What Is Forex Trading? A Beginner’s Guide to How It Works

Forex trading means buying one currency and selling another at the same time. You trade currency pairs like EUR/USD. Your goal is to profit from price changes driven by interest rates, inflation, news, and market risk.

Forex runs 24 hours a day from Monday to Friday. It is the largest financial market by daily turnover, with about $7.5 trillion traded per day, based on the BIS 2022 survey.

In this guide, you will learn how forex trading works, what a currency pair is, how pricing moves in pips, and how spreads affect your cost. You will also learn the basics of leverage and margin, why many retail traders lose money, and how to control risk with position sizing and stop-loss orders.

Key Takeaways

Key Takeaways

- In het kort: Forex is the global market where you trade one currency for another, in pairs like EUR/USD.

- In het kort: It is the largest financial market by turnover, about $7.5 trillion per day, based on the BIS 2022 survey.

- In het kort: Your profit or loss comes from small price moves, measured in pips, and from your position size.

- In het kort: You pay trading costs through the spread, the difference between bid and ask.

- In het kort: Leverage lets you control a larger position with less capital, but it also magnifies losses.

- In het kort: Margin is the deposit your broker requires to open and keep a leveraged trade.

- In het kort: Many retail traders lose money because they use too much leverage, risk too much per trade, or skip stop-loss rules.

- In het kort: Control risk with position sizing, stop-loss orders, and a clear limit on how much you can lose per trade.

- In het kort: If you trade with leverage, understand the mechanics first, read margin vs leverage.

What Is Forex Trading? (Definition and Plain-English Overview)

What forex trading means

Forex trading means you buy one currency and sell another, aiming to profit from a change in the exchange rate.

You trade currency pairs like EUR/USD or USD/JPY. If the pair rises, the first currency strengthens against the second. If it falls, it weakens.

Forex trading vs currency exchange

Currency exchange converts money for spending. You do it for travel, bills, or business payments. The goal is access, not profit.

Forex trading takes a view on price movement. You enter a position, manage risk, and close the trade for a gain or a loss.

- Exchange: One-time conversion. You accept the rate and fees.

- Trading: Ongoing positions. You face spreads, possible financing costs, and market risk.

How exchange rates work in plain English

An exchange rate shows the value of one currency priced in another.

Example: EUR/USD = 1.0800 means 1 euro costs 1.08 US dollars.

- If EUR/USD moves from 1.0800 to 1.0900, the euro strengthened vs the dollar.

- If it drops from 1.0800 to 1.0700, the euro weakened vs the dollar.

Rates move because buyers and sellers change their expectations about inflation, interest rates, growth, and risk. News can move prices fast. Liquidity can dry up around major events.

Why forex is the largest and most liquid market

Forex runs 24 hours a day, five days a week, across global trading sessions. Banks, funds, companies, and retail traders all take part.

This creates heavy volume and deep liquidity in major pairs. Deep liquidity often means tighter spreads and easier order filling, especially in EUR/USD, USD/JPY, and GBP/USD.

Daily turnover sits in the trillions of dollars. The BIS 2022 Triennial Survey reported about $7.5 trillion per day in average daily FX turnover.

If you want to understand how pair types differ in liquidity and spreads, see major, minor, and exotic currency pairs.

How the Forex Market Works (Who Trades and Why Prices Move)

Market participants, who trades and why

- Banks and dealers. They make prices and match orders. They hedge client flows and trade for their own books. Their activity drives most day to day liquidity in major pairs.

- Central banks. They set policy rates and manage reserves. They may buy or sell currency to smooth volatility or to support policy goals. Their signals can move markets even without large trades.

- Corporations. They convert currencies to pay suppliers, staff, and taxes. They hedge future cash flows with forwards and options. Their flows often cluster around month end and large invoice dates.

- Funds and asset managers. They adjust currency exposure inside global portfolios. They trade macro themes, yield differences, and risk. They can move price when they rebalance size.

- Retail traders. You trade through a broker on margin. Retail volume is smaller than institutional flow, but it can amplify short term moves during news and high volatility sessions.

What moves currency prices

- Interest rates and expectations. Currencies tend to strengthen when a country offers higher expected yields. Markets move on rate paths, not just the current rate.

- Inflation. High inflation can weaken a currency if it erodes purchasing power. It can also strengthen it if it forces tighter policy. Watch how inflation changes central bank expectations.

- Growth and jobs. Strong data can support a currency through higher rate expectations and capital inflows. Weak data can do the opposite.

- Geopolitics and policy risk. Elections, sanctions, conflicts, and trade policy can reprice a currency fast. Liquidity can disappear during shocks.

- Risk sentiment. When markets seek safety, funding currencies and high beta currencies can move hard. JPY and CHF often react during risk off episodes, AUD and NZD often react during risk on and risk off swings.

News and data releases, why economic calendars matter

FX prices adjust when new information changes rate expectations, growth outlook, or risk. You need a calendar because many moves start in seconds.

- Top tier releases. CPI, jobs reports like US Nonfarm Payrolls, GDP, central bank rate decisions, and press conferences.

- Market reaction depends on expectations. Price often moves more on the gap versus forecast than on the headline number.

- Timing matters. Liquidity can thin out before a release. Spreads can widen and fills can worsen right at the timestamp.

- Read the whole package. For jobs, look at wages and revisions. For inflation, look at core measures. For central banks, read the statement and track changes in language.

Liquidity, volatility, and slippage, what to expect in fast markets

Liquidity means how easily you can trade without moving price. Volatility means how far price moves in a given time. Slippage means your fill price differs from your requested price.

- Liquidity changes by pair and session. EUR/USD and USD/JPY usually trade with tighter spreads than exotics. London and New York overlap often brings the deepest liquidity.

- Volatility clusters. It often spikes around scheduled data, central bank events, and geopolitical headlines. It often drops in quiet hours and holidays.

- Spreads can widen. This often happens during rollover, around news, and during thin liquidity. A wider spread raises your break even point.

- Slippage increases in fast markets. Stop orders can fill worse than your stop level if price gaps. Limit orders control price but may not fill.

- Execution quality matters. Your broker, order type, and market conditions decide your fill. If you want a deeper dive, see how the forex market works.

Currency Pairs Explained (Majors, Minors, Exotics)

Base Currency vs. Quote Currency

Forex quotes come in pairs, like EUR/USD.

- Base currency is the first currency, EUR.

- Quote currency is the second currency, USD.

The price tells you how much quote currency you need to buy 1 unit of the base currency.

If EUR/USD = 1.0850, you pay 1.0850 USD for 1 EUR.

If EUR/USD rises, the euro strengthens versus the dollar. If it falls, the euro weakens versus the dollar.

Majors, Minors, and Exotics

Brokers group pairs by liquidity, spread, and typical volatility. These traits affect your costs and your risk.

| Group | What it includes | Typical traits | What it means for you |

|---|---|---|---|

| Majors | Pairs with USD and a major economy currency, like EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, NZD/USD | Highest liquidity, tightest spreads, deep order books | Lower trading costs in normal conditions, cleaner fills, usually less slippage than thinner pairs |

| Minors | Major currencies without USD, like EUR/GBP, EUR/JPY, GBP/JPY, AUD/JPY | Good liquidity but less than majors, spreads often wider than majors | Costs rise, moves can be sharper around local data and central bank events |

| Exotics | One major currency plus an emerging market currency, like USD/TRY, USD/MXN, USD/ZAR, EUR/TRY | Lower liquidity, wider spreads, bigger gaps, more rollover impact | Higher break even, higher slippage risk, stop losses can fill far from your level in fast markets |

- Start with majors if you want tighter spreads and more consistent execution.

- Treat exotics like a different product. Size smaller. Expect wider spreads and faster drawdowns.

Cross Pairs and USD’s Role in Pricing

A cross pair is a pair that does not include USD, like EUR/GBP or AUD/JPY.

USD still matters because it anchors global FX pricing. Many cross prices come from two USD pairs.

Example cross pricing:

- If EUR/USD rises while GBP/USD stays flat, EUR/GBP tends to rise.

- If both EUR/USD and GBP/USD rise, EUR/GBP may barely move.

This matters for risk. A cross can load you into two macro stories at once. You can also end up with hidden USD exposure through correlated moves. For more detail on pricing and execution, see how the forex market works.

Going Long vs. Going Short

When you trade a pair, you always buy one currency and sell the other.

- Go long EUR/USD means you buy EUR and sell USD. You profit if EUR/USD rises.

- Go short EUR/USD means you sell EUR and buy USD. You profit if EUR/USD falls.

Think in simple terms. Long means you expect the base currency to strengthen versus the quote currency. Short means you expect it to weaken.

Core Forex Terms Beginners Must Know

Pips and Pipettes: Measuring Price Movement

A pip is the standard unit of price movement in forex. Most pairs quote to 4 decimal places. One pip equals 0.0001.

Example: EUR/USD moves from 1.1050 to 1.1051. That is a 1 pip move.

A pipette is one tenth of a pip. Many brokers show a 5th decimal place. One pipette equals 0.00001.

Example: EUR/USD moves from 1.10500 to 1.10507. That is 0.7 pips, or 7 pipettes.

Pairs with JPY usually quote to 2 decimals. One pip equals 0.01, and one pipette equals 0.001.

Lot Sizes: Standard, Mini, Micro

A lot is how you size your trade. Lot size controls your exposure and how much you gain or lose per pip.

- Standard lot: 100,000 units of the base currency.

- Mini lot: 10,000 units of the base currency.

- Micro lot: 1,000 units of the base currency.

Bigger lots mean bigger pip value. Your profit and loss moves faster. Your margin use rises too.

If you want to size trades with a rule-based method, see our position sizing guide.

Bid, Ask, and Spread: The Built-in Trading Cost

Bid is the price you can sell at. Ask is the price you can buy at.

The spread is the difference between ask and bid. You pay it when you enter a trade.

If EUR/USD shows 1.10500 bid and 1.10502 ask, the spread is 0.00002, which is 0.2 pips.

Lower spreads usually reduce your costs, especially if you trade often.

Order Types: Market, Limit, Stop, Stop-limit

Orders control how you enter or exit a trade.

- Market order: fills at the best available price now. You get speed, not price control.

- Limit order: fills only at your price or better. You control price, but you may miss the trade.

- Stop order: becomes a market order after price hits your stop level. You use it to enter breakouts or to exit with a stop loss.

- Stop-limit order: becomes a limit order after price hits your stop level. You set a stop trigger and a limit price. You avoid bad fills, but you risk no fill in fast moves.

Fast markets can cause slippage. Your fill price can differ from your requested price, mainly with market and stop orders.

Rollover, Swap, and Overnight Financing

If you hold a position past your broker’s daily cutoff, your trade can earn or pay an overnight charge.

- Rollover: the process of extending a position to the next trading day.

- Swap: the interest credit or debit from holding the pair overnight. It depends on the rate difference between the two currencies and your broker’s markup.

- Overnight financing: the general term brokers use for the daily hold cost, including swaps on spot FX or funding charges on leveraged products.

If you go long the higher-rate currency versus the lower-rate currency, you may earn swap. If you hold the lower-rate currency, you often pay swap.

Swap rates change. Brokers publish long and short swap values per pair. Check them before you hold trades for days or weeks.

Leverage and Margin (How Small Deposits Control Larger Positions)

Margin requirement, margin used, and free margin

Margin is the deposit your broker locks to open and hold a leveraged trade. It is not a fee. It is tied to your position size and your broker’s margin rate.

Leverage sets the margin requirement. Higher leverage means lower required margin. Lower leverage means higher required margin.

- Margin requirement, the percentage of the position value you must post.

- Used margin, the amount currently locked across your open trades.

- Free margin, the funds left to absorb losses and open new trades.

Example with simple numbers.

- Account equity: $1,000.

- You open a $10,000 position.

- If margin requirement is 2%, used margin is $200.

- Free margin starts at $800, before any floating profit or loss.

Margin calls and liquidation, how losses can snowball

Your broker tracks your margin level. It compares your equity to your used margin. When losses cut your equity, your margin level falls.

- Margin call, a warning level. The broker may block new trades.

- Stop-out or liquidation, a forced close level. The broker closes positions to reduce used margin and limit further loss.

Losses can snowball because leverage magnifies the dollar impact of small price moves. When equity drops, you have less free margin. You then hit margin thresholds faster, especially if spreads widen or the market gaps.

Simple path to liquidation.

- You have $1,000 equity and $500 used margin.

- Your trade moves against you and your floating loss hits $400.

- Your equity drops to $600. Free margin drops to $100.

- A wider spread or another small move can push equity down further.

- If you hit the broker’s stop-out level, the platform starts closing trades.

Leverage examples with clear profit and loss numbers

Assume EUR/USD. One standard lot is 100,000 units. A 10 pip move is about $100 per standard lot, because 1 pip is about $10 per standard lot on USD-quoted pairs.

| Position size | Approx. $ per pip | 10 pips profit | 10 pips loss |

|---|---|---|---|

| 0.10 lot (10,000 units) | $1 | +$10 | -$10 |

| 0.50 lot (50,000 units) | $5 | +$50 | -$50 |

| 1.00 lot (100,000 units) | $10 | +$100 | -$100 |

Now connect that to a small deposit.

- You deposit $1,000.

- You use 50:1 leverage to control a $50,000 position, about 0.50 lot.

- A 50 pip loss is about $250. That is 25% of your account.

- A 100 pip loss is about $500. That is 50% of your account.

Leverage does not change the market. It changes how much a normal move hits your equity. If you want more detail on terms, read margin vs leverage in forex.

Practical guidelines, keep leverage conservative as a beginner

- Size positions from risk, not from max leverage. Decide how much you can lose on a trade, then set lot size to fit.

- Risk small per trade. Many beginners cap risk at 1% of equity per trade, sometimes less.

- Keep used margin low. Aim to keep plenty of free margin so normal swings do not trigger margin pressure.

- Avoid stacking correlated trades. Multiple positions that move together act like one bigger leveraged bet.

- Plan for spreads and volatility. News can widen spreads and move price fast, which can hit stop-outs earlier than you expect.

- Know your broker’s margin call and stop-out levels. Read them in the account terms before you trade live.

Ways to Trade Forex (Instruments and Access Methods)

Spot FX vs. Forwards and Futures

Spot FX is the core forex market. Price quotes stream in real time. In retail trading, you usually do not take physical delivery of currency. Your broker rolls positions each day and applies a swap or financing charge.

FX forwards are private contracts between two parties to exchange currencies at a set rate on a future date. Banks and companies use them to hedge cash flows. You will face credit risk to the counterparty and wider dealing spreads. Most beginners do not trade forwards directly.

Currency futures trade on regulated exchanges. Each contract has a fixed size, tick value, and expiry. You post margin through the exchange clearing system. You get central pricing and standard terms, but fewer pair choices than spot. You must manage expiry and rolling.

- Spot: flexible sizing, many pairs, broker pricing, rollover costs.

- Forwards: customized terms, counterparty credit risk, used for hedging.

- Futures: regulated exchange, standardized contracts, expiry and roll.

CFDs and Retail Broker Models

Many retail accounts trade forex through CFDs or rolling spot contracts. You trade a price feed on a broker platform. You do not own a currency deposit. Your profit or loss comes from the price change times your position size, minus spreads, commissions, and financing.

Before you deposit, verify how your broker executes trades. This affects your fills, your costs, and your risk in fast markets.

- What you are trading: a broker contract that tracks a currency pair price, not an exchange-traded instrument.

- Regulation and client money: check the regulator, license number, and whether client funds sit in segregated accounts.

- Execution model: read whether the broker uses dealing desk, internalization, or routes orders to liquidity providers.

- Costs: confirm the typical spread, any commission per lot, and overnight swap rates.

- Order handling: confirm how stop-loss and take-profit orders trigger, and whether stops can slip during news. See What Is Slippage in Forex?.

- Risk controls: check negative balance protection, margin call rules, and stop-out levels.

- Withdrawal rules: read funding methods, processing times, and fees. Test a small withdrawal early.

ETFs and Currency Funds

If you want currency exposure without high leverage, you can use currency ETFs and currency mutual funds. You buy and sell them in a brokerage account like a stock or fund.

- Pros: simple access, no margin rollover, clear pricing, fits long-term portfolios.

- Cons: limited pair selection, market hours follow the exchange, tracking error can occur, fees apply.

- What to check: expense ratio, assets under management, tracking method, liquidity and average volume, bid-ask spread, and the fund’s currency exposure rules.

Copy Trading and Signal Services

Copy trading links your account to another trader’s positions. Signal services send trade ideas you execute yourself. Both can reduce your workload, but they do not remove risk. Many track records break once market conditions change.

- Main benefit: structure. You follow a defined approach instead of improvising.

- Main pitfall: you copy risk you do not understand, including leverage, correlation, and holding through news.

- Track record checks: review duration, maximum drawdown, average win and loss size, worst month, and performance during high-volatility periods.

- Risk rules: set your own max daily loss, max drawdown stop, and position size cap. Avoid systems that scale up after losses.

- Incentives: watch for revenue tied to volume, spreads, or referral payments. That can push overtrading.

- Transparency: avoid services that hide open trades, use vague entries, or refuse to disclose risk limits.

- Trial process: start on a demo or small account. Compare copied fills to the provider’s stated fills.

A Step-by-Step Example of a Forex Trade

1) Choose a pair and define your thesis

Start with a liquid, tight-spread pair. Use EUR/USD for this example.

Your thesis states what you expect, and why, in one sentence.

- Pair: EUR/USD

- Thesis: You expect EUR/USD to rise because US inflation data came in below forecast, which can weaken the USD, and price broke above a recent resistance level.

- Trade type: Buy EUR/USD (you buy EUR and sell USD).

2) Calculate position size, pip value, and total risk

Set a fixed risk per trade before you pick your lot size.

- Account size: $10,000

- Risk per trade: 1% = $100

- Stop-loss distance: 25 pips

For EUR/USD, a 1 pip move equals 0.0001 in price. With USD as the quote currency, pip value stays simple.

- Pip value (standard lot 100,000): about $10 per pip

- Pip value (mini lot 10,000): about $1 per pip

Position size formula.

Lots = Risk in USD / (Stop in pips × Pip value per 1.00 lot)

Plug in the numbers.

- Lots: $100 / (25 × $10) = 0.40 lots

- Units: 0.40 × 100,000 = 40,000 EUR

- Risk: 25 pips × ($10 × 0.40) = $100

If your broker shows different pip values due to account currency or pricing, use the platform’s pip-value tool and keep the same risk math.

3) Place entry, stop-loss, and take-profit

Decide how you enter. Market orders fill now. Limit orders wait for your price.

Sample setup using a market entry.

| Action | Buy EUR/USD |

| Position size | 0.40 lots (40,000 units) |

| Entry | 1.10000 |

| Stop-loss | 1.09750 (25 pips) |

| Take-profit | 1.10500 (50 pips) |

| Risk | $100 |

| Reward | 50 pips × ($10 × 0.40) = $200 |

| Risk to reward | 1:2 |

Place the stop and take-profit when you place the trade. Do not rely on adding them later.

4) What happens after entry: spread, swaps, and exit outcomes

You pay the spread when you enter and exit. The spread is the gap between bid and ask.

- Example spread: 1.2 pips

- Spread cost (one side, at entry): 1.2 × ($10 × 0.40) = $4.80

- Round-turn spread cost (entry + exit): about $9.60

Your platform may show profit as slightly negative right after entry. That is the spread.

If you hold past your broker’s daily rollover time, you may pay or earn swap. Swap depends on the pair, your direction, and broker rates.

- Example swap: -$1.50 per day on 0.40 lots

- Held 3 nights: about -$4.50

Exit outcomes on this setup.

- Stop-loss hit: -25 pips = -$100, plus spread and any swap.

- Take-profit hit: +50 pips = +$200, minus spread and any swap.

Fills can differ from your order price in fast markets. That difference is slippage. See what is slippage in forex if you want to control it with order types, timing, and broker settings.

Forex Trading Strategies for Beginners (Simple Frameworks)

Trend-Following Basics (Higher Highs and Higher Lows)

Trend-following aims to trade with direction.

- Uptrend: price makes higher highs and higher lows.

- Downtrend: price makes lower highs and lower lows.

- Range: price fails to make progress in either direction.

Use a simple structure check.

- Mark the last two swing highs and swing lows.

- If highs and lows both rise, you only look for buys.

- If highs and lows both fall, you only look for sells.

Basic entry framework.

- Wait for a pullback against the trend.

- Enter when price starts moving back with the trend.

- Place your stop beyond the last swing point that proves you wrong.

- Target the prior high or low, or use a fixed risk to reward plan like 1:2.

Range Trading Basics (Support, Resistance, Mean Reversion)

Range trading assumes price returns to the middle after reaching extremes.

- Support: an area where price often stops falling.

- Resistance: an area where price often stops rising.

Basic range framework.

- Identify a clear top and bottom that held at least two times each.

- Buy near support, sell near resistance.

- Set your stop outside the range boundary, not inside it.

- Take profit near the middle of the range first, then at the opposite side.

Risk you must respect.

- Ranges break.

- When volatility expands, stops near the edges get hit fast.

- Wide spreads during news can turn a clean range entry into a poor fill.

Breakout Approach (Volatility Expansion, False-Break Risk)

Breakouts try to capture a move after price leaves a tight area.

Simple breakout checklist.

- Find consolidation with multiple touches and shrinking swings.

- Mark the high and low of the box.

- Plan the trade before the break, entry, stop, target.

Two beginner-friendly execution options.

- Close confirmation: enter only after a candle closes outside the level.

- Retest entry: enter after price breaks, then returns to test the level.

False-break control.

- Place your stop where the breakout should not return, often back inside the box.

- Avoid breakouts into obvious higher timeframe support or resistance.

- Skip low-liquidity hours when spikes can trigger stops and reverse.

Timeframes and Style Selection (Scalping, Day Trading, Swing Trading)

| Style | Typical hold time | Common charts | Main focus | Beginner risk points |

|---|---|---|---|---|

| Scalping | Seconds to minutes | M1 to M5 | Small moves, many trades | Spread and slippage can erase edge, fast decisions, high trading costs |

| Day trading | Minutes to hours, flat by end of day | M15 to H1 | Intraday trend and levels | Overtrading, news spikes, inconsistent stops |

| Swing trading | Days to weeks | H4 to D1 | Bigger moves, fewer trades | Overnight swap, weekend gaps, wider stops need smaller position size |

Pick one style based on time and temperament.

- If you cannot watch charts, do not scalp.

- If you cannot hold overnight, do not swing trade.

- If your stops must be tight, avoid volatile pairs and major news windows.

Match the timeframe to your stop size.

- Lower timeframes usually need tighter stops but suffer more from spread noise.

- Higher timeframes usually need wider stops and smaller lot sizes to keep risk fixed.

Backtesting and Journaling (Validate Without Guesswork)

Do not trust a strategy you have not tested.

Basic backtest process you can run in a spreadsheet.

- Write exact rules, entry trigger, stop placement, take profit, and time filter.

- Choose one pair and one timeframe.

- Collect at least 100 trades if possible, 30 is a minimum for a first check.

- Log each trade, entry price, stop in pips, target in pips, result in R.

Track these core metrics.

- Win rate: winners divided by total trades.

- Average win and average loss: measured in R, not dollars.

- Expectancy: (win rate x avg win) minus (loss rate x avg loss).

- Max drawdown: worst peak to trough in R.

Use journaling to remove repeat mistakes.

- Record screenshots of entry and exit.

- Note session time, spread at entry, and any news nearby.

- Tag the setup type, trend, range, breakout.

- Review every 20 trades and change one variable at a time.

Keep risk constant while testing.

- Risk a fixed percent per trade, such as 0.5% to 1%.

- Hold your risk per trade steady and let position size change with stop distance.

- Use the same pip value logic each time, see What Is a Lot Size in Forex if you need a quick refresher.

Risk Management and Trading Psychology (The Real Beginner Edge)

Risk per Trade and the 1 to 2 Percent Rule

Your job is to stay in the game. Risk control does that.

Set a fixed risk per trade. Most beginners use 0.5% to 1%. Some use 2% and accept bigger drawdowns. Pick a number and keep it constant.

- Account size: $5,000

- Risk per trade: 1%

- Max loss per trade: $50

Now position size becomes math. Wider stop, smaller size. Tighter stop, larger size. You do not change your risk because you feel confident. You do not increase risk to win back losses.

Use a hard daily loss limit. Example, stop trading after 2R or 3R down for the day. It cuts impulse trades and protects your next week.

Stop Loss Best Practices and Common Mistakes

A stop loss is a price level that proves your idea wrong. Place it before you enter.

- Put the stop where your setup fails, not where the loss feels smaller.

- Keep the stop in the system, not in your head.

- Expect normal noise. If your stop sits inside normal swing size, you will bleed.

Common beginner errors:

- Moving the stop farther: you turn a planned small loss into a large loss.

- Canceling the stop: you trade hope, not a plan.

- Revenge trading after a stop-out: you take low quality entries to “get it back.”

- Using the same stop size on every trade: volatility changes, your stop should match structure and conditions.

If you trail a stop, do it with rules. Example, move it only after a new swing forms or after price closes beyond a level. Do not trail because you feel nervous.

Risk to Reward Ratios and Why Win Rate Is Not Everything

Win rate alone does not tell you if a system works. Your average win and average loss matter more.

Focus on expectancy:

Example outcomes using R, where 1R equals your risk per trade.

A lower win rate can still grow an account if wins outweigh losses. A high win rate can still fail if losses spike or winners stay small.

Pick a target that fits your setup. Many beginners force 3R targets in markets that rarely run. Others take profits at 0.5R and need an unrealistic win rate.

Managing Emotions: Fear, Greed, Overtrading, Decision Fatigue

Trading problems often start as process problems.

- Fear: you cut winners early, you skip valid entries, you tighten stops without a rule.

- Greed: you add size late, you remove targets, you hold through exit signals.

- Overtrading: you take marginal setups because you want action.

- Decision fatigue: after too many charts and inputs, you stop following your plan.

Use simple controls:

- Trade a fixed session, then stop.

- Limit the number of trades per day. Example, max 3.

- Use a short checklist. Setup, level, stop location, target, news check.

- Journal one sentence after each trade, what you followed, what you broke.

Reduce the number of pairs you watch. More pairs means more impulses. Start with liquid majors, see our best forex pairs for beginners.

Common Beginner Traps: Martingale, “Sure Thing” Signals, Chasing News Spikes

These mistakes blow accounts fast.

- Martingale and doubling down: you increase size after losses. One trend can wipe you out.

- “Sure thing” signals: you outsource judgment to alerts. You skip testing, you skip risk rules.

- Chasing news spikes: you buy the top and sell the bottom. Spreads widen, fills worsen, stops slip.

If you trade around news, you need rules for it. If you do not, stand aside. You can make money without the first 30 seconds of a release.

Risk management is your edge before you have a strategy edge. Keep losses small, keep rules simple, and survive long enough to learn.

Pros and Cons of Forex Trading (Is It Right for You?)

Potential Advantages

- High liquidity in major pairs. EUR/USD, USD/JPY, and GBP/USD often trade with tight spreads and steady fills in normal conditions. Liquidity can drop fast in off-hours and around major news.

- Easy access. You can open a retail account with a small deposit and trade from a phone or desktop. You can also start on a demo account to learn platform basics without risking cash.

- Flexible hours. Forex runs 24 hours a day from Monday to Friday. You can trade around your schedule, but you still need to pick specific hours and stick to them. Use forex market hours to avoid thin sessions.

- Two-way markets. You can buy or sell a currency pair. You do not need an “uptick rule” mindset. You still need a plan for trend and range conditions.

Potential Disadvantages

- Leverage cuts both ways. Small price moves can create large gains or large losses. A few bad trades can wipe out weeks of progress if you oversize positions.

- More moving parts than it looks. You manage pairs, position size, margin, stops, order types, rollover timing, and session behavior. Many beginners fail from execution errors, not from “wrong market calls.”

- Outcomes stay inconsistent for many traders. Retail FX and CFD brokers often publish risk warnings showing a majority of retail accounts lose money. Your results depend on risk controls, costs, and discipline, not on effort alone.

Costs to Consider

- Spreads. You pay the bid-ask difference each time you enter and exit. Spreads widen during low liquidity and around news. Your “cheap” pair at noon can turn expensive at rollover.

- Commissions. Some accounts charge a commission per side and offer lower spreads. Compare total cost per round trip, not the headline spread.

- Swaps, rollover financing. If you hold trades past the daily cutoff, you may pay or receive a swap based on rate differentials and broker markup. This can matter more than the spread on multi-day holds. Read more on forex swap fees.

- Data and platform fees. Many retail platforms are free, but some brokers charge for advanced tools, premium data, or inactivity. VPS hosting can add a monthly cost if you run automated trading.

Realistic Expectations

- The learning curve is real. Expect months to learn execution and risk, then more time to build a repeatable process. You will spend most of your early hours on position sizing, journaling, and rule testing.

- Trading is a probability game. You can follow rules and still lose on a single trade, or on a streak. You need enough capital, small enough risk, and enough sample size to let odds play out.

- Performance varies by market regime. A strategy can work in a trend and fail in a range, or the reverse. Costs and slippage also change by session and volatility. You need rules for when to trade and when to stop.

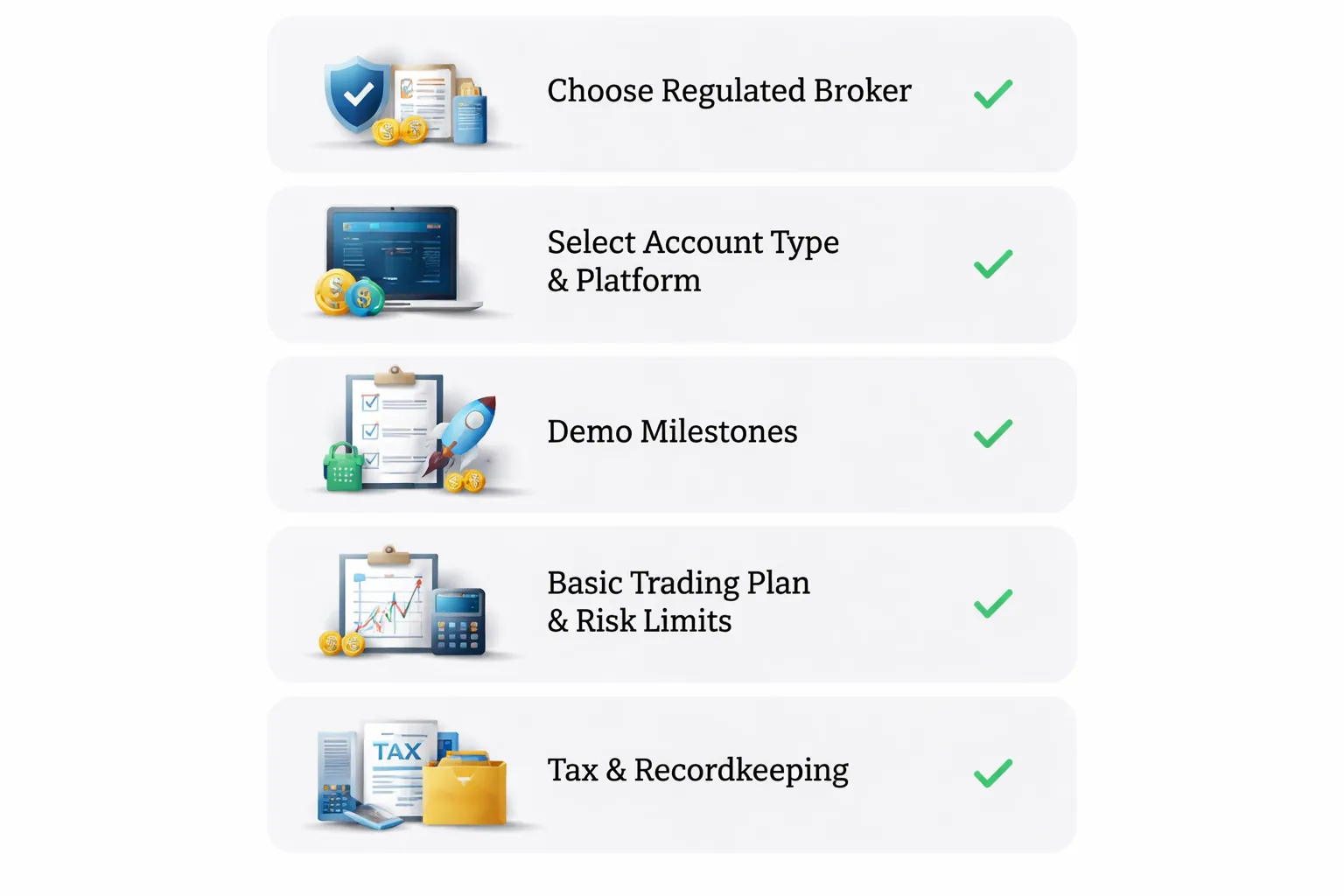

How to Start Forex Trading Safely (Beginner Checklist)

Choosing a regulated broker

- Start with regulation. Check the broker’s license on the regulator’s official register. Do not rely on a badge on the broker site.

- Confirm your legal entity. Large brands run multiple entities. Make sure your account sits under the regulated entity in your country or region.

- Look for segregation of client funds. Your cash should sit in separate client accounts, not mixed with the broker’s operating funds.

- Know what segregation does and does not do. It can reduce misuse risk. It does not remove market loss risk.

- Check reputation with specific tests. Search for: “withdrawal delay”, “price manipulation”, “re-quote”, “slippage”, “account closed”, plus the broker name.

- Test withdrawals early. Deposit small. Place a trade or two. Withdraw. Time the process.

- Understand the product. Many retail accounts trade FX via CFDs. Broker risk, fees, and execution rules depend on the product and entity.

Account types and platform selection

- Pick pricing you can measure. You will usually choose between spread-only pricing and raw spreads plus commission.

- Compare costs in money terms. Estimate your average cost per trade as: spread cost + commission + swaps if you hold overnight.

- Match the account to your style. Frequent trading usually needs lower all-in costs. Infrequent trading feels swaps more.

- Choose a platform you can execute fast. MT4 and MT5 have deep broker support. cTrader often offers clean order entry and good depth tools.

- Check order types you need. Market, limit, stop, stop-loss, take-profit, and trailing stop. Confirm how the broker handles stop orders in fast markets.

- Verify trade reporting. You need exportable history with timestamps, entry, exit, size, and fees.

Demo account to live transition

- Use demo for process, not profit. Practice order entry, stops, position sizing, and journaling.

- Set milestones before you risk capital.

| Milestone | Minimum target |

|---|---|

| Plan compliance | Follow your rules on at least 50 trades |

| Risk consistency | Same % risk per trade, no oversized “make it back” trades |

| Max drawdown control | Stay within a preset limit, for example 5% to 10% on demo |

| Execution competence | Correct stop placement, correct lot size, no accidental orders |

| Cost awareness | Track spread, commission, and swap on every trade |

- Go live small. Your first goal is clean execution under real fills and real emotion.

- Keep your strategy unchanged at first. Change size last. Do not change rules because of a few early outcomes.

Building a basic trading plan

- Define your market list. Start with 1 to 3 pairs. Major pairs often have tighter spreads and deeper liquidity.

- Define when you trade. Pick sessions and days. Avoid low-liquidity hours if spreads widen.

- Define your setup rules. Entry trigger, stop placement rule, take-profit rule, and invalidation point.

- Use hard risk limits. Set risk per trade as a small fixed percentage. Many beginners use 0.25% to 1% per trade.

- Set a daily stop. Cap daily loss and stop trading when you hit it. This prevents tilt and overtrading.

- Size positions from risk, not from confidence. Your stop distance and risk limit should determine your position size. Use this guide for the math: position size in forex.

- Write down your no-trade rules. Examples: major news minutes, spreads above a threshold, platform issues, fatigue.

- Review on a fixed schedule. Weekly review works for most beginners. Focus on: rule adherence, average win, average loss, win rate, and costs.

Tax and recordkeeping basics

- Assume taxes apply. Forex tax rules vary by country and by product type. Your broker’s statement does not replace local tax guidance.

- Save clean source records. Keep monthly statements, confirmations, and your full trade export.

- Track the fields that matter. Date and time, instrument, size, entry, exit, profit or loss, commission, spread cost estimate, swap, and account currency.

- Separate deposits and withdrawals from trading P and L. This avoids false performance numbers and bookkeeping errors.

- Log your method. Note your setup, stop, target, and reason for entry. This supports review and audits.

- Know your reporting basis. Many traders must report realized gains, sometimes in local currency converted at specific rates. Check local rules early.

Common Forex Scams and Red Flags (Protect Your Money)

Unrealistic promises, guaranteed returns, and “risk-free” claims

Forex has risk. Anyone selling “guaranteed” profits lies.

- Guaranteed returns. Markets move. No strategy wins every week.

- “Risk-free” trading. Leverage can wipe accounts fast. Risk does not disappear.

- Fixed daily or weekly income. Real trading results vary by market volatility and position size.

- “Secret bank algo” stories. Scammers use vague language and avoid audited records.

- Pressure to “act now”. They want your deposit before you verify anything.

If someone promises a specific return with no drawdowns, treat it as a scam until proven otherwise.

Signal sellers and managed-account pitfalls, what to verify

Most signal and copy services market wins, not risk. You must verify the track record and the rules.

- Verified performance. Ask for a broker statement or third party verification. Screenshots mean nothing.

- Full history. You need at least several months of trades, not a cherry-picked week.

- Max drawdown. Focus on worst peak-to-trough loss, not win rate.

- Trade logic and risk limits. Get clear rules for stop losses, position sizing, and maximum leverage.

- Execution realism. Signals can fail with spread widening, slippage, and delayed entries. This links to how pricing and fills work in how the forex market works.

- Fees and conflicts. Watch for high subscription fees plus affiliate kickbacks from brokers.

- Access to your account. Do not share passwords. Avoid giving trading permissions unless you understand the legal structure.

Managed accounts add another risk. You rely on the manager, the broker, and the withdrawal process. Verify all three.

Broker red flags, withdrawal issues, opaque pricing, and aggressive bonuses

Your main risk sits with custody and execution. Many problems show up only when you try to withdraw.

- Withdrawal delays. Excuses, changing requirements, and long “processing” times signal trouble.

- Blocked withdrawals tied to bonuses. Some bonuses lock your funds behind volume targets. You can lose control of your money.

- Opaque pricing. Hidden markups, wide spreads on “standard” accounts, and unclear commissions.

- Frequent requotes or rejected orders. It can indicate poor execution quality or dealing desk abuse.

- Unclear legal entity. The website brand and the regulated company name must match.

- High-pressure sales. Calls pushing bigger deposits, “account upgrades”, or recovery offers after losses.

- “Recovery” scams. A second group claims it can recover your lost funds for a fee. Many victims lose more.

Practical due diligence checklist, regulation, reviews, and test withdrawals

- Confirm regulation. Find the broker’s license number and verify it on the regulator’s site. Match the company name and address.

- Check account protections. Look for segregated client funds and clear insolvency handling.

- Read the legal docs. Review the client agreement, fees, and bonus terms. Look for withdrawal conditions and dispute steps.

- Inspect pricing. Compare typical spreads and commissions during normal hours and news events.

- Test support. Ask direct questions about swaps, margin policy, and execution. Track response quality and speed.

- Start small. Fund the minimum, place a few small trades, then request a withdrawal.

- Run a test withdrawal early. Do it before you scale up. Use the same payment method you plan to rely on.

- Use review sites with care. Ignore extremes. Look for patterns like repeated withdrawal complaints and unexplained slippage.

- Keep clean records. Save confirmations, chats, emails, and statements. You need them if a dispute starts.

| Red flag | What it often means | What you should do |

|---|---|---|

| Guaranteed returns | Fraud or deceptive marketing | Walk away |

| Bonus locks withdrawals | You lose control of your funds | Decline the bonus, confirm terms in writing |

| Withdrawal delays with excuses | Cash flow issues or intentional blocking | Stop adding funds, escalate, document everything |

| Unclear regulated entity | Offshore shell or fake license | Verify on regulator site, avoid if mismatch |

| Signal seller shows screenshots only | Cherry-picked results | Demand verified history and drawdown data |

Frequently Asked Questions

What is forex trading?

Forex trading means buying one currency and selling another as a pair. You trade price changes between the two. You can profit or lose based on how the exchange rate moves after you enter.

How does a currency pair work?

A pair quotes the value of one currency in another. EUR/USD at 1.1000 means 1 euro costs 1.10 US dollars. If the quote rises, the base currency strengthens against the quote currency.

What are pips and spreads?

A pip is a standard price step, often 0.0001 for most pairs and 0.01 for JPY pairs. The spread is the gap between bid and ask. You start each trade down by the spread.

How does leverage work in forex?

Leverage lets you control a larger position with a smaller margin deposit. It magnifies gains and losses. If price moves against you, your broker can close the trade through a margin call or stop-out.

How much money do you need to start?

It depends on your broker and your risk rules. Many accounts open with $100 or less, but small balances force high leverage or tiny position sizes. Size trades so a loss stays within your set percent risk.

How do you calculate position size?

Use your account risk per trade, stop-loss distance in pips, and pip value. Position size equals risk amount divided by stop distance times pip value. Use a position sizing formula and stick to it.

When is the forex market open?

Forex runs 24 hours a day from Monday to Friday, following major sessions, Asia, London, New York. Liquidity and spreads change by session. News releases can widen spreads and spike volatility.

What are the main costs in forex trading?

Key costs include spread, commissions, and swap or overnight financing. Slippage adds hidden cost during fast markets. Check the broker’s fee schedule per account type and compare typical spreads, not minimums.

Is forex trading gambling?

It becomes gambling when you trade without a plan, use oversized leverage, or chase losses. Treat it like risk management. Use defined entries, stops, and position sizing. Track results over a meaningful sample size.

Why do many retail traders lose money?

Main causes include high leverage, poor risk control, overtrading, and ignoring execution costs. Short-term strategies suffer from spread and slippage. Many traders also lack tested rules and change methods after drawdowns.

How do you choose a safe forex broker?

Start with regulation and entity checks. Confirm the license on the regulator’s website and match the legal name. Test withdrawals early with small amounts. Avoid brokers with delay excuses, blocked payouts, or unclear entities.

Are forex signals worth paying for?

Most paid signals fail to show full data. Do not trust screenshots. Ask for a verified track record, full trade history, and maximum drawdown. Check if results include fees and slippage. Walk away if they refuse.

How do you compute pip value?

Pip value depends on pair, lot size, and your account currency. It changes with price when the quote currency differs from your account currency. Use a calculator or a formula to avoid sizing errors. See pip value calculator.

Conclusion

Conclusion

Forex trading means buying one currency and selling another. Price moves in pips. Your costs show up in spreads, commissions, and swaps. Leverage magnifies gains and losses, so your risk control matters more than your entry.

Keep your process simple. Pick one pair. Use one timeframe. Track every trade, including fees and slippage. Size each position from a fixed risk per trade, then place your stop loss before you enter. If you cannot calculate pip value and position size fast, do not trade live.

Final tip. Set a maximum loss limit for the day and week, then stop when you hit it. This one rule prevents most account blowups. Use a position sizing plan you can execute without guessing, see how to calculate position size in forex.

-

- What is forex trading?

- How does a currency pair work?

- What are pips and spreads?

- How does leverage work in forex?

- How much money do you need to start?

- How do you calculate position size?

- When is the forex market open?

- What are the main costs in forex trading?

- Is forex trading gambling?

- Why do many retail traders lose money?

- How do you choose a safe forex broker?

- Are forex signals worth paying for?

- How do you compute pip value?

-

- What is forex trading?

- How does a currency pair work?

- What are pips and spreads?

- How does leverage work in forex?

- How much money do you need to start?

- How do you calculate position size?

- When is the forex market open?

- What are the main costs in forex trading?

- Is forex trading gambling?

- Why do many retail traders lose money?

- How do you choose a safe forex broker?

- Are forex signals worth paying for?

- How do you compute pip value?