials, inflation expectations, growth, and risk sentiment. Liquidity changes your fill quality and your true trading cost, learn more in forex liquidity explained.

How pricing works: quotes, spreads, and what you actually pay

Spot forex pricing, quotes, and what a pip really costs

Spot forex uses a two-way quote. You see a bid and an ask. You sell at the bid. You buy at the ask. The difference is the spread.

Pairs use base currency and quote currency. In EUR/USD, EUR is base. USD is quote. A quote of 1.0850 means 1 EUR costs 1.0850 USD.

Most major pairs move in pips. For EUR/USD a pip is 0.0001. For USD/JPY a pip is usually 0.01. Many brokers show fractional pips. You might see 1.08503. That last digit is a pipette.

Your pip value depends on your position size and your account currency. For pairs quoted in USD, a standard lot is 100,000 units. On EUR/USD, 1 pip is about $10 per standard lot. On USD/JPY, pip value changes with price because JPY is the quote currency. If you do not know your pip math, read what are pips in forex.

- What you pay first, the spread in pips times pip value.

- What you pay next, any commission if you use a raw spread account.

- What you keep paying, the overnight financing or swap if you hold past rollover.

Futures pricing, ticks, and the difference between last price and tradable price

Futures trade on a central exchange with an order book. Price forms from bids and offers at each level. You can see where liquidity sits. Your fill depends on where your order hits the book.

Futures move in ticks, not pips. Each contract defines a tick size and a tick value. Tick size is the minimum price move. Tick value is what that move is worth in cash per contract.

Do not price your trade from the chart’s last trade. Last trade can print at a size you cannot get. You trade at the bid or ask, or inside the spread if you use a limit order and get filled.

- What you pay first, the bid-ask spread in ticks.

- What you pay next, exchange fees, clearing fees, and broker commission.

- What can hit you, wider spreads and thinner depth outside liquid hours.

Options pricing, intrinsic vs extrinsic value, and why implied volatility matters

Options trade with a bid and ask, like spot and futures. The spread can be wide on less liquid strikes or expirations. You feel that cost immediately.

Option price has two parts. Intrinsic value is how much the option sits in-the-money right now. Extrinsic value is everything else, time value and volatility.

Implied volatility sits inside extrinsic value. If implied volatility rises, option premiums tend to rise. If implied volatility falls, premiums tend to fall, even if spot barely moves.

- Buyers pay a premium. That premium is your max loss, before fees.

- Sellers receive a premium. Your risk can grow fast if price runs through your strike.

- You also pay in Greeks, theta decay over time and vega exposure to volatility changes.

Hidden cost drivers most traders miss

- Slippage. Market orders fill where liquidity exists, not where you clicked. Fast moves and news spikes magnify it.

- Liquidity gaps. Spot can gap around session changes and news. Futures can gap between sessions. Options can go no-bid on far strikes.

- Spread widening. Spreads widen when depth thins. Your stop loss becomes more expensive because you exit at worse prices.

- Rollover effects. Spot FX applies daily rollover via swaps. Futures roll via contract expiration and calendar spreads. Options decay into expiration and liquidity shifts as open interest moves.

- Execution model. A tighter displayed spread means little if fills are poor, requotes happen, or partial fills increase average entry cost.

Real-world cost comparison checklist

| Cost item | Spot forex | Futures | Options |

|---|---|---|---|

| Spread | In pips or fractional pips, often variable | In ticks, visible order book, varies by session | Often widest relative to price, varies by strike and expiry |

| Commission | Sometimes built into spread, sometimes per lot | Per contract, plus exchange and clearing fees | Per contract, plus exchange and clearing fees |

| Financing | Daily swap or rollover, depends on rate differentials | Embedded in futures pricing, no daily swap line item | Embedded in premium and carry, plus opportunity cost of capital |

| Slippage | High impact during news and thin liquidity | Depends on depth, order type, and volatility | Common on market orders, can be severe on illiquid chains |

| Rollover and expiry | No expiry, rollover daily if held overnight | Contract expiry, roll cost via calendar spread | Expiry is core to the product, time decay is constant |

| Fees and taxes | Broker dependent, tax rules vary by country | Exchange fees and tax rules vary by country | Exchange fees and tax rules vary by country |

Before you compare markets, write your cost in one unit, money. Spread cost plus commissions plus expected slippage plus holding cost. If you cannot estimate slippage, use a conservative number based on your average trade size and the market’s typical depth at your trading time.

Market structure and transparency: exchange vs OTC and why it matters

Centralized vs fragmented liquidity

Spot forex trades over the counter. Liquidity fragments across banks, non bank market makers, prime brokers, ECNs, and retail brokers. Your fill depends on your broker’s liquidity pool, your trade size, and your execution setup.

Futures and listed options trade on exchanges. Liquidity concentrates in one order book per contract and venue. You see the same bids and offers as everyone else on that exchange.

- Spot forex: No single “best price” for the whole market. Prices differ by venue and broker.

- FX futures: Central limit order book. One reference price stream for that exchange.

- FX options: Exchange listed options have centralized books. Many FX options also trade OTC with dealer quotes, which brings back fragmentation.

Clearing and settlement differences

Spot forex follows spot settlement conventions. Most major pairs settle T+2. USD/CAD often settles T+1. You usually roll positions through swaps if you hold past end of day. Your broker sets the rollover schedule and swap rates.

Futures clear through a clearinghouse. You do not settle the full notional each day. You post margin. The exchange marks positions to market daily. Profits and losses credit or debit your account each session. Contracts expire, so you must roll if you want continuous exposure.

Options depend on the venue and product. Listed options clear like futures options. You pay premium up front. Your risk and margin change with price and volatility. If exercised, you move into the underlying, or you cash settle, based on the contract specs.

Counterparty and broker risk

In spot forex, your broker sits in the middle. Two common setups matter.

- Dealer model: Your broker can internalize your trade and act as the counterparty. Your fill quality depends on their dealing rules, last look, and risk controls.

- Agency model: Your broker routes orders to liquidity providers and charges markup or commission. You still rely on their routing, risk checks, and relationships.

In futures and exchange listed options, the clearinghouse becomes the central counterparty after the trade. Your main exposure shifts to your FCM or broker and the clearing system. Segregation rules and margining reduce counterparty risk, but they do not remove broker failure risk.

Price transparency and data quality

Exchange markets give you clearer market data. You can buy Level II depth, see prints, and use time and sales. A consolidated tape does not exist across all futures exchanges, but each venue provides an official feed for its own book.

Spot forex gives you broker feeds. “Level II” often reflects only that broker’s liquidity providers, not the full market. Two brokers can show different spreads and different depth at the same time. This affects backtests, stop placement, and slippage estimates.

- If you scalp: Exchange depth and prints help you judge liquidity at your size. Spot forex depth may not translate to executable size.

- If you trade news: Fragmented OTC pricing can widen unevenly. You can see different spikes across brokers.

- If you backtest: Match your test data to your execution venue. Do not assume a “universal” spot forex price.

If you want a broader baseline for how forex fits with other markets, see forex vs stock trading.

Leverage, margin, and risk controls across the three

Margin in spot forex

Spot forex margin usually works as a broker-set deposit on a leveraged position. Your broker may call it margin requirement, used margin, and free margin.

- Initial margin: The amount your broker locks to open the trade. Example, 2 percent margin equals 50:1 leverage.

- Used margin: Margin tied up in open positions.

- Free margin: Equity minus used margin. This is your buffer for losses and new trades.

- Margin level: Often equity divided by used margin, shown as a percent. This number drives warnings and forced liquidations.

- Stop-out: Your broker starts closing positions when your margin level hits a set threshold. They often close the largest losing trade first, but rules vary by broker.

- Negative balance protection: Some brokers cap losses at your account balance. Others do not. This matters most in gaps and fast markets.

Spot forex risk controls depend on broker policy. Read the margin call and stop-out rules before you size up. If your broker offers guaranteed stop losses, check the cost and the limits. Many accounts do not get them.

Futures margin mechanics

Futures margin works through the clearinghouse. The exchange sets the contract. Your broker enforces the risk rules. You post margin, then your account settles every day.

- Initial margin: The required deposit to open one contract.

- Maintenance margin: The minimum balance you must keep to hold the contract.

- Variation margin: Daily mark-to-market. Profits and losses hit your account balance each session.

- Margin call: If your account drops below maintenance, you must add funds or reduce risk. Many brokers liquidate fast if you do not meet the call.

Futures margin can change when volatility rises. Exchanges can raise requirements without warning. That can force position cuts even if your trade thesis stays intact.

Options risk profile

Options split risk between buyers and sellers.

- If you buy options: Your max loss equals the premium paid, plus fees. You control risk at entry. You still face decay and volatility changes.

- If you sell options: Your risk can exceed the premium received. Naked calls have uncapped risk. Short puts have large downside risk. Your broker will margin the position and can increase requirements in stress.

- Assignment risk: Short options can get assigned before expiration, especially around dividends for equity options, and in-the-money as expiry nears. Assignment can create stock or futures exposure you did not plan to hold overnight.

Options give you defined risk only when you structure them that way. Spreads and long options cap losses. Naked selling does not.

How leverage changes outcomes

Leverage changes your error tolerance. Small moves can become large account swings when your position size is too big.

| Market | Typical leverage access | Core sizing trap |

| Spot forex | Often high for retail, broker dependent | Overtrading because margin looks cheap |

| Futures | Embedded in contract notional and margin | One contract is too large for small accounts |

| Options | Built into premium and Greeks | Selling “small premium” with large tail risk |

Use position sizing based on loss in dollars, not margin required. Set your stop level first. Then size the trade so a stop-out does not break your account.

- Common pitfall in spot forex: You open several correlated pairs. Your margin looks fine. Your risk stacks in the same direction.

- Common pitfall in futures: You trade a full-size contract when a micro contract fits your risk. Your stop has to be too tight, so you get shaken out.

- Common pitfall in options: You sell short-dated options for income. One gap move wipes out many small wins.

If you want a clean baseline on spot forex mechanics before you compare products, read what forex trading is and how it works.

Liquidity, trading hours, and execution quality

Session behavior in spot FX

Spot FX trades 24 hours a day from the Monday open in Asia to the Friday close in New York. Liquidity is not constant. It clusters around major financial centers.

- London session: Often the deepest flow for EUR, GBP, and CHF pairs. Spreads tend to compress.

- New York session: Strong flow in USD pairs. US data releases can dominate price action.

- London and New York overlap: Usually the highest liquidity window. You often get tighter spreads and faster fills, but also sharper moves around news.

News drives microstructure. Scheduled events can widen spreads, thin depth, and increase slippage within seconds.

- High-impact data: CPI, NFP, central bank decisions. Expect spread expansion and partial fills if you trade size.

- Fixes and roll: Liquidity can shift around the London 4pm fix and around daily rollover. Your costs can change fast.

- Weekend gaps: Spot FX pauses over the weekend. If risk hits while markets are closed, your stop can fill far from your level at the Sunday open.

Futures trading hours and liquidity cycles

Major currency futures trade nearly 24 hours on centralized exchanges, with a short daily maintenance break. Liquidity still concentrates in US and European hours.

Futures liquidity also concentrates by contract month.

- Front-month focus: Most volume sits in the nearest liquid contract. Spreads and depth usually look best there.

- Rollover weeks: Liquidity migrates from the expiring contract to the next one. If you trade the wrong month, you pay with worse spreads and thinner depth.

- Exchange order book: You can see top-of-book and often depth. Execution quality depends on queue position and available resting liquidity.

Options liquidity realities

Options liquidity varies by underlying, expiry, and strike. The headline market can look active, but many strikes trade rarely.

- Wider spreads: Options often have wider bid-ask spreads than spot or futures, especially away from at-the-money.

- Strike selection matters: At-the-money and near-the-money strikes usually have tighter markets. Deep out-of-the-money strikes can be thin.

- Expiry concentration: Weekly and front expiries tend to trade more. Far-dated expiries can have poor fills unless you work limit orders.

- Greeks shift your execution: Delta and gamma change with price. A limit price that made sense seconds ago can stop making sense after a fast move.

Order types and execution tools

Execution quality comes from your order choice, not your opinion of direction. Use the tools that control price and risk.

- Market order: Prioritizes fill speed. You accept slippage.

- Limit order: Prioritizes price. You accept missed fills.

- Stop order: Triggers after price trades your level. In fast markets it can fill far from the stop.

- Stop-limit order: Adds a limit to cap the worst fill. You can get no fill during a spike.

- OCO: One-cancels-other. Useful for bracketed entries or breakout orders.

- Bracket orders: Entry with attached stop and target. Reduces execution errors when price moves fast.

Availability differs by venue and broker. Many futures platforms offer native OCO and brackets at the exchange. Spot FX depends on broker rules and how they route orders. Options often need limit orders, especially outside the most liquid strikes.

How to measure execution quality

Measure what you can control. Track your costs per trade and per month.

| Metric | What it tells you | What to watch |

|---|---|---|

| Spread | Your basic entry cost | Average spread by session, spread blowouts at news |

| Depth | How much you can trade near the quoted price | Thin books during roll, off-hours, and data releases |

| Fill rate | How often your limits get filled | Missed trades in fast markets, partial fills in size |

| Slippage | The gap between your expected and actual fill | Stop order slippage around news and session opens |

| Re-quotes | Broker refusal to fill at the requested price | More common on some spot FX dealing desk setups |

Normalize your results in pips so you can compare across products and position sizes. If you need a quick refresher, review what pips are in forex.

Contract specifications and sizing flexibility

Spot forex position sizing

Spot FX sizing uses lots. Your broker usually lets you trade in standard, mini, and micro increments.

- Standard lot, 100,000 units of the base currency.

- Mini lot, 10,000 units.

- Micro lot, 1,000 units.

Notional exposure changes with the pair price. Example, 1 standard lot of EUR/USD equals 100,000 EUR. If EUR/USD trades at 1.1000, your USD notional is about 110,000.

Pip value scales with size. On EUR/USD, 1 standard lot is about $10 per pip, 1 mini is about $1 per pip, 1 micro is about $0.10 per pip.

Your main advantage in spot FX is sizing flexibility. You can usually scale position size in small steps, which helps you control risk on smaller accounts.

Futures standardization

Futures use fixed contract specs set by the exchange. You pick the contract, then you trade whole contracts or approved fractions if your broker offers them.

- Contract size, fixed notional per contract. Example, CME Euro FX futures (6E) controls 125,000 EUR per contract. Micro Euro FX (M6E) controls 12,500 EUR.

- Tick size and tick value, the smallest price move and its dollar value. Example, 6E tick is 0.00005 and equals $6.25. M6E tick is $0.625.

- Expiry months, you trade specific delivery months, often quarterly. You must roll if you want to stay in the trade past expiration.

Standardization makes costs and fills easier to compare across brokers. It also limits sizing. If 1 contract is too large for your risk plan, you either use a micro contract or you do not take the trade.

Options contract terms

Options add more sizing and pricing variables. You choose the contract terms before you size the trade.

- Strike, the price level you buy or sell the right at.

- Expiration, the date the option stops trading and settles.

- Style, American or European exercise rules. American style can be exercised any time before expiration. European style can be exercised only at expiration.

Options also have a premium. Your max loss on a long option is the premium paid, before fees. Your exposure still changes with price and time. Delta drives how much the option behaves like the underlying.

Contract multipliers matter. Many FX options are built on futures, so the option exposure follows the futures contract size and its tick structure.

Choosing the right notional exposure for your account size

Use a sizing routine that starts with risk, then backs into notional. Keep it consistent across spot, futures, and options.

- Step 1, set risk per trade as a percent of equity. Many traders use 0.25% to 1%.

- Step 2, define invalidation. Put a stop level in pips for spot, ticks for futures, or a premium limit for long options.

- Step 3, compute dollar risk per unit. Spot, pip value times stop pips. Futures, tick value times stop ticks. Options, premium paid plus fees for long options.

- Step 4, size the position. Contracts or lots equals allowed dollar risk divided by risk per unit. Round down.

- Step 5, check margin and liquidity. Margin must leave room for normal swings and spreads.

If you rely on leverage, separate sizing from margin. Size from your stop and risk limit first, then confirm margin second. Review forex leverage explained if you mix the two.

| Product | Smallest practical size | What fixes the contract | Key sizing constraint |

|---|---|---|---|

| Spot forex | Often 0.01 lot, broker dependent | Broker lot rules | Pip value scales with lot size; margin varies by broker |

| Futures | 1 micro contract if available | Exchange specs | Whole contract risk can be too large without micros |

| Options | 1 contract | Strike, expiry, style, multiplier | Premium, delta, and time decay change exposure |

Expiration, rollover, and carrying costs (the part most traders underestimate)

Spot forex rollover, swaps, and interest rate differentials

Spot forex has no expiry. Your broker still “rolls” your position each day after the broker’s cut-off time. You pay or receive a swap, also called rollover.

The swap comes from the interest rate differential between the two currencies, plus your broker’s markup. If you hold a higher-yielding currency against a lower-yielding one, you often earn positive carry. If you hold the low yielder, you often pay.

- Swap can flip. Central bank changes and short-term funding stress can turn a positive swap negative.

- Wednesday is larger. Many brokers charge or credit a 3-day rollover midweek to account for weekend settlement.

- Leverage magnifies it. You pay swap on the full notional, not just your margin.

- Rates are broker-specific. Two brokers can quote different swaps on the same pair.

Carry trade basics are simple. Positive carry can support a long-term position. It does not protect you from price moves. A few bad weeks of FX trend can erase months of carry.

Futures expiration, roll process, and basis risk

Futures expire. You must close, roll, or accept delivery or cash settlement, depending on the contract. Most traders roll before first notice day or before liquidity drops in the front month.

Rolling means you sell the expiring contract and buy the next one, or the reverse if you are short. Your P&L depends on both price movement and the roll price difference.

- Contango. The next contract trades at a higher price than the current one. Longs pay the roll. Shorts benefit.

- Backwardation. The next contract trades lower than the current one. Longs benefit. Shorts pay.

- Basis risk. Your hedge can drift because spot and futures do not move in perfect lockstep, especially around roll and during funding shocks.

In currencies, forward points reflect interest rate differentials. That means the roll “cost” often maps to rate spreads, but the exact roll level also depends on liquidity and positioning.

Options expiry, time decay, and volatility crush

Options expire. Time works against option buyers and in favor of option sellers. This shows up as theta, the daily loss of extrinsic value if price and volatility stay the same.

- Theta accelerates. Decay speeds up as expiry gets closer, especially at-the-money options.

- Volatility crush. Implied volatility can drop right after a known event. Option prices can fall even if spot moves your way.

- Event risk is priced in. Earnings-style logic applies to FX events, central bank meetings, CPI, jobs data. You often pay for that uncertainty upfront.

If you buy options as a hedge, match expiry to the risk window. If you buy short-dated options for a slow-moving view, theta can bleed you out before the move arrives.

Holding-period implications, intraday vs swing vs long-term

| Instrument | Best fit by holding period | Main cost you feel | Main “gotcha” |

|---|---|---|---|

| Spot forex | Intraday to multi-week | Spread, commissions, swap if held past rollover | Swap varies by broker and can dominate returns in long holds |

| Futures | Intraday to multi-month | Commissions, exchange fees, roll impact near expiry | Roll timing and basis can change hedge results |

| Options | Defined window trades and hedges | Premium, theta, implied volatility | Right view, wrong timing still loses, vol crush can hit hard |

If you trade intraday, expiration and carry matter less. If you swing trade, you must track rollover and the futures calendar. If you hedge long-term, you must plan for repeated futures rolls or repeated option re-hedges, and you must budget for the ongoing carrying cost.

For holding time selection, see forex timeframes explained.

Strategies: when spot, futures, or options tends to fit best

Short-term trading setups

For scalping and day trading, execution and spread matter more than carry.

- Spot FX: Fits fast in and out trading. You get small sizing steps and many pairs. Your main cost is spread, plus any commission model your broker uses. Track news spikes and spread widening around session opens and high-impact releases.

- FX futures: Fits short-term trading when you want one central order book and visible volume. You trade set contract sizes, so position granularity can be worse than spot. You pay exchange and clearing fees, plus bid-ask spread. Liquidity concentrates in the front contract, so use the most active month.

- FX options: Fits short-term only when you trade volatility, not direction alone. You can define max loss, but you pay premium and the spread can be wide. If you buy options for a quick move, theta works against you and implied volatility can drop after the event.

Swing and position trading

Once you hold for days or weeks, financing, rollover, and contract calendars start to dominate your results.

- Spot FX: You face daily rollover. Positive carry can help, negative carry can bleed. On Wednesdays, many brokers apply triple swap to account for weekend settlement.

- FX futures: You avoid daily swap, but the carry shows up in the futures price and in roll yield when you switch contracts. If you hold through roll, plan the roll date, the liquidity shift, and the spread between months.

- Options: You can cap downside without a stop. You still face time decay and changing implied volatility. If you hold long options through quiet periods, theta can dominate even if spot drifts your way.

Your sizing method matters more on multi-day holds. If you cannot convert your intended risk into clean trade size, your stop placement and your risk per trade break. Use consistent unit sizing and know your lot size before you set stops and targets.

Hedging use cases

Hedging is a cash-flow problem first. Pick the instrument that matches your exposure horizon and your need for flexibility.

- Importers and exporters: Use forwards in the real world, but in trading accounts you often replicate with futures or options. Futures fit fixed invoice dates if you can match contract months. Options fit when you want protection but still want to benefit if FX moves in your favor.

- Portfolio hedging: If you hold foreign stocks or bonds, you can hedge the currency overlay with futures for cleaner accounting and standardized contracts. Spot can work, but swap costs and broker terms can vary.

- Multi-currency expenses: If your costs are recurring, you need a repeatable hedge schedule. Futures require periodic rolls. Options require periodic re-hedges or a rolling collar. Spot requires managing ongoing swap and gap risk.

Volatility and event strategies with options

Options fit best when the distribution matters more than the point forecast.

- Long straddle: Buy call and put at the same strike. You need a move larger than the total premium. You also need implied volatility to not collapse too hard after the event.

- Long strangle: Buy out-of-the-money call and put. Premium is lower, but you need a larger move. This fits when you expect a breakout but you want defined risk.

- Defined-risk directional: Buy a call or put, or use a vertical spread to reduce premium. You cap max loss and you avoid stop-run noise, but your probability of profit depends on strike selection and implied volatility level.

- Selling premium: Short options can harvest decay, but event gaps can overwhelm small collected premium. Margin and tail risk management must be explicit.

Spreads and relative-value approaches

Spreads work when you want to reduce outright direction risk, target carry, or trade the term structure.

- Calendar spreads in futures: Long one contract month, short another. You trade roll dynamics, not spot alone. Liquidity and tick value differ by contract, so model the spread in price terms and in dollars per tick.

- Risk reversals in options: Long call and short put, or the reverse. You express skew and directional bias with lower upfront cost than a single long option, but you take asymmetric tail risk from the short leg.

- Synthetic FX positions: Use options to replicate spot exposure with defined risk, or use futures plus options for a hedged book. This can help when you need strict downside limits or need to shape your payout around a budget rate.

Pros and cons comparison (spot forex vs currency futures vs FX options)

Where spot forex shines

- Access: You can open a small account and trade fractional position sizes. You can scale in and out without matching an exchange contract.

- Flexibility: No fixed expiries. You can hold a position as long as your broker offers the pair and you can fund margin.

- Breadth of pairs: You get many majors, minors, and exotics from one platform. Futures concentrates liquidity in fewer contracts.

- Low friction for active execution: You can place stops, limits, and OCO brackets with most brokers. You can trade 24 hours a day from Monday to Friday.

Where spot forex can disappoint

- OTC opacity: There is no single tape. Your fill quality depends on your broker, its liquidity providers, and its internal risk controls. Learn the mechanics in how the forex market works.

- Broker conflicts: Some brokers run a dealing desk and can internalize your flow. You face execution rules you do not control.

- Costs hide in the spread and swap: Many accounts show “commission free,” but you still pay the spread. Overnight funding can dominate P and L on longer holds, especially in high rate differentials.

- Price gaps and slippage still happen: News releases can blow through stops. Liquidity can thin fast around rollovers, holidays, and risk events.

Where currency futures shine

- Transparency: You get centralized order books and time and sales. You can see depth and prints on the exchange.

- Regulation and clearing: A regulated exchange and clearinghouse sit between you and the counterparty. That reduces counterparty risk versus a single broker.

- Standardized pricing: You can benchmark fills against the same market other participants trade. That helps if you care about auditability.

- Institutional-style tools: You can use exchange order types, spread trading, and cross margining in some setups.

Key futures drawbacks

- Contract sizing: You trade fixed contract values. Micro contracts help, but you still have step sizes that can force you to take more or less risk than you want.

- Expiration and roll: Contracts expire. You must roll to the next contract to maintain exposure. Rolls can add slippage and spread costs.

- Exchange and clearing fees: You pay explicit commissions and fees. Costs stay visible, but they are still real.

- Less pair variety: Liquidity clusters in a small set of majors. Many crosses that are easy in spot require legging or synthetic spreads in futures.

Where FX options shine

- Defined-risk structures: Long options cap downside at premium paid. That matters when you cannot tolerate a stop gap through.

- Hedging precision: You can hedge known event risk, cap worst-case rates, or build collars and seagulls around a budget.

- Payoff shaping: You can express views on volatility, skew, and tail scenarios. You can separate direction from volatility exposure.

Options trade-offs

- Complexity: You manage Greeks, implied volatility, and exercise style. P and L drivers change as spot moves and time passes.

- Wider spreads: Many retail venues quote wider option spreads than spot or futures. Complex structures can add more friction.

- Time decay: Long premium positions lose value as expiry approaches if spot and implied volatility do not move in your favor.

- Tail risk if you sell options: Short premium can look stable until it breaks. Margin can expand fast in stress.

Pros and cons table (quick comparison)

Decision matrix by trader profile

Regulation, taxation, and account considerations (high-impact, often ignored)

Regulatory oversight differences

Regulation shapes your counterparty risk, pricing transparency, and complaint path.

- Spot forex (OTC): You trade with a broker or dealer, not on an exchange. Oversight depends on the broker’s home jurisdiction. Some regulators enforce leverage limits, reporting, segregation rules, and marketing standards. Others offer lighter supervision. Your trade can face broker-specific execution rules and conflicts of interest.

- Futures: In the US, futures trade on regulated exchanges under the CFTC, with NFA oversight for brokers. You face standardized contracts, centralized clearing, and daily mark-to-market. Your counterparty becomes the clearinghouse, not the broker.

- Options on futures: Same CFTC and exchange framework as futures, plus extra rules around options approvals and disclosures. You must understand assignment, exercise, and expiration behavior.

If you need a clean audit trail, exchange timestamps, and standardized fills, you will usually get more structure in futures and options than in OTC spot. If you choose spot, learn how pricing and execution work in your broker’s model. See how the forex market works.

Tax treatment considerations

Taxes can change your net result more than spreads or commissions. Rules vary by country and account type, so treat this as a checklist, not a final answer.

- Spot forex: Often taxed under rules for FX transactions or derivatives, depending on how your broker books the product and where you live. Some jurisdictions treat rollover and financing as interest-like income. Others roll it into trading P&L.

- Futures: Often receive defined tax treatment because contracts are standardized and exchange-traded. In some countries, mark-to-market rules apply. In the US, certain futures may qualify for blended long-term and short-term treatment, but your situation depends on product and filing status.

- Options: Tax timing can differ based on whether you buy or write options, and whether positions expire, get exercised, or get closed early. Premiums, realized gains, and assignment events can create different reporting lines.

Before you scale size, confirm how your broker reports trades, how gains get classified, and how losses net across products. A mismatch can create surprise tax bills or limit loss offsets.

Platform and data needs

Your tools must match the product.

- Spot forex: You need solid execution logs, rollover and financing visibility, and clear order handling rules. If your broker internalizes flow, demand fill reports and slippage stats if available.

- Futures: You want depth of market, time and sales, and reliable historical tick data if you scalp or trade around news. Exchange data often requires paid subscriptions. Budget for it.

- Options: You need an options chain, implied volatility, and Greeks. Track delta, gamma, theta, and vega. You also need tools to map payoff at expiration and before expiration, because time decay and volatility shifts can dominate your P&L.

If your platform cannot show volatility inputs, margin impact, and scenario P&L, you will mis-size options risk.

Risk disclosures and suitability

Leverage multiplies errors. Your broker will ask for suitability details for a reason.

- Margin works differently: Spot margin terms come from the broker. Futures margin comes from the exchange and clearing process, plus broker add-ons. Options add premium risk for buyers and assignment risk for sellers.

- Gap risk is real: Stops do not guarantee fills in fast markets. Futures and options can gap at the open. Spot can gap on thin liquidity or major announcements.

- Account approvals matter: Options often require higher approvals, experience disclosures, and sometimes higher capital. Futures accounts can require risk acknowledgments and margin agreements.

- Know the loss mechanics: Spot and futures can move against you beyond your planned stop. Short options can create asymmetric losses. Some CFD-style accounts can go negative in certain jurisdictions, but rules differ.

Read the risk disclosure and margin schedule before you trade. If you cannot explain how you get liquidated, you cannot control risk.

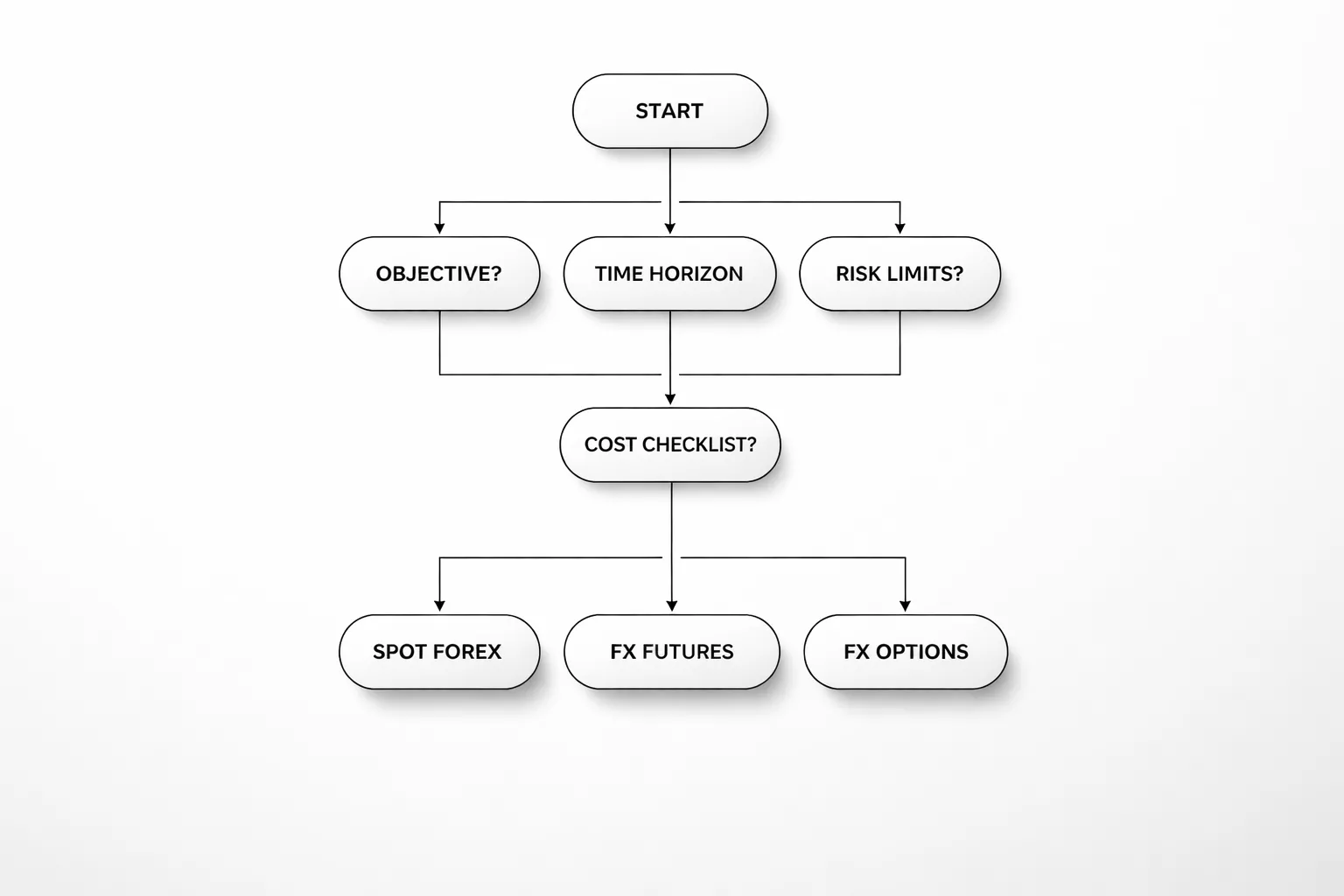

How to choose the right instrument: a step-by-step framework

Define your objective and time horizon

Start with the job you need the trade to do. Speculation and hedging need different tools.

- Spot FX. Best for short-term directional trades and active execution. No expiration date. You manage overnight financing if you hold positions.

- FX futures. Best when you want exchange pricing, centralized volume, and a standardized contract. You accept expiration and roll management.

- FX options. Best when you need defined payoff shapes, such as capped downside, or you want to express a view on volatility. You accept premium, spreads, and position management around expiration.

Then match the instrument to your holding period.

- Intraday. Spot and liquid near-month futures usually give tighter execution. Options can work, but spreads and time decay can dominate short holds.

- Multi-day to long-term. Futures and options can be cleaner for risk definition and hedging. Spot can still work, but you must model rollover and rate differentials.

Match the instrument to your risk tolerance

Pick the instrument that matches how you want losses to behave.

- Maximum loss clarity. Long options have a known max loss, the premium. Spot and futures do not. Loss depends on price movement and your liquidation rules.

- Gap risk. Futures and spot can gap through stops in fast markets. Your fill can be worse than planned. Plan for slippage, not your stop price.

- Assignment and exercise risk. Short options can get assigned. Your risk can change fast near expiration. Track delta exposure and your margin requirement daily if you sell options.

- Leverage control. Futures give fixed contract size. Spot lets you size more granularly. If you tend to oversize, fixed contracts can force discipline, or blow you up faster. Choose based on your behavior, not theory.

If you trade less-liquid currency pairs, start by understanding liquidity and spreads. Use this guide to compare major vs minor vs exotic pairs.

Estimate total costs before placing a trade

Build an all-in cost worksheet. Do it before you click.

| Cost item | Spot FX | Futures | Options |

|---|---|---|---|

| Spread | Often tight in majors, wider off-hours | Often tight in front month | Can be wide, varies by strike and expiry |

| Commission | Sometimes embedded, sometimes explicit | Explicit per contract, plus exchange and clearing fees | Per contract, plus exchange and clearing fees |

| Financing and carry | Swap or rollover each day you hold | Embedded in futures price, plus roll impact | Priced into option premium via rates and carry |

| Slippage | Depends on broker execution and volatility | Depends on liquidity and order type | Can be large in fast markets |

| Roll and expiry | None | Yes, you must roll or settle | Yes, you must manage expiry and exercise |

Convert costs into pips or dollars per trade. Then compare that number to your expected move and your stop distance. If costs eat the edge, change the instrument, change the setup, or do not trade.

Start small and validate execution

Prove the process before you scale.

- Paper trade for mechanics. Focus on order types, margin changes, and how your platform handles stops and fills. Treat it as a systems test, not a profit test.

- Use micro sizing. Risk a fixed small amount per trade. Keep it small enough that you follow rules.

- Run a post-trade review. Track planned entry, actual entry, slippage, all costs, and whether your exit matched the plan. Fix one execution issue at a time.

- Stress test one bad day. Model a gap, a spike in implied volatility, or a margin increase. If the account cannot survive that scenario, your size is too large.

Common mistakes to avoid

- Overleveraging. Most blowups start with size. Reduce leverage before you look for a better strategy.

- Ignoring roll costs in futures. Rolling can add or subtract meaningful cost. Track the price difference between contracts and the timing of your roll.

- Ignoring financing in spot. Overnight swap can turn a good trade into a bad trade. Include it in your expected return.

- Trading illiquid options. Wide spreads and poor fills can wipe out your edge. Stick to liquid expiries and strikes, and avoid chasing mid prices that never fill.

- Selling options without a loss plan. Short premium can lose fast. Define your max loss, adjustment rules, and margin buffer before entry.

- Using stop orders as a guarantee. Stops manage intent, not outcomes. Plan for slippage and gaps in spot and futures.

FAQ

Which market has the lowest costs?

It depends on your size and holding time. Spot often embeds cost in the spread and swap. Futures add exchange fees and commissions but can offer tight, transparent bids and offers. Options add spread plus implied volatility and time decay. Compare all-in cost on your exact trade plan.

Which is more regulated?

Exchange-traded futures and options sit under exchange rules, clearing, and daily settlement. Spot FX runs through brokers and liquidity providers, with regulation at the broker level. You manage more counterparty risk in spot. You manage more rule and margin structure in futures.

Do futures and options trade 24 hours like spot?

Spot runs nearly 24 hours from Monday to Friday. Many FX futures trade close to 23 hours per day on weekdays, with a daily maintenance break. Options follow the futures session but key strikes can go illiquid outside peak hours. Check your venue’s schedule.

Can you hold spot forever, but futures expire?

Yes. Spot has no expiry, but you pay or earn rollover each day. Futures expire on a set date, so you must close or roll. Options expire too, and time decay accelerates near expiry. Plan the exit date before you enter.

Which offers better price transparency?

Futures usually win. You see a centralized order book, prints, and volume. Spot prices come from your broker’s feed and can vary across venues. You can still trade spot well, but you must watch spread behavior and execution quality. Read what is spread in forex.

Is leverage higher in spot?

Often, yes. Spot brokers may offer higher headline leverage. Futures use exchange-set initial and maintenance margin that changes with volatility. Options leverage depends on premium paid, delta, and margin rules for selling. Higher leverage increases your chance of rapid loss.

Are futures “safer” because they clear through an exchange?

Clearing reduces counterparty risk versus an OTC spot relationship. It does not reduce market risk. Futures can gap, and margin calls can force liquidation fast. Your main safety tool is position size and risk limits, not the product label.

Do options cap your risk?

Buying options caps risk at the premium paid, plus fees. Selling options can carry large or undefined risk, depending on the structure. Spreads can define risk but still need margin and exit rules. Liquidity matters more than theory, especially near strikes.

What is the cleanest product for directional trading?

Spot or futures. Spot keeps it simple, but you must account for swap and variable spreads. Futures give fixed contract sizing and a transparent book, but you manage expiries and margin. Options add extra variables like implied volatility and theta, which can overwhelm simple direction.

Can you hedge spot with futures or options?

Yes. You can offset spot exposure with FX futures, or define a payoff with options. Match notional size, currency pair, and timing. Watch basis risk, since futures and spot can diverge. A hedge that does not align in size or horizon becomes a new trade.

Which works best for news trading?

None guarantees clean fills. Spot spreads can widen hard. Futures can slip during fast moves and thin books. Options can price in the event through implied volatility, making premiums expensive. If you trade news, cut size, predefine max loss, and expect worse execution.

Conclusion

Conclusion

Spot FX gives you access and flexibility. Futures give you a centralized exchange, standard sizing, and clear volume. Options give you defined risk and flexible payoff, but you pay for time and implied volatility.

Pick the product that matches your constraint. If you need tight sizing and no expiry, use spot. If you need transparency and exchange rules, use futures. If you need a hard loss limit and can accept premium decay, use options.

- Match your time horizon to the contract. Avoid rolling risk and basis surprises.

- Size to worst-case execution. Spreads and slippage expand when liquidity drops. Read more in what is slippage in forex.

- Know your full cost. Include spread, commission, financing or carry, exchange fees, and option IV.

- Plan exits before entries. Use hard stops or option structures. Do not rely on fills during spikes.

Your final step. Write a one-page checklist for your setup, product, size, max loss, and exit rules. Run it every trade. If any item fails, you pass.

-

- Which market has the lowest costs?

- Which is more regulated?

- Do futures and options trade 24 hours like spot?

- Can you hold spot forever, but futures expire?

- Which offers better price transparency?

- Is leverage higher in spot?

- Are futures “safer” because they clear through an exchange?

- Do options cap your risk?

- What is the cleanest product for directional trading?

- Can you hedge spot with futures or options?

- Which works best for news trading?

-

- Which market has the lowest costs?

- Which is more regulated?

- Do futures and options trade 24 hours like spot?

- Can you hold spot forever, but futures expire?

- Which offers better price transparency?

- Is leverage higher in spot?

- Are futures “safer” because they clear through an exchange?

- Do options cap your risk?

- What is the cleanest product for directional trading?

- Can you hedge spot with futures or options?

- Which works best for news trading?