Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

The forex market runs 24 hours a day from Monday to Friday, but price action is not equal across the clock. Liquidity, volatility, and spreads change as Sydney, Tokyo, London, and New York open and close.

This guide breaks down each major trading session and its hours. You will learn when volume tends to rise, when spreads often tighten, and when two sessions overlap and create the strongest moves. You will also learn which hours often turn choppy, when weekend gaps become a risk, and how to match your schedule to the pairs you trade.

If you need a quick primer on how the market works first, read what forex trading is.

Key Takeaways

- In het kort: Forex runs 24 hours a day from Monday to Friday, then shuts for the weekend.

- Trading activity clusters into four sessions, Sydney, Tokyo, London, New York. Session choice matters.

- Expect the strongest moves when sessions overlap. Liquidity rises and spreads often tighten.

- London session drives a large share of daily volume. Many pairs see their best liquidity during London and the London to New York overlap.

- Tokyo hours tend to suit JPY pairs. Expect slower conditions in many non JPY pairs unless news hits.

- Quiet windows can turn choppy. You often see more noise, wider spreads, and weaker follow through.

- Plan around scheduled news. Major releases can spike volatility, widen spreads, and increase slippage.

- Watch the Friday close and Sunday open. Weekend gaps can hit stops and limit orders.

- Match your trading hours to your pairs. Trade when your pair’s home session is open and liquid.

To manage fast moves during overlaps and news, learn how slippage in forex works and how to reduce it.

Forex Market Hours & Trading Sessions: The Big Picture

What forex market hours are

Forex runs on a global, over-the-counter network. Banks, brokers, funds, and firms quote prices to each other. There is no single exchange that sets one open and close time.

That structure creates the 24/5 schedule. Trading follows the business week across time zones. When one region closes, another opens.

What a “trading session” means

A trading session is a window when a major financial center drives volume and pricing. Sessions overlap, but one region often sets the tone.

- Sydney: Starts the trading week. Often thinner liquidity.

- Tokyo: More activity in JPY pairs and Asia-driven flows.

- London: The main liquidity hub for many pairs.

- New York: Heavy USD flow, major US data, and fixes.

Why session timing changes spreads, slippage, and price movement

Liquidity rises when more institutions quote prices. Liquidity drops when fewer participants trade. This shows up in your trading costs and execution.

- Spreads usually tighten in active hours, and widen in thin hours.

- Slippage increases when price moves fast or the order book is thin.

- Price movement often clusters around opens, closes, overlaps, and scheduled news.

You feel this most during London and New York hours, and during the overlap. You also feel it during rollover, late Friday, and early Sunday when liquidity can dip and pricing can jump.

Typical weekly schedule (and why broker times differ)

Most brokers show forex as open from Sunday to Friday, with a daily rollover break. The exact clock time depends on your broker’s server time, and daylight saving changes.

| Market event | What you typically see | What it means for you |

|---|---|---|

| Weekly open | Sunday evening (platform time varies) | Wider spreads are common. Weekend gaps can fill fast. |

| Daily rollover | About 5:00 pm New York time | Liquidity can drop. Spreads can widen. Swaps apply. |

| Weekly close | Friday late afternoon New York time | Liquidity fades. Spreads can widen. Stops can slip. |

Use your platform’s market watch and session indicators. Convert session times to your local clock. Then plan your trading around the highest-liquidity windows for your pair. If you also trade equities, compare how forex hours differ from stocks using forex trading vs stock trading.

Forex Trading Sessions (Sydney, Tokyo, London, New York) — Times & Characteristics

Sydney session, UTC times and what to expect

Typical hours: 22:00 to 07:00 UTC.

- Liquidity: Lower than London and New York. Spreads can run wider, especially outside AUD and NZD pairs.

- Best-fit pairs: AUDUSD, NZDUSD, AUDJPY, NZDJPY, AUDNZD.

- Price behavior: More range trading. Clean breakouts happen, but they fail more often than during London.

- What to watch: Australia and New Zealand data. Also watch early week gaps after the weekend.

- How to trade it: Use smaller targets and tighter filters. Avoid forcing trades in thin conditions.

Tokyo session, UTC times and what to expect

Typical hours: 00:00 to 09:00 UTC.

- Liquidity: Better than Sydney. Still lighter than London. Depth concentrates in JPY crosses.

- Best-fit pairs: USDJPY, EURJPY, GBPJPY, AUDJPY, EURUSD during overlap windows.

- Price behavior: Often ranges. Strong trends show up when Japan data hits, risk sentiment shifts, or BOJ headlines land.

- What to watch: Japan CPI, GDP, Tankan, BOJ communication, and regional risk moves tied to equities.

- How to trade it: If your system needs volatility, focus on Tokyo, London overlap. If you trade mean reversion, Tokyo can fit.

London session, UTC times and what to expect

Typical hours: 08:00 to 17:00 UTC.

- Liquidity: Highest of the day. Spreads often tighten. Fills improve.

- Best-fit pairs: EURUSD, GBPUSD, USDCHF, EURGBP, major crosses.

- Price behavior: Stronger trends and cleaner breakouts, especially in the first 2 to 4 hours.

- What to watch: UK and Eurozone releases, central bank speakers, and large order flow around the London open.

- How to trade it: Plan for speed. Use defined invalidation levels. If you scalp, you will often get the best spreads here.

New York session, UTC times and what to expect

Typical hours: 13:00 to 22:00 UTC.

- Liquidity: Very high early, then drops after London closes. Late session can turn choppy.

- Best-fit pairs: EURUSD, GBPUSD, USDJPY, USDCAD, XAUUSD for many brokers.

- Price behavior: News-driven moves and fast reversals. You often see trend continuation or a hard fade after a data spike.

- What to watch: US CPI, NFP, FOMC, jobless claims, GDP, and major bond yield moves.

- How to trade it: Reduce size into major releases, or stand aside. Slippage risk rises during high-impact news. If you hold trades, confirm your broker execution model and how pricing works in how the forex market works.

Forex session hours table, use UTC then convert to your time

Start with UTC. Then convert to your local clock. Use your platform session markers or a time zone converter with DST support.

| Session | Typical open, UTC | Typical close, UTC | Your local time |

|---|---|---|---|

| Sydney | 22:00 | 07:00 | Convert from UTC with DST rules |

| Tokyo | 00:00 | 09:00 | Convert from UTC with DST rules |

| London | 08:00 | 17:00 | Convert from UTC with DST rules |

| New York | 13:00 | 22:00 | Convert from UTC with DST rules |

Session Overlaps Explained (Most Active Forex Hours)

What session overlaps are and why they matter

A session overlap happens when two major forex sessions run at the same time. More banks, funds, and brokers quote prices at once. Liquidity concentrates. You usually get tighter spreads, faster fills, and more follow-through on moves.

If you want the highest activity, trade overlaps. If you want quieter conditions, avoid them.

Session overlap windows (UTC)

| Overlap | Typical window, UTC | What to expect |

|---|---|---|

| Tokyo–London | 08:00 to 09:00 | Short overlap, often thinner liquidity than London core hours |

| London–New York | 13:00 to 17:00 | Highest liquidity, frequent breakouts, strong trend days |

| Sydney–Tokyo | 00:00 to 07:00 | Asia-Pacific flow, steadier moves in AUD, NZD, JPY pairs |

London–New York overlap (often best for day traders)

Typical UTC window: 13:00 to 17:00.

- You get the deepest liquidity of the day. London and New York desks trade at the same time.

- Many major pairs show their strongest intraday range here, especially EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

- More liquidity often means tighter spreads and cleaner execution on market orders and stops.

- US data releases often hit during this block. That can create the day’s main move.

This overlap suits breakout and trend-following day trading. It also suits active scalping if you manage news risk.

Tokyo–London overlap (usually thinner)

Typical UTC window: 08:00 to 09:00.

- This overlap is only one hour. Volume can rise, but it often does not match London’s later peak.

- Thinner liquidity means fewer quotes at each price level. Your spread can widen and slippage can increase, especially outside top pairs.

- Moves can look sharp, then fade when London fully takes control.

If you trade this window, focus on the most liquid pairs. Keep targets realistic. Use limit orders when possible. If you need a refresher, read what is spread in forex.

Sydney–Tokyo overlap (Asia-Pacific flow)

Typical UTC window: 00:00 to 07:00.

- Tokyo brings volume. Sydney adds regional flow. You often see steadier price action than during US news hours.

- AUD/JPY and NZD/JPY can react to risk tone and Asia equity moves.

- AUD/USD often responds to commodity headlines, China-linked news, and Australian data.

- JPY pairs can move on BOJ communication, yields, and broader risk sentiment.

This overlap can work well for range trading when no major data sits on the calendar.

When overlaps are not ideal

- Whipsaws near major news. Price can spike both ways. Stops can trigger before direction forms.

- First and last minutes of an overlap. Order flow can shift fast as one region hands off to another.

- Illiquid crosses. Even during overlaps, some pairs stay thin. Spreads can stay wide and fills can slip.

- High-impact event clusters. CPI, jobs data, central bank decisions, and surprise headlines can override normal liquidity benefits.

Best Times to Trade Forex (Matched to Strategy & Goals)

Best Times for Scalping

Scalping needs tight spreads, fast fills, and steady volume. Trade when liquidity peaks and avoid session handoffs.

- Best window: London open through the London to New York overlap.

- Best pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF. You get lower spreads and deeper books.

- Avoid: rollover and spread reset around the daily swap cut. Spreads can widen and slippage rises.

- Avoid: the first and last minutes of an overlap. Price can spike both ways.

- Adjust size: cut risk before major releases. CPI, jobs data, and rate decisions can break your stop logic.

Best Times for Day Trading

Day trading works best when the market prints clean intraday moves. You want breakouts, not drift.

- London open: often sets the day’s first strong move. Watch the first 60 to 120 minutes for range breaks.

- London to New York overlap: highest volume for many majors. Breakouts and continuation moves show up more often.

- New York morning: strong follow through when US data hits and equity markets open.

- Plan around releases: mark high impact times first. Trade after the first impulse if spreads and fills stabilize.

Best Times for Swing Trading

Swing trading cares less about the exact hour. You still need consistent execution and a schedule built around daily structure.

- Daily close and new day open: use this time for analysis, order placement, and risk checks. Many swing setups form around daily candle closes.

- Macro release windows: central bank decisions, inflation, and labor data can drive multi day trends. Reduce leverage into events, then reassess after price digests the news.

- Pair selection matters more than session timing: stick to liquid majors and major crosses. Thin markets can distort levels.

Liquidity still impacts your entries and stops. If you trade less liquid pairs, read Forex liquidity explained before you size up.

Best Times for Range Trading

Range trading needs slow conditions and stable spreads. You want mean reversion, not momentum.

- Best window: Asian session for many USD and EUR pairs. Price often stays inside a defined box when Europe and the US stay quiet.

- Look for: flat intraday structure, repeated rejections at the same highs and lows, and shrinking average true range.

- Best approach: fade range extremes with tight invalidation. Take profits faster near the midrange.

- Avoid: the transition into London. Ranges can break and not come back.

- Avoid: days with scheduled top tier data. A range can fail in seconds.

Best Times by Market Condition: Trending vs Choppy vs Event-Driven

| Market condition | What you see | Best sessions and times | Strategies that fit |

|---|---|---|---|

| Trending | Higher highs, higher lows, or the reverse. Pullbacks hold. | London open and London to New York overlap. Add focus on the first 2 hours of London and New York morning. | Breakout day trades, trend pullback entries, swing continuation trades. |

| Choppy | False breaks, quick reversals, weak follow through. | Asian session, or mid session lulls when major centers slow down. | Range trading, mean reversion, smaller targets, tighter time stops. |

| Event-driven | Wide spreads, fast gaps, one candle moves that rewrite levels. | Scheduled release windows during London and New York. Central bank decisions can dominate any session. | News volatility plans, post release continuation, reduced size or stay flat until spreads normalize. |

Best Times to Trade by Currency Pair (Pair–Session Fit)

How to match a pair to a session

Trade a pair when its home markets are open. You get more orders, tighter spreads, and cleaner fills. Liquidity peaks during session overlaps, London and New York in particular.

- London session: strongest for EUR and GBP pairs.

- New York session: strongest for USD pairs, often with follow through from London.

- Tokyo session: strongest for JPY pairs, plus early AUD and NZD flow.

- Overlap windows: highest liquidity, fastest price discovery, most breakouts.

Majors: EUR/USD, GBP/USD, USD/JPY

Majors trade well most of the day, but they do not trade the same across sessions. Focus on when their main dealing centers run hot.

- EUR/USD: best during London and the London to New York overlap. Expect the tightest spreads and the most reliable momentum. Asia can work for range trades, but moves often stall before Europe opens.

- GBP/USD: best during London, then stays active into early New York. UK data can move this pair hard in the first half of London. Expect sharper spikes than EUR/USD, plan wider stops or smaller size.

- USD/JPY: best during Tokyo and early London. It often wakes up again during New York when US yields move. Asia gives cleaner trend legs on risk and yield themes, London and New York can add fast reversals around US releases.

Commodity FX: AUD/USD, NZD/USD, USD/CAD

Commodity linked pairs respond to local session flow and local data. You usually get the best spreads and follow through when those markets open.

- AUD/USD: best during Sydney and Tokyo, then again during the London handoff. Australian data and China headlines often hit during Asia hours. London can extend or fade the Asia move.

- NZD/USD: best during Wellington and Sydney, then Tokyo. Liquidity is thinner than AUD/USD, so spreads can widen outside Asia. Be stricter with limit entries and avoid chasing breaks in dead hours.

- USD/CAD: best during New York and the London to New York overlap. CAD reacts to Canadian data and oil, most impact shows during North America. Outside those hours, expect slower fills and more spread cost.

European crosses: EUR/GBP, EUR/CHF

Crosses price best when Europe runs. Outside European hours, spreads widen and levels break more easily.

- EUR/GBP: best during London. UK and Eurozone releases drive fast repricing. The overlap can work, but the cleanest moves usually print in the first half of London.

- EUR/CHF: best during London and the broader European morning. CHF can go quiet for long stretches, then gap on risk shocks. Avoid thin hours if you rely on tight stops.

JPY crosses: GBP/JPY, AUD/JPY

JPY crosses combine two volatility engines. They can trend in Asia, then spike in London. Your timing changes your trade type.

- GBP/JPY: most aggressive during London and the overlap. Tokyo can set the range, London often breaks it. Expect fast stop runs, reduce size if you cannot monitor closely.

- AUD/JPY: best during Tokyo because both legs trade actively. London can still move it, but spreads and whipsaws often increase when liquidity shifts between regions.

Emerging market pairs: narrower windows, wider spreads

EM pairs trade with higher friction. Liquidity concentrates in short local windows. Outside them, spreads widen and slippage rises.

- Best timing: trade near the local market open and during the main overlap with London or New York, depending on the currency.

- Common risk: sudden gaps on policy headlines, capital flow news, and thin order books.

- Execution rule: use limit orders more, widen your tolerance for spreads, and avoid holding large size into local data releases.

- Cost check: track spread and pip cost before you trade. Use a pip value calculator to measure what each move and each spread point means for your position size.

| Pair group | Pairs | Best sessions | What to expect |

|---|---|---|---|

| Majors | EUR/USD, GBP/USD | London, London to New York overlap | Tight spreads, strong trends, clean breakouts around data |

| Majors | USD/JPY | Tokyo, early London, New York on US yields | Asia trend legs, US data driven surges |

| Commodity FX | AUD/USD, NZD/USD | Sydney, Tokyo | Best liquidity in Asia, thinner outside it |

| Commodity FX | USD/CAD | London to New York overlap, New York | Oil and data moves, strong North America flow |

| European crosses | EUR/GBP, EUR/CHF | London, European morning | Better fills in Europe, choppy outside it |

| JPY crosses | GBP/JPY, AUD/JPY | Tokyo for base flow, London for spikes | Range set in Asia, volatility jumps in London |

| Emerging markets | USD/MXN, USD/ZAR, USD/TRY, others | Local hours, main overlap with London or New York | Wider spreads, slippage risk, headline gaps |

The Daily Forex “Break”: Rollover, Swap, and Why Liquidity Drops

What the daily rollover is

Forex has no central exchange close. But it still has a daily settlement cut.

That cut is the rollover. Your broker rolls spot positions from one value date to the next. If you hold a trade past the cut, you carry it into the next trading day.

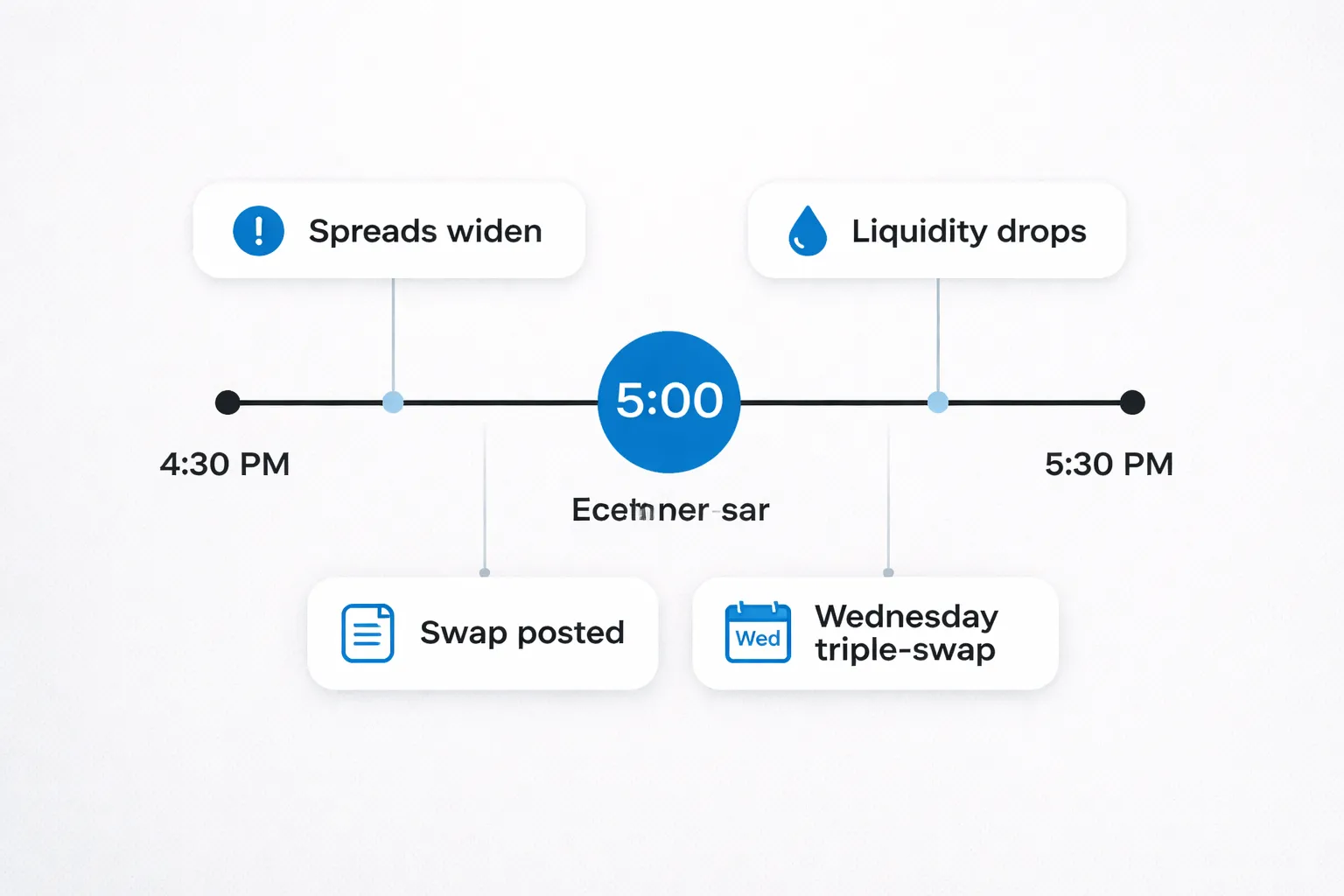

Typical rollover window in New York time

Most brokers use 5:00 pm New York time as the daily rollover timestamp. Liquidity often drops in a short window around it, usually 5 to 30 minutes, sometimes longer.

The exact window varies by broker because of:

- Server time and platform settings. Some label rollover by “end of day” in server time, then convert it for reports.

- Liquidity provider behavior. Banks and prime brokers widen quotes or reduce size near the cut.

- Holiday calendars. Around US, UK, EU, or local bank holidays, the disruption can start earlier and last longer.

- Daylight saving shifts. New York and London do not switch on the same dates, so week-to-week conditions can change even if the “5 pm NY” label stays.

Why liquidity drops at rollover

Dealers reduce risk near the settlement boundary. Many participants pause quoting or cut available size. You see fewer resting orders and thinner depth.

That is a liquidity event, not a “market close.” Price can still move, but it moves on less flow. Read more on forex liquidity if you want the mechanics.

How rollover affects spreads, stops, and slippage

- Spreads widen. Majors can widen from “normal” to several times normal. Crosses and exotics can blow out more.

- Stops trigger easier. A wider spread can hit your stop even if the mid price barely moved.

- Limit fills get worse. If quotes gap, your limit may not fill where you expect, or it may miss entirely.

- Slippage increases. Thin depth means market orders and stop orders fill at the next available price, not the last traded price.

Swap and financing basics

Swap is the daily financing adjustment for holding a position past rollover. Your broker applies it as a credit or debit, based on the two currencies in the pair and your broker’s markup.

Key points:

- You pay or earn swap once per day, if you hold through rollover.

- Long and short swap differ. Each side has its own rate.

- It hits open positions, not closed trades. Close before rollover and you avoid that day’s swap.

Wednesday triple-swap

Spot FX settles on a T+2 basis for most pairs. Brokers apply triple-swap on Wednesday to account for weekend settlement.

- Hold past Wednesday rollover, you usually get charged or credited three days of swap.

- Some pairs differ. A few instruments have different settlement conventions. Your broker’s contract specs control what you actually get charged.

Practical rules to trade rollover safely

- Avoid new entries near rollover. Do not open fresh trades inside the window your broker tends to widen spreads.

- Do not “tighten stops” into rollover. A tight stop often becomes an easy target when spreads expand.

- Place stops with spread in mind. If your stop sits near obvious levels, give it room for rollover widening or get flat before the cut.

- Use limit orders away from the noise. If you must trade, work limits at levels that still make sense if spreads widen.

- Check swap before you hold. If swap is strongly negative, the carry cost can erase your edge fast, especially on triple-swap day.

- Review your broker’s rollover time and swap table. Treat their specs as the source of truth.

Daylight Saving Time (DST) & Time Zone Confusion (How to Avoid Mistakes)

GMT vs UTC vs Broker Server Time, What You Need to Know

UTC is the global time standard. It does not change for Daylight Saving Time.

GMT often gets used like UTC in trading articles. In practice, many sources label times as GMT even when they mean UTC. Do not assume they match.

Broker server time is what your platform uses for candle opens, daily close, rollover, and swap. It can be UTC+0, UTC+2, UTC+3, or something else. It can also change when DST starts or ends.

Your charts follow broker server time, not your local clock, and not what a website calls GMT.

How DST Shifts London and New York Session Times

DST creates the biggest timing mistakes because London and New York do not switch on the same dates.

- London moves between UTC+0 and UTC+1.

- New York moves between UTC-5 and UTC-4.

- For part of the year, the London and New York overlap shifts by one hour.

- Session open and close times you memorized can be wrong for weeks.

Rule to follow. Treat session times as seasonal. Recheck them every March and November, and also when the UK switches.

Confirm Session Times Inside Your Trading Platform

Start with your platform clock. Then map sessions to that clock.

- Look at the time shown on your chart axis. That is your broker server time.

- Open Market Watch, right-click a symbol, choose Specification, and find trading hours and session breaks.

- Check swap and rollover cut time in the same specs area when available.

- Mark your own session lines on the chart using the platform time, not your local time.

If your broker publishes a server time offset, write it down as UTC+X. Use that number as your conversion base.

Use an Economic Calendar Correctly

Most calendar errors come from the wrong time zone setting.

- Set the calendar time zone to UTC or to your local time. Do not leave it on a default you did not choose.

- Verify the event time against a second source when DST just changed.

- Match the release time to your platform time before you place orders.

- If you trade news spikes, confirm the symbol trading hours and expected liquidity for that hour.

Checklist, Convert Session Hours to Your Local Time Reliably

- Find your broker server time offset, write it as UTC+X.

- Confirm if your broker changes server time for DST, check their notices.

- Pick one reference time for planning, use UTC or broker server time, do not mix.

- Convert London, New York, Tokyo, and Sydney sessions from the reference time to your local time.

- Recheck conversions during DST change weeks in the US and UK.

- Validate on your chart by spotting known opens, then save the template.

- Before trading a new schedule, confirm spreads and liquidity at that hour.

News Releases & Scheduled Events That Override “Normal” Session Behavior

News Releases & Scheduled Events That Override “Normal” Session Behavior

Session hours tell you when liquidity tends to rise. The calendar tells you when liquidity can vanish or turn chaotic. High impact news can dominate London and New York, even outside the usual overlap.

High impact releases that move the most during London and New York

- US CPI, PCE, retail sales, GDP, jobless claims. Large, fast moves in USD pairs.

- US NFP and unemployment rate. Often the most violent scheduled event of the month.

- Central bank decisions, Fed, ECB, BoE, BoJ, RBA, BoC. Rate decision plus statement plus press conference can extend volatility for hours.

- PMI and inflation prints for UK and Eurozone. Often hit hardest during the London morning.

- Bond auctions and major speeches, Fed Chair, ECB President. They can reverse the first move.

What news does to spreads, volatility, and execution

- Spreads widen. Liquidity providers pull quotes. Your “normal” spread becomes irrelevant.

- Price gaps inside seconds. Candles can skip levels. Stops can fill worse than planned.

- Slippage rises. Market orders can fill far from your click. Stops can slip, limit orders may not fill.

- Requotes and rejects increase. Some brokers throttle fills during spikes.

- Correlation spikes. Multiple pairs move as one, then snap back.

If you trade news, you trade execution risk as much as direction. Review your broker’s fill policy and learn how to reduce the damage. Use this guide on slippage in forex if you need the mechanics.

Pre news vs post news approaches

- Stand aside. If your edge depends on stable spreads and clean levels, do not trade 5 to 15 minutes before high impact releases.

- Reduce risk early. Cut size, tighten exposure, or flatten positions before the release. Do not “hope” through it.

- Trade the post move, not the number. Wait for the first spike, then look for a pullback, a range break, or a retest with spreads back near normal.

- Use a defined breakout plan. If you trade breakouts, set rules for max spread, max slippage, and a cancel time. Skip the trade if any rule fails.

- Confirm the second reaction. The first move often fades after the press conference starts or after revisions hit the tape.

Cross market events that can hijack “quiet” sessions

- CAD and oil inventory data. Weekly crude inventories can move oil fast. USD/CAD can follow, especially if oil breaks a key level.

- AUD and China data. China PMIs, GDP, and trade numbers often hit during Asia hours. AUD pairs can spike even when London is closed.

- JPY and risk shocks. Equity index futures drops can push JPY strength quickly, even outside Tokyo’s peak.

Risk controls for news hours

- Size down. If your stop must be wider during news, cut position size to keep risk constant.

- Prefer limit orders for entries. Limits control entry price. Market orders maximize fill risk during spikes.

- Use hard stops. Mental stops fail when price jumps. Place the stop, then accept slippage as part of the risk.

- Consider guaranteed stops if your broker offers them. You pay for the protection. You remove gap risk.

- Set a max spread rule. If spread exceeds your limit, you do not enter. No exceptions.

- Avoid holding large exposure into the release. If you must hold, hedge or reduce, then reassess after spreads normalize.

When NOT to Trade: Low-Liquidity Traps and Holiday Effects

Late Friday Conditions and Weekend Gap Risk

Liquidity often drops late Friday, especially after the New York afternoon. Spreads widen. Fills get worse. Small orders move price more.

Weekend gaps add a separate risk. The market closes. News keeps moving. Price can reopen far from your stop. Your stop becomes a market order at the reopen, and you take slippage.

- Do not open new swing trades late Friday unless your plan allows gap risk.

- Reduce position size if you hold through the close.

- Avoid tight stops. Thin markets hit stops that would survive in normal liquidity.

- Check your broker’s cutoff times. Some widen spreads before the official close.

Major Market Holidays and Liquidity Impact (US, UK, JP)

Holidays cut participation. Fewer banks quote tight prices. You see wider spreads and slower execution. Breakouts fail more often. Price jumps on low volume.

| Holiday market | Pairs most affected | Common trading issues |

|---|---|---|

| US holiday | EUR/USD, GBP/USD, USD/JPY, USD/CAD | Wider spreads in New York hours, weaker follow-through, sudden spikes |

| UK holiday | GBP pairs, EUR/GBP | Thin London session, choppy ranges, fake breakouts |

| Japan holiday | JPY pairs, AUD/JPY, NZD/JPY | Thinner Tokyo flow, larger spread jumps around fixes, poor fills |

Do not assume “quiet” means “safe.” Quiet often means fragile. One headline can move price fast because depth is missing.

Early Asian Session and Post-Rollover Thin Markets

Early Asia can run thin, especially after New York closes and before Tokyo volume builds. Many pairs drift, then snap back. Your stop gets tagged, then price returns.

Rollover adds another trap. Brokers reset swap, rebalance books, and widen spreads. You pay more to enter. You pay more to exit.

- Avoid new entries right after the daily rollover on your platform.

- Avoid scalping when spreads fluctuate from tick to tick.

- If you must trade Asia, focus on pairs with real activity in that window, like AUD, NZD, JPY crosses.

How to Spot Poor Conditions Fast

- Widening spreads. Your cost rises and your stop sits closer to the real market. Track spread as a number, not a feeling.

- Erratic candles. Long wicks, sudden one candle spikes, and instant reversals signal thin order books.

- Low tick volume. Fewer ticks per minute means less participation. Signals degrade. Backtests from active hours stop matching live behavior.

- Slippage on small orders. If small size gets poor fills, larger size will get worse.

Set rules. If spread exceeds your limit, you do not trade. If tick volume drops below your minimum, you do not trade.

Alternative: Paper Trade or Backtest During Low-Quality Windows

Use low-liquidity windows for work that does not need fills.

- Replay charts and practice execution.

- Backtest session filters, spread limits, and no-trade windows.

- Refine risk rules, including your position size, and document results. Use the same inputs you use live.

If you need a sizing refresher before you go live again, review how to calculate position size.

Broker Platform Hours vs Market Hours (Common Confusion)

Broker Platform Hours vs Market Hours

Spot FX can trade almost 24 hours from Monday open to Friday close. Your broker platform can still pause quotes or block trading. Platform hours are a mix of market access, broker risk controls, and product rules.

Why Your Broker Can Pause Quotes While Forex Is “Open”

- Daily maintenance, many brokers run a short server restart near rollover. Charts freeze, order placement fails, or fills slow.

- Liquidity provider downtime, your broker may lose a price feed or widen pricing filters if one or more providers drop out.

- Risk limits, brokers may restrict new orders during news spikes or thin liquidity to control exposure.

- Weekend and reopen gaps, some brokers stop pricing early on Friday or delay full depth on Sunday open.

Symbol-Specific Trading Hours (It Is Not All “Forex”)

Your platform shows many instruments, each with its own hours. Do not assume your FX schedule applies to everything.

- Spot FX pairs, usually follow the 24x5 cycle, with reduced liquidity around rollover.

- Metals like XAUUSD and XAGUSD often trade longer hours but can have a short daily break.

- Indices and oil CFDs follow their underlying exchange hours or a broker-defined schedule, often with larger breaks and different rollover rules.

- Crypto CFDs may run 24x7, but spreads and execution can change sharply on weekends.

How to Verify Trading Hours and Contract Specs Inside Your Platform

- Open the symbol details panel, then check Trading Hours.

- Confirm contract size, tick value, and minimum lot.

- Check margin requirements and any session-based margin changes.

- Review swap or financing fields, and the triple-swap day.

- Read the broker spec sheet for the symbol. Match it to what your platform shows.

Execution Quality Still Changes by Session

Market open does not mean market quality. Your results depend on spreads, fees, and available liquidity.

- Spreads widen in thin periods, at rollover, and during fast news. Track typical spreads per session, not the broker minimum.

- Commissions matter most when you trade frequently. Compare all-in cost, spread plus commission.

- Liquidity providers affect fill speed and rejection rates. More providers usually helps during busy overlaps, and during shocks.

- Slippage and re-quotes rise when the book is thin or price moves fast. If you need a deeper refresher, read what is slippage in forex.

Choosing a Broker for Your Session

- Measure spreads during your hours, especially London and New York overlap if you trade it. Log median and worst-case.

- Check rollover policy, confirm the rollover time, triple-swap day, and whether the broker widens spreads or restricts orders.

- Confirm execution model, look for clear language on pricing sources, order handling, and rejected orders.

- Verify symbol hours for every market you trade, including metals and indices, before you build a session plan.

Practical Trading Workflow: Building a Session-Based Plan

Step 1: Choose pairs aligned with your available hours

Start with your schedule. Pick pairs whose main volume hits when you can trade.

- Asia hours: AUD, NZD, JPY pairs often show cleaner ranges and slower moves.

- London hours: EUR and GBP pairs often move first and trend more.

- New York hours: USD pairs react hard to US data and equity flows.

- Overlaps: Expect higher volume, faster moves, and wider opportunity, plus faster losses.

Limit your universe. Track 3 to 6 pairs. Build stats on those pairs only.

Step 2: Define session-specific setups

Write one play per session. Keep rules tight. Avoid mixing logic across sessions.

- London breakout: Mark the Asia range. Define a breakout trigger. Require a retest or a momentum close. Place the stop beyond the opposite side of the range, or beyond the last swing.

- New York reversal: Mark the London move and key levels. Wait for failure signs, sweep and reject, break of structure, or strong counter candle at a level. Target the mean, the London open, or the session midpoint.

- Asia range: Define the range window. Fade the extremes only after confirmation. Keep targets small, often the range mid, then the opposite band.

Document exact entry, stop, target, and exit rules. Include a no trade rule, such as high impact news within 15 minutes.

Step 3: Set alerts for session opens, closes, and overlaps

Use alerts to reduce screen time and improve timing.

- Set alerts 10 minutes before each session open you trade.

- Set alerts for the London and New York overlap window.

- Set alerts for your key levels, Asia high and low, previous day high and low, and weekly open.

- Set spread alerts. Use one simple rule, pause trading if spreads exceed your normal level. Review what a spread is if you do not track it yet.

Keep alerts aligned with your broker server time. Adjust for daylight saving changes.

Step 4: Use volatility tools to set stops and targets

Match risk to current conditions. Do not use fixed pip stops across all sessions.

- ATR: Use a daily ATR to size expectations. Use an intraday ATR to set working stops and targets.

- Session range: Log the typical Asia range, London first hour range, and New York first hour range for your pairs.

- Stop placement: Put stops where the setup fails, then check if that distance fits your risk per trade.

- Target logic: Target the next liquidity area, prior swing, session open, or a measured portion of ATR.

Run a simple filter. If the current session range already hit your typical max, reduce size or skip. You trade late moves less.

Step 5: Journal performance by session

Journal each trade with session tags. Build evidence. Cut what fails.

- Win rate: Wins divided by total trades per session.

- Average win and average loss: Measure in R or in account currency.

- Expectancy: (Win rate x average win) minus (Loss rate x average loss).

- Mistake rate: Late entries, moved stops, revenge trades, skipped rules.

- Market condition: Trend day, range day, news day, low liquidity day.

Review weekly. Keep the best session and setup combinations. Drop the rest. Your plan gets simpler and your stats get cleaner.

FAQ

What are forex market hours?

Forex runs 24 hours a day from Monday open to Friday close, based on global banking hours. Trading rolls from Sydney to Tokyo to London to New York. Most brokers pause pricing for a few minutes at the daily rollover, often around 5pm New York time.

What time does the forex market open and close?

The week starts when Sydney opens on Monday local time and ends when New York closes on Friday local time. Your exact clock time depends on your time zone and daylight saving shifts. Use your broker server time to avoid time conversion errors.

What are the main forex trading sessions?

The main sessions are Sydney, Tokyo, London, and New York. London and New York usually drive the most volume. Tokyo often leads JPY pairs. Sydney often sets the tone for AUD and NZD pairs, with thinner liquidity early in the week.

What are the best times to trade forex?

Trade when liquidity and volume are high. The London session and the London and New York overlap usually give the tightest spreads and cleanest follow through. Match your trading style to session behavior, trend setups in London, volatility trades in overlaps.

What are the worst times to trade forex?

Avoid thin liquidity windows. Late New York after the main move fades often turns choppy. The period before major news can stall price. The daily rollover can widen spreads and trigger stops. If your spread spikes, stand down.

What are overlapping sessions, and why do they matter?

Overlaps happen when two major centers trade at the same time. Volume rises and spreads often tighten. You also get faster moves and more false breakouts. Use overlaps for momentum setups, and reduce size if volatility exceeds your stop distance.

Why do spreads widen at certain times?

Spreads widen when liquidity drops or risk rises. Common causes include rollover, market opens, holidays, and high impact news. Brokers widen spreads to manage risk when fewer quotes sit in the order book. Track spread by session in your journal.

What is the daily forex rollover, and why does it matter?

Rollover is the daily settlement cut off used to apply swap or financing. Many brokers show a short liquidity dip around this time, often near 5pm New York time. Spreads can jump and fills can slip. Avoid placing tight stops during rollover.

Does daylight saving time change session hours?

Yes. Session times shift when the US or UK changes clocks, and the change dates do not always match. This can move the London and New York overlap by one hour for weeks. Check an economic calendar and your broker time each season.

Should you trade during major economic news releases?

Only if your plan covers news volatility. Slippage and spread spikes can ruin tight stops. If you trade news, use predefined rules for position size, stop distance, and max loss. If you avoid news, stop trading 10 to 30 minutes before release.

Which pairs move most in each session?

JPY pairs often move more in Tokyo. GBP and EUR pairs often move more in London. USD pairs often move more in New York. In overlaps, cross flows increase, so EURUSD, GBPUSD, and USDJPY often show the cleanest liquidity and execution.

How do you pick the right session for your strategy?

Start with your setup needs. If you trade breakouts, focus on London open and overlaps. If you trade ranges, focus on calmer periods and defined Asian ranges. Backtest by session and track expectancy. Keep one or two sessions that pay.

How do you manage position size when volatility changes by session?

Size your trade from stop distance, not from feelings. Higher volatility sessions usually need wider stops. If your stop doubles, your lot size should drop to keep risk constant. Use a fixed risk per trade and calculate position size from your stop.

See How to Calculate Position Size in Forex for a step by step formula.

Conclusion

Conclusion

Forex runs 24 hours a day, five days a week. Liquidity and volatility change by session. Your results depend on trading when your pair moves and spreads stay tight.

- Match the session to your pair. Trade EUR and GBP during London and New York. Trade JPY and AUD during Tokyo and Sydney.

- Use overlap windows for the cleanest activity. London and New York often bring the most volume and the fastest fills.

- Protect your edge during dead hours. Expect wider spreads and slower movement. Reduce frequency or stand aside.

- Plan for news. Either trade it with a rule set, or stay flat until spreads normalize.

Final tip. Build a simple session plan and stick to it. Pick two trading windows you can repeat each week. Track spread, average range, and slippage for your pair in those hours. Keep risk fixed per trade and adjust your position size to the stop you need. If you also use margin, keep it controlled. Review forex leverage before you scale up.

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

16 hours ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

16 hours ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

16 hours ago -

Spot Forex vs Futures vs Options: What’s the Difference?

16 hours ago -

Major vs Minor vs Exotic Currency Pairs: Differences + Examples

16 hours ago

-

-

- News Releases & Scheduled Events That Override “Normal” Session Behavior

- High impact releases that move the most during London and New York

- What news does to spreads, volatility, and execution

- Pre news vs post news approaches

- Cross market events that can hijack “quiet” sessions

- Risk controls for news hours

-

- What are forex market hours?

- What time does the forex market open and close?

- What are the main forex trading sessions?

- What are the best times to trade forex?

- What are the worst times to trade forex?

- What are overlapping sessions, and why do they matter?

- Why do spreads widen at certain times?

- What is the daily forex rollover, and why does it matter?

- Does daylight saving time change session hours?

- Should you trade during major economic news releases?

- Which pairs move most in each session?

- How do you pick the right session for your strategy?

- How do you manage position size when volatility changes by session?

-

-

- News Releases & Scheduled Events That Override “Normal” Session Behavior

- High impact releases that move the most during London and New York

- What news does to spreads, volatility, and execution

- Pre news vs post news approaches

- Cross market events that can hijack “quiet” sessions

- Risk controls for news hours

-

- What are forex market hours?

- What time does the forex market open and close?

- What are the main forex trading sessions?

- What are the best times to trade forex?

- What are the worst times to trade forex?

- What are overlapping sessions, and why do they matter?

- Why do spreads widen at certain times?

- What is the daily forex rollover, and why does it matter?

- Does daylight saving time change session hours?

- Should you trade during major economic news releases?

- Which pairs move most in each session?

- How do you pick the right session for your strategy?

- How do you manage position size when volatility changes by session?

-

What Is Forex Trading? A Beginner’s Guide to How It Works

16 hours ago -

How Does the Forex Market Work? (Participants, Pricing & Execution)

16 hours ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

16 hours ago -

Spot Forex vs Futures vs Options: What’s the Difference?

16 hours ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

16 hours ago

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

16 hours ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

16 hours ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

16 hours ago -

Spot Forex vs Futures vs Options: What’s the Difference?

16 hours ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

16 hours ago