Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

Forex trading is legal in the United States, but you must follow strict federal rules. The CFTC and NFA oversee most retail forex activity. These rules control who can offer forex accounts, how brokers handle your orders, and how much leverage you can use.

This guide explains the law in plain terms. You will learn which regulators matter, what “regulated broker” means, how leverage limits work, and what restrictions apply to US residents. You will also learn how to check a firm’s registration and avoid common compliance traps before you deposit money. For scam warning signs, use our safety checklist for spotting forex scams and unregulated brokers.

Key Takeaways

- In het kort: Forex trading is legal in the United States, but you must use the right firms and follow strict rules.

- For retail forex, the main regulators are the CFTC and the NFA. They set and enforce most day to day forex conduct rules.

- Stock and futures regulators still matter. FINRA and the SEC can apply if your product is a security or you trade through a broker dealer.

- A regulated broker is not a marketing claim. It means the firm holds the right registration, follows capital and reporting rules, and submits to audits and enforcement.

- US retail leverage has hard caps. Expect up to 50:1 on major pairs and 20:1 on non major pairs with regulated providers.

- US residents face restrictions. Many offshore brokers do not accept US clients, and some products and bonuses can trigger compliance issues.

- Do your own verification before you deposit. Check a firm and its people in official databases, then confirm the exact entity name matches your account paperwork.

- Watch for compliance traps. High leverage promises, vague licensing claims, and pressure to deposit fast are common red flags. Use our safety checklist for spotting forex scams and unregulated brokers before you fund an account.

Is Forex Trading Legal in the United States? The Direct Answer

Is forex trading legal in the United States?

Yes. Forex trading is legal in the United States when you trade through the right type of firm, on allowed products, under U.S. rules.

Most legal issues come from the counterparty you use, the leverage offered, and how a firm markets or manages your money.

What “legal” means in practice

- Product rules. Retail forex must follow U.S. limits on leverage and margin, plus strict disclosure and reporting standards. You cannot legally access “offshore” retail forex terms from inside the U.S. through a compliant U.S. offering.

- Platform rules. Your trading platform should sit under a registered, supervised U.S. entity, with clear terms, risk disclosures, and complaint channels.

- Counterparty rules. For spot retail forex, your counterparty generally needs to be a properly registered U.S. firm. In practice, that means a regulated broker type that can lawfully offer retail FX to U.S. customers, with principals and sales staff tied to registrations and oversight.

If a firm cannot show you its exact registered legal name, regulator status, and U.S. permissions for retail forex, treat that as a stop sign.

Who can trade

- U.S. residents. You can trade, but you usually must use a U.S.-regulated broker that accepts U.S. residents for retail forex.

- U.S. citizens living abroad. Your passport does not control access by itself. Your broker will look at your country of residence, local rules, and its own licensing. Some firms accept U.S. citizens abroad, others do not.

- Non-U.S. residents. You can trade in the U.S. only if the broker can onboard you under its policies and the laws that apply to you. Many U.S. retail forex brokers limit accounts to U.S. residents.

When forex activity crosses into illegal territory

- Using an unregistered offshore broker while you live in the U.S. This is the most common problem. “Licensed offshore” does not meet U.S. retail forex requirements.

- Taking customer funds or giving managed-account services without registration. If someone trades your account for you, pools money, or collects performance fees, they may need specific U.S. registrations.

- Signal sellers and “account managers” making earnings claims. Guaranteed returns, fake track records, and pressure to deposit can move a sales pitch into fraud fast.

- Illegal leverage and bonus schemes. Offers like extreme leverage, deposit bonuses tied to volume, or vague “pro accounts” for retail users often signal non-compliant dealing.

- Identity and funding issues. Using false information, third-party payments, or source-of-funds deception can trigger AML violations and account freezes.

If you also care about religious compliance, read our guide to swap-free Islamic forex accounts before you choose an account type.

How Forex Is Regulated in the U.S. (The Regulatory Framework)

The U.S. Forex Regulatory Framework

In the U.S., retail forex sits inside the derivatives rulebook. That puts most broker oversight under the CFTC and the NFA. Other agencies step in when forex gets sold as a security, or when you trade it through a securities account.

CFTC: Derivatives Regulator for Retail Forex

The Commodity Futures Trading Commission, the CFTC, oversees retail off-exchange forex when a firm offers it to U.S. customers. It sets core rules on who can offer retail forex, how they must handle customer funds, what disclosures they must give you, and what sales practices cross the line.

- Who it applies to. Retail Forex Dealers, FCMs, and introducing brokers that solicit or accept retail forex orders in the U.S.

- Capital and risk controls. CFTC rules require regulated firms to meet financial requirements and maintain risk management controls.

- Customer protection. The framework targets fraud, abusive solicitation, misleading performance claims, and failures to supervise.

- Retail forex is different from spot. Many “spot FX” products marketed to retail U.S. customers fall under retail forex rules when the structure looks like leveraged rolling contracts.

NFA: Registration, Compliance, and Day-to-Day Enforcement

The National Futures Association, the NFA, runs the front line. Most legitimate U.S. forex brokers are NFA Members and register in the right category. The NFA writes detailed rules, audits members, and disciplines firms and individuals.

- Registration and background checks. The NFA handles registration for firms and associated persons, and reviews disciplinary history.

- Sales practice rules. It polices advertising, disclosures, and solicitation. It also flags high-pressure tactics and misleading profit claims.

- Supervision requirements. Firms must supervise employees, monitor communications, and keep records.

- Dispute channels. The NFA offers arbitration and complaint processes that give you a formal path when something goes wrong.

SEC and FINRA: When Forex Becomes a Security Product

The SEC and FINRA get involved when someone packages forex exposure as a security, or routes it through a securities account. Examples include certain pooled products, managed accounts marketed like investments, or forex-linked securities.

- Forex-linked securities. If the product is a security under U.S. law, SEC rules can apply, even if the underlying exposure tracks currencies.

- Broker-dealer activity. If a broker-dealer solicits or sells the product, FINRA rules on communications, suitability, supervision, and account handling can apply.

- Shared red flags. “Guaranteed returns,” fake track records, and unregistered offerings trigger enforcement fast.

Federal vs. State: Why “State-Licensed” Is Not Enough

Retail forex regulation is federal. State licensing can matter for money transmission or related services, but it does not replace CFTC and NFA oversight for leveraged retail forex dealing.

- Forex dealing requires the right federal status. A firm can hold state registrations and still be non-compliant for retail forex.

- State claims get used in marketing. Some offshore firms cite state filings to look legitimate. You still need CFTC and NFA verification for retail forex.

- Practical check. Confirm the firm and its key people show active, matching registrations and memberships before you fund an account.

Key Laws and Rules You Should Know

These rules drive most of what you can and cannot do with a U.S. retail forex broker.

- Dodd-Frank. Tightened retail forex access, pushed more oversight into the CFTC framework, and strengthened enforcement tools.

- CFTC retail forex rules. Cover counterparty eligibility, disclosures, business conduct, recordkeeping, and supervision expectations for retail forex activity.

- Anti-fraud and anti-manipulation authority. The CFTC can pursue fraud, misrepresentation, and manipulation tied to retail forex solicitation and trading.

- AML and KYC expectations. Regulated firms must verify identity and monitor funding behavior. Your account can freeze if your documents or funding trail do not make sense.

If you want a practical broker due-diligence flow, use our safety checklist for spotting forex scams and unregulated brokers before you deposit.

Who Can Legally Offer Forex to U.S. Retail Traders

RFEDs and FCMs, the firms that can take the other side of your forex trade

In the U.S., retail forex dealers must register and follow CFTC rules. Most retail traders access spot forex through one of two firm types.

- RFED (Retail Foreign Exchange Dealer). An RFED can act as your counterparty for retail forex. It can solicit you, open your account, hold your funds, quote prices, and execute your trades.

- FCM (Futures Commission Merchant). An FCM can offer retail forex if it meets extra retail forex requirements. It can also carry futures and options accounts. Many U.S. brokers operate as an FCM and offer retail forex under that registration.

Practical takeaway. If a firm offers you leveraged spot forex in the U.S., you should see it listed as an RFED or an FCM with retail forex permissions. If you cannot confirm that, stop.

IBs, APs, CTAs, and CPOs, who can introduce you or manage money

Some registered parties can market, refer, or manage. They do not all hold your funds or act as counterparty.

- IB (Introducing Broker). An IB can solicit or refer you to an RFED or FCM. An IB typically does not hold your money. It often earns commissions or spreads via the carrying firm.

- AP (Associated Person). An AP is an individual tied to an RFED, FCM, or IB. APs can solicit you, take orders, and provide customer support under the firm’s supervision. You should be able to verify the person and the firm.

- CTA (Commodity Trading Advisor). A CTA can provide trading advice for compensation. Some CTAs manage your account using a power of attorney or similar authorization, depending on the structure and registrations.

- CPO (Commodity Pool Operator). A CPO runs a pooled vehicle that trades derivatives, which can include forex. You invest in the pool. You do not own the underlying trading account directly.

Practical takeaway. If someone “manages” your forex trading, ask what they are registered as, what entity holds your funds, and what authority they have to place trades. Get it in writing.

Banks vs. broker-dealers vs. forex dealers, how the roles differ

| Type | Main regulator lens | What you usually get | Common retail forex reality |

|---|---|---|---|

| RFED or FCM | CFTC and NFA | Leveraged retail spot forex, plus platform access | Primary legal route for U.S. retail forex |

| Bank | Bank regulators, plus CFTC rules in some FX contexts | FX services, wires, conversions, institutional pricing | Most banks do not offer leveraged retail spot forex accounts like retail brokers do |

| Broker-dealer | SEC and FINRA | Securities trading | Forex is not typically offered as leveraged spot retail forex under broker-dealer rules |

Practical takeaway. Do not assume “regulated” equals “allowed to offer U.S. retail forex.” You need the right registration for the product.

Red flags that often show up in illegal offers

- “Regulated overseas.” Offshore regulation does not authorize retail forex solicitation to U.S. customers. If they target you in the U.S., you need U.S. registrations.

- Deposit bonuses and trading credits. Bonus schemes often pair with aggressive terms, forced volume targets, and blocked withdrawals. Many U.S. regulated firms avoid these structures.

- Unverifiable registration. The firm name does not match, the domain does not match, or the person contacting you cannot be found in official records. Treat this as a stop signal.

- “We are an introducing broker” with no carrying firm. A real IB points you to a specific RFED or FCM that holds your account.

- Pressure to fund with crypto or third-party wires. This often bypasses normal controls and increases your fraud risk.

If you want a step-by-step screen, use our safety checklist for spotting forex scams and unregulated brokers before you send funds.

What U.S. Rules Mean for Retail Traders (Practical Implications)

Leverage limits and margin rules (major vs. non-major pairs)

U.S. rules cap leverage for retail forex.

- Major pairs: Max 50:1 leverage, or 2 percent margin.

- Non-major pairs: Max 20:1 leverage, or 5 percent margin.

This changes position sizing. A strategy built around 100:1 or 200:1 leverage will not translate. You may need smaller targets, wider stops, or fewer concurrent positions.

Margin calls can hit fast in volatile pairs. Check your broker’s margin policy, especially for news events and weekends. Some firms raise margin requirements around high risk periods.

FIFO and no-hedging rules, how they affect strategy execution

Most U.S. retail forex accounts follow FIFO. First in, first out. You close the oldest position first when you trade the same pair in the same direction.

Many U.S. brokers also restrict hedging in the same account. You cannot hold equal long and short positions in the same pair to freeze exposure. Some platforms net positions instead of keeping separate tickets.

- Scaling in and out becomes harder. Partial exits can force you to close older entries instead of the one you want.

- Grid and martingale systems break. They rely on precise ticket control.

- Trade management via multiple orders needs planning. Use one position with bracket orders if your broker supports it.

Why many platforms and products differ in the U.S. (including common MT4 and MT5 limitations)

U.S. rules limit who can offer retail forex. You usually trade through an RFED or an FCM. That smaller broker pool shapes platform choice.

Some global brokers do not accept U.S. clients. Others offer different product menus inside the U.S. You may see fewer CFDs and fewer synthetic products, because they often fall outside what U.S. retail forex firms offer.

MT4 and MT5 access can also differ. Some U.S. firms do not offer MetaTrader at all. Others restrict features that clash with FIFO or hedging limits. You may need to run a netting setup, adjust EAs, or rebuild execution logic to avoid ticket-level hedging.

Order execution, slippage, re-quotes, and best execution expectations

Retail forex in the U.S. often uses dealer-style execution. Your broker can act as counterparty. That makes execution quality a key risk factor.

- Slippage: You can get a worse fill in fast markets. You can also get price improvement. Track both.

- Re-quotes: Some platforms reject your price and offer a new one. This shows up more in thin liquidity and news spikes.

- Stops and gaps: Stop orders trigger at the stop level, but fills can land beyond it. Weekend gaps and sudden moves can exceed your expected loss.

Read the broker’s execution policy. Look for how it handles price improvement, trade rejections, and order types. Log your fills. Compare requested price versus executed price over at least 50 to 100 trades.

Required risk disclosures and what to actually look for in them

U.S. forex dealers must give risk disclosures. Do not skim them. Use them to spot structural risks in how your broker operates.

- Counterparty model: Confirm whether the firm can trade against you as principal. That does not prove misconduct, but it raises the need to monitor execution.

- Execution and pricing: Look for language on re-quotes, slippage, and order rejection. If it says fills are not guaranteed at requested prices, plan for slippage in your risk model.

- Margin policies: Check when margin requirements can change, and whether the firm can liquidate positions without notice if you breach margin.

- Conflicts of interest: Look for disclosures that the dealer profits when you lose, or that it can offset your trades at its discretion.

- Fees and spreads: Identify all trading costs. Spread, commissions, rollover, and non-trading fees. Small differences compound fast.

If you want a step-by-step screen before you open an account, use our safety checklist for spotting forex scams and unregulated brokers.

Forex Products: What’s Allowed vs. Restricted in the U.S.

Spot forex vs. retail forex contracts

In the interbank market, spot forex settles in about two business days. Most U.S. retail traders do not access that market directly.

What you usually get at a U.S. forex dealer is a retail off-exchange forex contract. It is an agreement between you and the dealer. Your dealer sets execution, spreads, and financing terms under its rulebook.

- Common offering: Rolling spot style contracts on major and some minor pairs.

- Less common: Exotics, very high leverage, and features that resemble CFDs.

- Key check: Make sure the firm is registered as an RFED or FCM, and is an NFA member.

Futures and options on currencies

Currency futures and options trade on regulated U.S. exchanges. You trade standardized contracts. The exchange sets core terms like contract size and expiration.

- Where they trade: Designated Contract Markets, such as CME.

- Who regulates: CFTC oversees the market, NFA oversees member conduct, and the exchange runs surveillance.

- Why some traders prefer them: Central clearing, standardized pricing, and published contract specs.

- Tradeoffs: Expirations, tick sizes, and margin rules differ from retail forex.

| Product | Typical venue | What you are trading | U.S. access |

|---|---|---|---|

| Retail forex (off-exchange) | RFED or FCM dealer platform | Contract with the dealer | Allowed with registered firms |

| Currency futures | Exchange (DCM), cleared | Standardized futures contract | Allowed |

| Currency options | Exchange (DCM), cleared | Standardized option on futures or spot reference | Allowed |

CFDs and why retail CFDs are generally prohibited for U.S. residents

Most brokers market CFDs as simple ways to trade FX, indices, and commodities with leverage. In the U.S., retail CFD dealing usually violates securities and commodities rules when offered off-exchange to retail customers.

- Practical result: U.S. residents rarely have lawful access to retail CFDs from U.S. firms.

- Common risk: Offshore CFD sites may accept U.S. clients, but you lose key U.S. protections and may have limited recourse.

Binary options and high-risk structures

Binary options legality depends on where you trade them and who offers them. Many retail binary offerings sold online are unregistered and unlawful in the U.S.

- Generally allowed: Exchange-traded binaries on a regulated U.S. exchange.

- Generally risky: Broker-sold binaries that act like bets against the house, with no registered venue.

- Your check: Confirm the platform is a regulated exchange or a properly registered entity.

Crypto-forex pairs and “FX-like” crypto products

Some platforms list crypto pairs that look like forex, such as BTC/USD. Regulators may treat these products as commodities, securities, or derivatives, depending on structure and marketing.

- Spot crypto: A cash market trade can sit outside the retail forex framework, but other rules can apply.

- Leveraged or margined crypto: Can trigger CFTC oversight and specific retail commodity rules if it does not deliver as required.

- Perpetuals and crypto CFDs: Often unavailable to U.S. retail traders onshore. Offshore access increases legal and custody risk.

- Bottom line: Product label does not control the law. The contract terms do.

When you compare products, also compare tax treatment. See our guide to forex taxes in the U.S. for the core differences traders run into.

How to Verify a Forex Broker’s Legal Status (Step-by-Step)

1) Check NFA BASIC first

NFA BASIC is your fastest filter. Use it before you open an account.

- Go to NFA BASIC and search the firm name and any “doing business as” names. Also search the NFA ID if the broker lists one.

- Match the legal entity. Confirm the full legal name and address match what appears on the broker website and account paperwork.

- Confirm the registration category. For U.S. retail forex, you typically want to see FCM and RFED. Some firms show both.

- Check current status. Look for language like ACTIVE or Approved. Avoid firms marked Not currently registered, Withdrawn, Suspended, or Banned.

- Review disciplinary history. Open “Regulatory Actions” and “NFA Actions.” Read the order. Note fines, restitution, bans, and repeat violations.

- Verify the people. Search the firm’s principals and sales staff as well. Confirm they appear in BASIC and review any actions tied to them.

2) Confirm CFTC registration and what it covers

NFA membership matters, but CFTC registration defines what the firm can legally do in U.S. derivatives markets.

- Confirm the firm shows as CFTC registered in BASIC. BASIC typically displays CFTC registration details for registrants.

- Know what you are checking. An RFED or FCM can take the other side of retail forex trades and hold retail forex margin. A firm registered only in other categories may not be allowed to offer U.S. retail forex the way you expect.

- Do not confuse “regulated somewhere” with U.S. legality. A foreign license does not grant permission to solicit and onboard U.S. retail customers onshore for products the U.S. restricts.

- Confirm the product. If the broker offers CFDs, “perpetuals,” or options-style products to U.S. retail, treat that as a compliance red flag. Match the product to the firm’s category.

3) Evaluate segregation practices, capital strength, and counterparty risk

Legal status is step one. Your next risk is custody and the broker’s balance sheet.

- Ask where your funds sit. Get the name of the depository bank and the account type used for customer funds. Save the written answer.

- Understand segregation limits. Some retail forex margin handling differs from securities brokerage custody rules. Read the broker’s customer agreement for how it holds, uses, and transfers customer money.

- Look for financial disclosures. Review any posted financial statements, risk disclosures, and required filings the firm makes available. If the broker refuses to share basic custody details, walk.

- Map your counterparty. In many retail forex setups, the broker is your direct counterparty. Your profit can be the broker’s loss. That creates an incentive problem unless controls exist.

- Check execution model claims. “STP” and “ECN” are marketing terms. Your contract controls. Confirm how the broker prices, routes, and fills orders, and when it can reject or reprice.

4) Read the fine print, fees, markups, rollover, and conflicts

Most bad outcomes come from documents you skip. Read these before you fund.

- Customer agreement. Confirm governing law, arbitration clauses, margin call policy, liquidation rights, and how the broker can change margin requirements.

- Fee schedule. Identify commissions, platform fees, data fees, wire and ACH fees, inactivity fees, and withdrawal charges.

- Spreads and markups. Check whether the broker uses variable spreads, adds a markup, or both. Look for language about “last look,” requotes, and off-market pricing.

- Financing and rollover. Find the exact method used to calculate swaps or financing. Note cut-off times, triple-swap days, and any discretion the broker reserves.

- Conflicts of interest. Read disclosures about principal trading, internalization, hedging practices, and how the broker profits from customer losses.

- Promotions. Treat bonuses and “risk-free” offers as risk. They often add withdrawal limits, volume targets, or forced holding periods.

5) Due diligence checklist before you send money

- Identity match. Legal name, address, and website domain match across BASIC, the broker site, and your account documents.

- Correct category. The firm shows RFED or FCM status appropriate for retail forex.

- Clean status. Registration shows current, with no suspension or bar.

- Disciplinary review done. You read the actual NFA or CFTC actions and understand what happened.

- People verified. Principals and sales contacts appear in BASIC with acceptable history.

- Funding path is normal. You fund the broker entity directly via standard rails. Avoid crypto-only funding, personal accounts, or third-party payment processors.

- Custody answers in writing. You have written confirmation of where funds are held and how withdrawals work.

- Costs mapped. You can estimate all-in trading cost, including spread, commission, and financing.

- Liquidation rules understood. You know when the broker can close positions and how it handles negative balances.

- Withdrawal test. Start small, then request a withdrawal early. Track time to process and any surprise fees.

- Scam screening. Run a final safety check using our forex scam checklist.

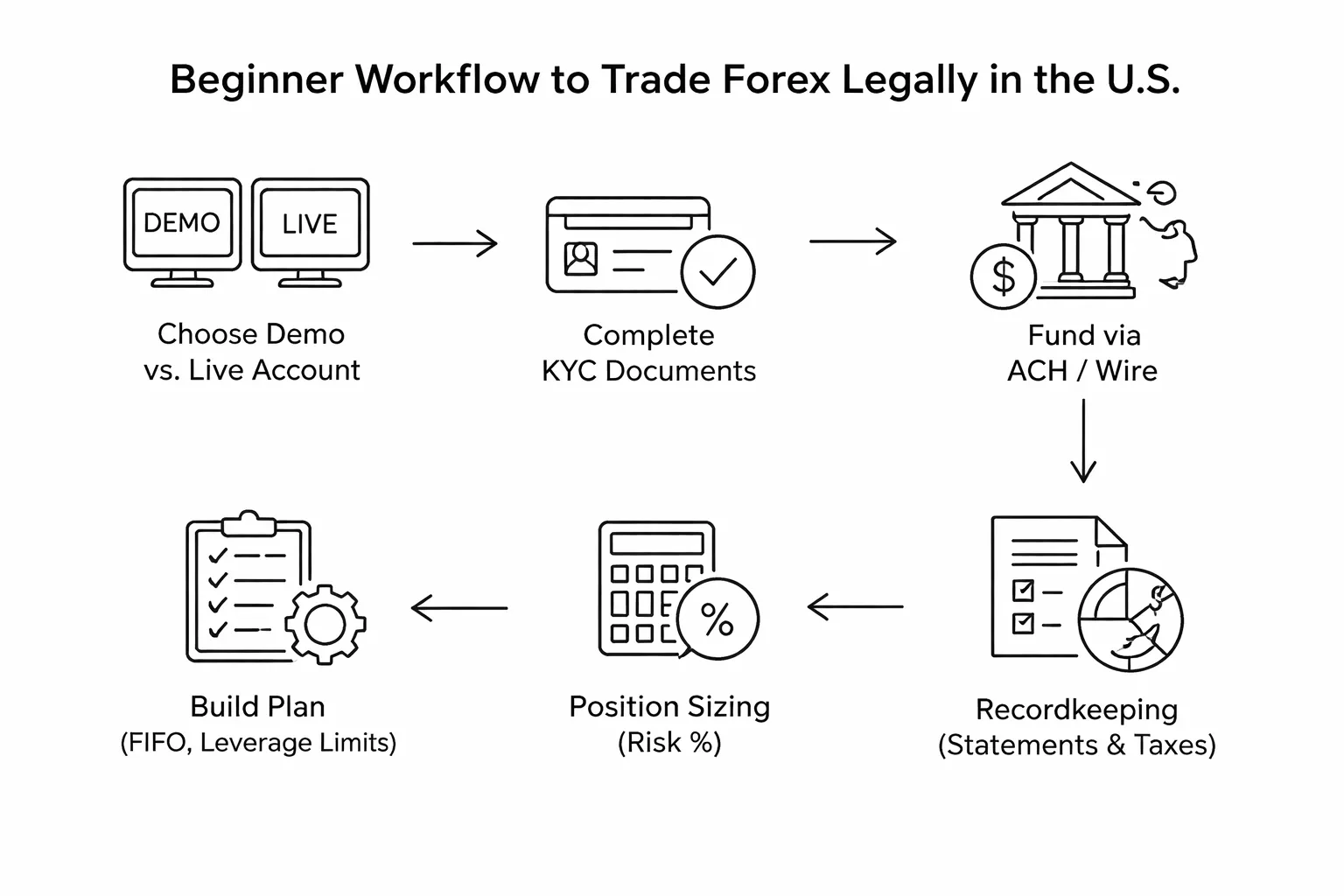

How to Start Trading Forex Legally in the U.S. (Beginner Workflow)

1) Pick an account type that fits your goal

Start with a demo account. Use it to learn the platform, order types, and margin behavior. Track results, but treat them as practice, not proof.

Move to a live account when you can follow your rules for at least 30 trades. Fund small. Your first goal is execution and process, not profit.

- Demo account: No real money, good for platform fluency and testing a plan.

- Live account: Real fills, real slippage, real emotions, real financing costs.

- Standard vs micro: Some brokers offer smaller contract sizes or lower minimums. Use the smallest size available so you can control risk per trade.

2) Open the account and complete KYC fast

U.S. forex brokers must verify identity under AML and KYC rules. Expect questions. Answer them. Delays usually come from missing or mismatched documents.

- Identity: Government issued photo ID.

- Address: Utility bill, bank statement, or lease, recent and matching your application.

- Tax status: Social Security Number, and a tax form such as W-9 for U.S. persons.

- Funding source: Bank account ownership details, and sometimes proof of funds for larger deposits.

- Suitability: Broker questionnaire on experience, income, and risk tolerance.

Use your legal name and a consistent address. Do not try to route money through someone else. Expect enhanced checks if you use multiple accounts or frequent deposits and withdrawals.

3) Fund the account using clean, traceable methods

Use funding methods in your name. Keep it simple. You want a clear trail for AML reviews and future tax reporting.

- ACH or bank wire: Common for U.S. brokers, strong audit trail, often best for larger amounts.

- Debit card: Sometimes available, often higher fees or tighter limits.

- Checks: Less common, slower.

Before you deposit, confirm minimums, deposit fees, withdrawal fees, and processing times. Then repeat the withdrawal test you already planned, with a small amount.

4) Build a basic trading plan that follows U.S. constraints

U.S. retail forex rules shape how you trade. Your plan must fit them.

- Leverage limits: Often 50:1 on major pairs and 20:1 on non-majors. Lower leverage reduces liquidation risk.

- FIFO: If you hold multiple positions in the same pair and direction, you must close the oldest first.

- No hedging in the same account: You cannot hold long and short in the same pair at the same time in a way that offsets.

Write your plan in one page:

- Market and timeframe: Example, EUR/USD, 1H.

- Setup rules: Exact entry trigger, no discretion words.

- Stop loss rule: Always placed at entry, based on structure or a fixed distance.

- Take profit rule: Fixed multiple of risk or a defined level.

- Trade limits: Max trades per day, and a hard stop after a daily loss limit.

- News rule: When you will not trade, such as major releases.

5) Use simple position sizing and risk limits

Start with a fixed risk per trade. Keep it small. Many beginners use 0.25 percent to 1.0 percent of account equity per trade.

Use a sizing formula you can repeat:

- Risk per trade ($): Account equity x your risk percent.

- Stop distance: Your stop in pips.

- Position size: Risk per trade divided by stop distance and pip value.

Add guardrails:

- Max open risk: Cap total risk across all open trades, such as 2 percent.

- Margin buffer: Avoid using most of your available margin. Leave room for normal volatility.

- Loss control: If you hit your weekly limit, stop trading and review.

6) Keep trade records for broker disputes and taxes

Save records from day one. You need them for performance review, reconciliation, and tax filing.

- Broker statements: Monthly and annual statements, plus daily confirmations if available.

- Trade log: Date, pair, direction, size, entry, exit, stop, take profit, fees, financing, and notes on rule compliance.

- Funding log: Deposits, withdrawals, and related bank references.

- Platform evidence: Screenshots of fills if you contest execution.

Classify your forex tax treatment early. U.S. spot forex often falls under Section 988 by default, but some traders elect alternatives when eligible. Use our forex taxes in the US guide to understand recordkeeping needs before tax season.

Taxes and Reporting for U.S. Forex Traders (What to Ask a Tax Pro)

Common U.S. forex tax treatments

Your tax treatment depends on what you trade and how your broker books it. Spot forex often defaults to Section 988. Certain regulated currency contracts can fall under Section 1256. Some traders elect different treatment when rules allow, but timing and documentation matter.

- Section 988 (often spot FX), gains and losses generally count as ordinary income or loss.

- Section 1256 (certain regulated contracts), gains and losses generally receive blended treatment, often described as 60 percent long term and 40 percent short term. Mark to market rules also apply.

- Product matters, forex options, futures, and certain CFDs follow different rules than spot. Your platform label does not control IRS treatment.

Lock this down early. Do it before you place trades for the year. Use a specialist if you trade multiple products. See our forex taxes in the US guide for a deeper breakdown of Section 988 vs Section 1256.

Records and forms you usually need

You need clean records, even if your broker sends tax forms. You also need records that match your bank activity.

- Year end broker statement, realized P and L, open positions, financing, and fees.

- Trade log export, date and time, pair or contract, size, entry and exit, price, commissions, and swap or financing.

- 1099 forms if issued, many spot forex accounts do not receive a simple 1099-B. Do not assume no form means no tax.

- Cash movement records, deposits, withdrawals, wire confirmations, and exchange conversions.

- Corporate and payment records if you trade through an entity, include operating agreement, invoices, and accounting ledger.

Estimated taxes and cash planning

Forex profits can trigger quarterly estimated tax payments. Underpaying can create penalties. Your withholding from a day job may not cover trading income.

- Track realized gains monthly. Keep a running tax reserve.

- Ask your tax pro if you should pay quarterly estimates and how to calculate them with your other income.

- Plan for state tax if your state taxes capital or ordinary income.

Wash sale misconceptions

Many traders assume wash sale rules apply to every losing trade. That is not always true. It depends on the product and how it gets taxed. Wash sale treatment often ties to stock and securities rules, but your trades may fall outside that scope, or fall under a different framework.

- Do not label every quick re-entry as a wash sale.

- Do not ignore wash sale risk if you trade products that get treated as securities.

- Ask your tax pro to map each product you trade to the right rule set.

Why tax details vary by product

Two traders can both say “I trade forex” and still face different reporting. The IRS cares about the instrument, the venue, and the election choices you made.

- Spot FX can differ from currency futures.

- Options on currency can differ from leveraged spot.

- Hedging can change character, timing, and documentation requirements.

- Mark to market rules may apply to some contracts and not others.

When trading as a business may apply and what changes

Some active traders try to qualify as a trade or business. This can change how you handle expenses and accounting. It can also raise audit stakes if you push weak positions.

- Possible changes, treatment of platform costs, data fees, education, home office, and professional services may shift if you qualify.

- Entity choice, an LLC or S-corp does not automatically change your trader tax status. The facts and elections drive treatment.

- Retirement and benefits, structures may affect retirement plan options, payroll tax exposure, and deductible benefits.

What to ask a tax pro

- Which of my products fall under Section 988, Section 1256, or other treatment.

- Do I qualify to elect a different treatment, and what deadline applies.

- Which forms should I expect from my broker, and what do I file if I do not receive them.

- How to reconcile my broker P and L to my bank deposits and withdrawals.

- Whether I should pay quarterly estimated taxes, and what safe harbor method fits my situation.

- How financing, rollover, and platform fees should appear in my records.

- Whether my activity supports trader tax status, and what documentation I need to defend it.

| Topic | What you track | Why it matters |

|---|---|---|

| Instrument type | Spot, futures, options, broker account type | Drives tax section, timing rules, and reporting |

| Realized P and L | Closed trades by date | Supports income reporting and estimated taxes |

| Fees and financing | Commissions, spread costs if provided, swap, interest | Affects net results and expense classification |

| Cash movements | Deposits, withdrawals, currency conversions | Helps match taxable results to money flows |

Common Legal Pitfalls and Scams to Avoid

Offshore brokers targeting U.S. clients

Many scams start with an offshore broker that should not take U.S. retail clients. They pitch high leverage, bonuses, and fast onboarding. They avoid U.S. regulator names and give you vague “global” licenses.

- Common tactics: WhatsApp or Telegram outreach, Instagram ads, “limited-time” bonuses, and pressure to deposit the same day.

- Fake credibility: cloned websites, copied NFA IDs, and “regulated” badges that do not match any U.S. registry.

- Payment traps: crypto deposits, wire to personal accounts, or third-party payment processors. These make recovery harder.

- Platform tricks: web terminals that show profits you cannot withdraw, or “account manager” trades you cannot verify.

Account “recovery” scams after you lose money

Once you lose funds, another group may contact you and promise to recover them for a fee. They often claim ties to regulators, banks, or law firms. They usually want upfront payments or your account access.

- Red flags: upfront “legal” fees, requests for remote desktop access, demands for your ID again, and pressure to pay in crypto or gift cards.

- What to do: do not pay. Preserve evidence. Report the first fraud and the recovery attempt to the same agencies.

Signal sellers and managed-account fraud patterns

Signal and copy-trading offers often cross into illegal activity when the seller acts like an unregistered advisor or account manager. The risk rises when someone else controls your account or funds.

- Signal seller red flags: verified returns with no broker statements, no losing months, and “guaranteed” win rates.

- Managed-account red flags: they ask for your broker login, they trade without clear limits, or they move you to an offshore broker “for better leverage.”

- Pooled money red flags: they tell you to send funds to them directly, or to a “trading pool” wallet, instead of your own regulated account.

Use a checklist before you pay anyone. See how to spot forex scams and fake gurus.

Ponzi-like “forex investment programs” and unrealistic return claims

Ponzi-style forex programs sell steady monthly returns. They often show a dashboard that never draws down. Early withdrawals get paid with new deposits. The scheme collapses when inflows slow.

- Common claims: fixed returns, “risk-free” arbitrage, secret bots, insured profits, and fast compounding.

- Common controls: lockups, “maintenance windows,” and extra fees to “unlock” withdrawals.

- Reality check: legit trading returns vary. Drawdowns happen. No one can promise consistent high returns without risk.

Chargebacks, withdrawal issues, and your recourse

Withdrawal problems often signal fraud. Your options depend on how you paid and whether the firm falls under U.S. oversight.

- Card payments: you may have chargeback rights through your card issuer. Act fast and keep records of promises, receipts, and chats.

- Wires: recall chances drop fast once funds settle. Contact your bank immediately and file a fraud report.

- Crypto: transactions usually cannot reverse. You can still report wallet addresses and exchange off-ramps.

With a regulated U.S. forex dealer or registered firm, you can file complaints with the NFA and CFTC and create a formal record. With an unregulated offshore firm, you often rely on your bank, card network, and law enforcement reports. You still should report it. Reports help build enforcement cases and future warnings.

Where to report suspected forex fraud

- NFA: file a complaint and verify registration status. Use the BASIC database to check the firm and individuals.

- CFTC: submit a tip or complaint for suspected commodities and forex fraud.

- State Attorney General: report consumer fraud and investment scams targeting your state.

- FTC: report fraud that involves deceptive marketing, impersonation, or payment scams.

Keep your evidence organized. Save emails, chat logs, marketing claims, account statements, deposit receipts, wallet addresses, and withdrawal requests. Write a short timeline with dates, amounts, and names.

Pros and Cons of Trading Forex in the U.S.

Advantages of U.S. regulation

- Stronger guardrails. Retail forex brokers must register and follow CFTC and NFA rules. You get clearer standards on how firms handle customer accounts and sales practices.

- More disclosure. Regulated brokers must provide required risk disclosures and standardized reporting. This helps you compare costs and terms before you fund an account.

- Enforcement with teeth. U.S. regulators can fine firms, bar individuals, and pursue fraud cases. That does not prevent all losses, but it raises the cost of running a scam.

- Transparency checks. You can verify registration and disciplinary history through official records. Do this before you deposit.

Trade-offs for U.S. traders

- Fewer broker choices. Fewer firms meet U.S. capital and compliance standards. That can mean fewer platforms, fewer account types, and fewer promotions.

- Lower leverage caps. U.S. retail forex leverage typically caps at 50:1 on major pairs and 20:1 on non-majors. Lower leverage reduces blowups, but it also limits position sizing for small accounts.

- Strategy constraints. Many U.S. brokers enforce FIFO order handling and restrict hedging in the same account. If your approach relies on opposing positions or complex order stacks, you may need to adapt.

- Higher friction. Identity checks, funding rules, and stricter marketing limits can slow onboarding and reduce bonus style incentives.

Who the U.S. environment fits best

- Best for: traders who want regulated counterparties, clear disclosures, and a paper trail for disputes. Also a good fit if you value risk controls over maximum leverage.

- Less ideal for: traders who need very high leverage, broad broker choice, or flexible hedging rules inside one account.

- Common alternative: currency futures. Futures trade on regulated exchanges, use centralized pricing, and avoid retail forex dealing desk conflicts. They also come with different contract sizes, margin rules, and hours.

- Do not ignore taxes. Forex and futures can receive different U.S. tax treatment. See our guide to Forex taxes in the U.S. before you choose a product.

Frequently Asked Questions

Is forex trading legal in the United States?

Yes. You can trade forex in the U.S. if you use a properly regulated broker and follow U.S. rules. Most retail forex trading runs through firms registered with the CFTC and NFA, and it must follow leverage limits, reporting, and sales practice rules.

Who regulates retail forex in the U.S.?

The CFTC sets federal rules and enforces commodities laws. The NFA is the industry self regulator that registers firms, audits members, and publishes compliance actions. Your broker should show active CFTC registration and NFA membership.

Which brokers can legally offer retail forex to U.S. residents?

Only registered firms, typically an RFED or an FCM that offers retail forex. Many offshore brokers cannot accept U.S. clients. Before you fund an account, verify the firm and any sales rep in NFA BASIC.

What is the maximum leverage for U.S. retail forex?

Standard caps are 50:1 on major currency pairs and 20:1 on non majors. Brokers can set lower limits based on your account size or risk controls. Higher leverage offers from offshore firms can signal you are outside U.S. protections.

Can I trade forex with an offshore broker while living in the U.S.?

Some offshore firms still solicit U.S. clients, but you may lose key protections like U.S. disclosures, complaint processes, and enforcement reach. You also increase fraud risk. Use this forex scam checklist before you deposit.

Is forex trading taxed in the U.S.?

Yes. Retail spot forex often falls under Section 988 by default, while some products can use Section 1256 treatment. The choice can change your effective tax rate and loss rules. See our guide to Forex taxes in the U.S..

Is forex the same as currency futures?

No. Spot forex trades OTC with your broker as counterparty. Currency futures trade on regulated exchanges with centralized pricing and clearing. Futures use different contract sizes, margin rules, and trading hours, and they can receive different tax treatment.

Can U.S. brokers offer bonuses or guaranteed profits?

Be cautious. U.S. rules restrict misleading promotions and require risk disclosure. Claims of guaranteed returns, “no risk” trading, or pressure to deposit fast are red flags. A regulated firm should provide clear costs, leverage, and risk statements.

What does FIFO mean in U.S. forex rules?

FIFO means first in, first out. If you hold multiple positions in the same pair and size, the earliest position must close first. This limits certain trade management styles inside one account and can affect how you scale in and out.

Conclusion

Conclusion

Forex trading is legal in the United States. You can trade it, but you must follow tight rules. Those rules shape leverage, hedging, and how your orders close under FIFO.

Your edge comes from compliance and broker quality. Trade with a U.S. regulated broker under the CFTC and NFA. Verify the firm and each associated person. Read the risk disclosure. Know your costs, your leverage cap, and your margin terms before you place your first trade.

- Pick regulation first. Use a broker registered with the CFTC and an NFA member.

- Plan for U.S. constraints. Build your strategy around leverage limits, no-hedging rules, and FIFO order handling.

- Track every trade. Keep clean records for performance review and tax reporting.

- Walk away fast. If you see guaranteed returns, bonus traps, or pressure to deposit, stop and verify.

Final tip. Run every broker through a simple safety screen before you fund an account. Use this forex scam checklist and do not compromise on regulation.

-

-

- Leverage limits and margin rules (major vs. non-major pairs)

- FIFO and no-hedging rules, how they affect strategy execution

- Why many platforms and products differ in the U.S. (including common MT4 and MT5 limitations)

- Order execution, slippage, re-quotes, and best execution expectations

- Required risk disclosures and what to actually look for in them

-

- Is forex trading legal in the United States?

- Who regulates retail forex in the U.S.?

- Which brokers can legally offer retail forex to U.S. residents?

- What is the maximum leverage for U.S. retail forex?

- Can I trade forex with an offshore broker while living in the U.S.?

- Is forex trading taxed in the U.S.?

- Is forex the same as currency futures?

- Can U.S. brokers offer bonuses or guaranteed profits?

- What does FIFO mean in U.S. forex rules?

-

-

- Leverage limits and margin rules (major vs. non-major pairs)

- FIFO and no-hedging rules, how they affect strategy execution

- Why many platforms and products differ in the U.S. (including common MT4 and MT5 limitations)

- Order execution, slippage, re-quotes, and best execution expectations

- Required risk disclosures and what to actually look for in them

-

- Is forex trading legal in the United States?

- Who regulates retail forex in the U.S.?

- Which brokers can legally offer retail forex to U.S. residents?

- What is the maximum leverage for U.S. retail forex?

- Can I trade forex with an offshore broker while living in the U.S.?

- Is forex trading taxed in the U.S.?

- Is forex the same as currency futures?

- Can U.S. brokers offer bonuses or guaranteed profits?

- What does FIFO mean in U.S. forex rules?

-

What Is Forex Trading? A Beginner’s Guide to How It Works

14 hours ago -

How Does the Forex Market Work? (Participants, Pricing & Execution)

14 hours ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

14 hours ago -

Spot Forex vs Futures vs Options: What’s the Difference?

14 hours ago -

Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

14 hours ago

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

14 hours ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

14 hours ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

14 hours ago -

Spot Forex vs Futures vs Options: What’s the Difference?

14 hours ago -

Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

14 hours ago