Pip Value Calculator Explained (Plus How to Calculate Pip Value by Pair)

Pip value tells you how much money you make or lose when price moves one pip. It depends on your pair, your position size, and your account currency. Get it wrong and your risk math breaks.

This guide explains pip value in plain terms, then shows you how to calculate it by pair. You will learn the pip size for most FX pairs, how lot size changes pip value, and why JPY pairs and cross pairs work differently. You will also see when a pip value calculator helps, and when you should run the numbers yourself. If you trade with margin, pip value links your stop loss to your real cash risk. Use it with a clear view of margin vs leverage.

Key Takeaways

Key Takeaways

- In het kort: Pip value converts price movement into real money, for your account currency.

- A standard pip is 0.0001 for most pairs, and 0.01 for JPY pairs.

- Lot size drives pip value. Double the lot, double the pip value.

- If your account currency matches the quote currency, pip value is direct and simple.

- If your account currency does not match the quote currency, you must convert the pip value using an exchange rate.

- JPY pairs often look different because the pip size changes. The logic stays the same.

- Cross pairs add a conversion step. Your platform rate at entry can differ from the rate at exit.

- A pip value calculator saves time when you trade many pairs or change lot size often.

- Run the numbers yourself when you set stops and targets. It keeps your risk tight.

- Pip value links your stop loss to cash risk. Margin and leverage do not change pip value, they change how much capital you need to hold the trade.

- Use pip value with position sizing so your risk stays consistent across pairs.

Pip Value Calculator Explained: What It Is and Why It Matters

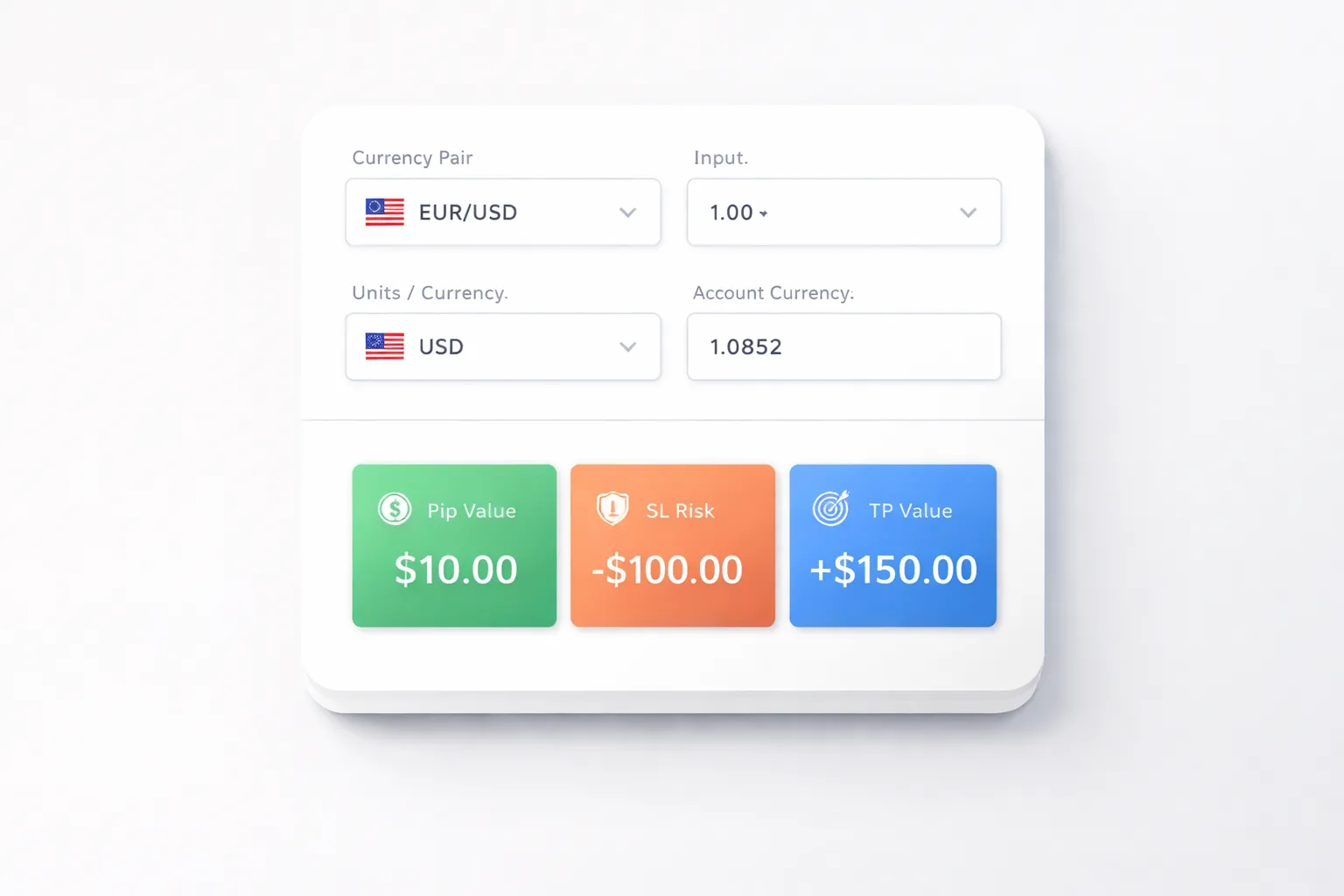

What a Pip Value Calculator Outputs

A pip value calculator converts price movement into money. It tells you what 1 pip costs or earns for your trade size.

- Per pip: Cash value of a 1 pip move for your position size.

- Per point, or pipette: Cash value of a 0.1 pip move on most pairs quoted to 5 decimals, or 3 decimals for JPY pairs.

- Per lot: Pip value for a standard lot (100,000 units), and often for mini (10,000) and micro (1,000) lots.

Good calculators also let you set account currency, pick the pair, and enter lot size. They then show the pip value in your account currency, not in the quote currency of the pair.

When You Rely on It Most

- Risk management: You tie your stop loss in pips to a fixed cash amount. Example, if your stop is 25 pips and pip value is $0.80, you risk about $20.

- Position sizing: You change lot size until the pip value makes your planned stop fit your risk limit.

- SL and TP planning: You check what your stop and target mean in dollars before you place the order. This helps you avoid trades where the cash risk is larger than you think.

You will use it more when you rotate between majors, minors, and exotics, because pip value shifts with the pair and the quote currency. If you need a refresher on pair types, see major vs minor vs exotic currency pairs.

Common Misconceptions

- Pip vs pipette: A pipette is one tenth of a pip. If your platform shows 1.23456, the last digit is the pipette. Your P and L still depends on the full pip move, but spreads and fills often move in pipettes.

- Pip value vs profit: Pip value is the money per pip. Profit depends on how many pips price moves after entry, direction, and your exit price. Pip value stays the same for a fixed pair, lot size, and account currency, but profit changes with outcome.

- Spread effects: The spread is a cost in pips that you pay at entry. Convert that spread to money using pip value. Example, a 1.2 pip spread with a $2.50 pip value costs about $3.00 per lot size used. This cost changes your break-even point, even if pip value does not.

Pips, Pipettes, Points, and Lot Sizes (Quick Foundations)

Pips vs Pipettes vs Points

A pip is the standard price step for most forex pairs.

- Most pairs (non-JPY): 1 pip = 0.0001. Example, EUR/USD moves from 1.0840 to 1.0841.

- JPY pairs: 1 pip = 0.01. Example, USD/JPY moves from 156.20 to 156.21.

A pipette is one tenth of a pip. Brokers show it as an extra decimal place to quote tighter spreads.

- Non-JPY pricing: 1 pipette = 0.00001.

- JPY pricing: 1 pipette = 0.001.

This changes what you see on your platform.

- EUR/USD from 1.08400 to 1.08423 is 2.3 pips, or 23 pipettes.

- USD/JPY from 156.200 to 156.236 is 3.6 pips, or 36 pipettes.

Many platforms also use the word point. In forex, a point usually means the smallest quoted step.

- If your broker quotes 5 decimals on EUR/USD, 1 point = 1 pipette.

- If your broker quotes 3 decimals on USD/JPY, 1 point = 1 pipette.

Lot Sizes and Why They Drive Pip Value

Pip value scales with your position size. Bigger lots mean each pip is worth more in money terms.

- Standard lot: 100,000 units of the base currency.

- Mini lot: 10,000 units.

- Micro lot: 1,000 units.

For most USD-quoted pairs where your account currency is USD, these are common pip values:

| Lot size | Units | Approx pip value on EUR/USD |

|---|---|---|

| Standard | 100,000 | $10.00 per pip |

| Mini | 10,000 | $1.00 per pip |

| Micro | 1,000 | $0.10 per pip |

CFDs may use different contract sizes. Always check the symbol specs. Your pip value comes from that contract size, not the name of the lot.

Lot size also ties into risk and margin. Read margin vs leverage if you want the clean rules.

Base Currency vs Quote Currency (Pair Anatomy)

Every forex pair has two parts.

- Base currency: the first currency in the pair.

- Quote currency: the second currency in the pair.

EUR/USD means 1 EUR priced in USD.

- If EUR/USD = 1.0840, then 1 EUR costs 1.0840 USD.

- A 1 pip move changes the price by 0.0001 USD per 1 EUR.

This matters for pip value.

- If your account currency matches the quote currency, pip value stays simple. Example, USD account trading EUR/USD.

- If your account currency does not match, you need a conversion rate to express pip value in your account currency.

How Pip Value Is Calculated (Core Formulas)

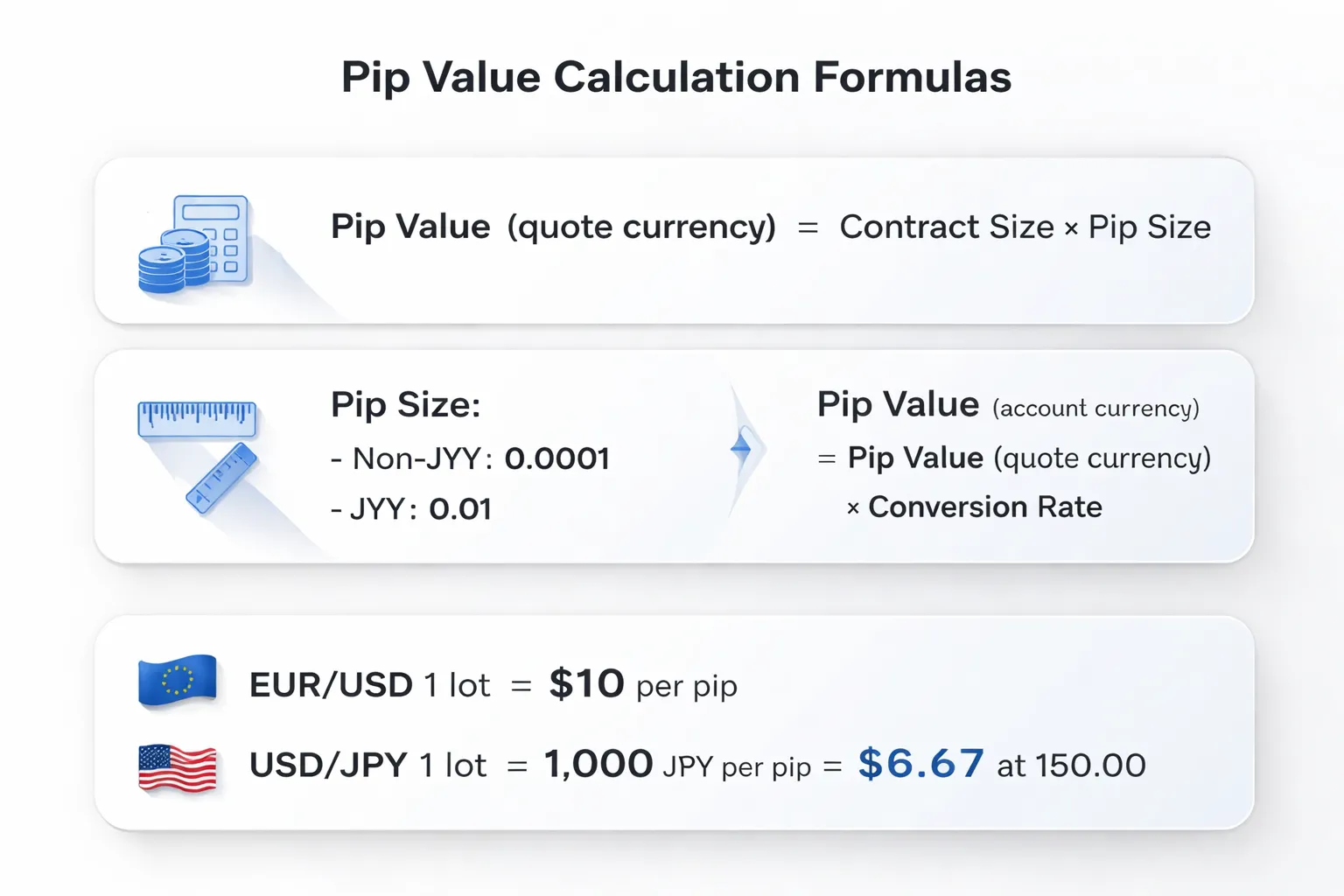

The core pip value formula

Pip value tells you how much money you gain or lose when price moves 1 pip.

Start with the value in the quote currency.

General formula (quote currency):

Pip Value = Contract Size × Pip Size

- Contract size is your position size in base currency units. Example, 100,000 units for 1 standard lot.

- Pip size is the pair’s pip increment. Most pairs use 0.0001. JPY pairs use 0.01.

Example, EUR/USD, 1 standard lot.

- Contract size = 100,000 EUR

- Pip size = 0.0001 USD per EUR

- Pip value = 100,000 × 0.0001 = 10 USD per pip

Pip size for JPY pairs vs non-JPY pairs

JPY pairs quote to two decimal places for the pip.

- Non-JPY pairs: pip size = 0.0001

- JPY pairs: pip size = 0.01

Example, USD/JPY, 1 standard lot.

- Contract size = 100,000 USD

- Pip size = 0.01 JPY per USD

- Pip value = 100,000 × 0.01 = 1,000 JPY per pip

Why account currency changes the final pip value

The formula above gives pip value in the quote currency.

If your account currency matches the quote currency, you stop there.

- USD account trading EUR/USD. Pip value comes out in USD. No conversion.

If your account currency does not match the quote currency, convert it.

Conversion step:

Pip Value (account currency) = Pip Value (quote currency) × Conversion Rate

- Use the rate that converts the quote currency into your account currency.

- Example, quote currency is JPY and your account is USD. Convert JPY to USD using USD/JPY.

Example, you calculated 1,000 JPY per pip on USD/JPY, but your account is USD.

- Conversion rate (JPY to USD) = 1 ÷ (USD/JPY price)

- If USD/JPY = 150.00, then 1 JPY = 1/150 USD

- Pip value = 1,000 × (1/150) = 6.67 USD per pip

If you need a refresher on pip sizes and pricing, see what pips are in forex.

How to Calculate Pip Value by Pair (Step-by-Step Examples)

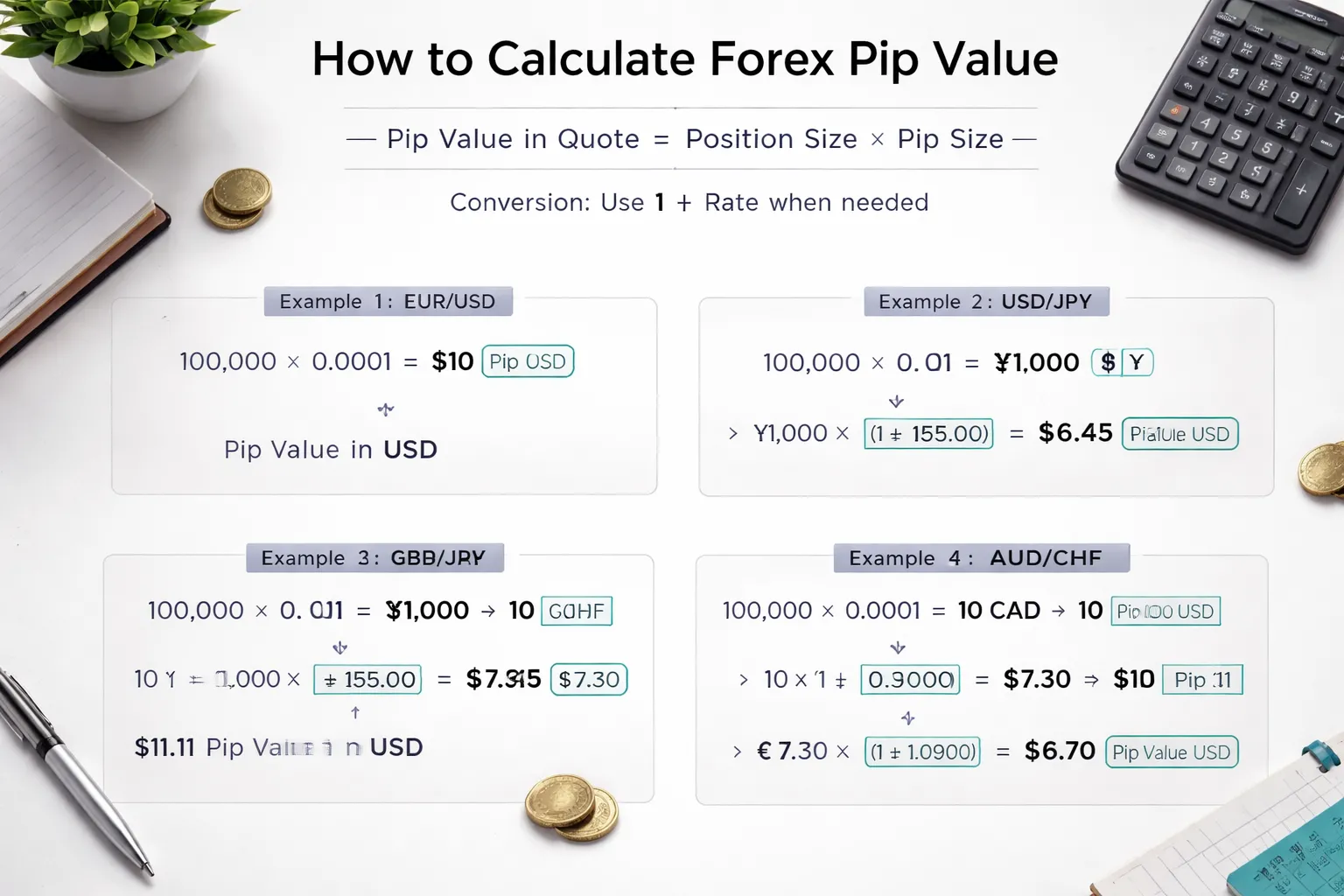

Example 1: EUR/USD pip value for 1 standard lot in a USD account

Assume you trade 1 standard lot, which is 100,000 units. If you need a refresher, see lot size in forex.

Pair: EUR/USD. Account currency: USD. Quote currency: USD.

Step 1, identify pip size. For most pairs, 1 pip = 0.0001.

Step 2, use the pip value formula when your account matches the quote currency.

Pip value = Position size × Pip size

Step 3, plug in the numbers.

- Position size = 100,000 EUR

- Pip size = 0.0001 USD per EUR

Pip value = 100,000 × 0.0001 = 10 USD per pip

Example 2: USD/JPY pip value and the special pip size handling

Pairs quoted in JPY use a different pip size.

Pair: USD/JPY. Account currency: USD. Quote currency: JPY.

Step 1, identify pip size. For JPY pairs, 1 pip = 0.01.

Step 2, calculate pip value in the quote currency (JPY).

Pip value in JPY = Position size × Pip size

- Position size = 100,000 USD

- Pip size = 0.01 JPY per USD

Pip value in JPY = 100,000 × 0.01 = 1,000 JPY per pip

Step 3, convert JPY pip value to your account currency (USD) using USD/JPY.

Pip value in USD = Pip value in JPY × (1 ÷ USD/JPY price)

- USD/JPY = 150.00

- 1 JPY = 1/150 USD

Pip value = 1,000 × (1/150) = 6.67 USD per pip

Example 3: GBP/CHF pip value in a USD account (quote-to-account conversion)

Here your quote currency does not match your account currency.

Pair: GBP/CHF. Account currency: USD. Quote currency: CHF.

Step 1, identify pip size. GBP/CHF uses 1 pip = 0.0001.

Step 2, calculate pip value in the quote currency (CHF).

Pip value in CHF = Position size × Pip size

- Position size = 100,000 GBP

- Pip size = 0.0001 CHF per GBP

Pip value in CHF = 100,000 × 0.0001 = 10 CHF per pip

Step 3, convert CHF to USD using USD/CHF.

Pip value in USD = Pip value in CHF × (1 ÷ USD/CHF price)

- USD/CHF = 0.90

- 1 CHF = 1/0.90 USD

Pip value = 10 × (1/0.90) = 11.11 USD per pip

Example 4: AUD/CAD pip value in an EUR account (two-step conversion workflow)

Here your quote currency is CAD and your account currency is EUR. You need a two-step conversion.

Pair: AUD/CAD. Account currency: EUR. Quote currency: CAD.

Step 1, identify pip size. AUD/CAD uses 1 pip = 0.0001.

Step 2, calculate pip value in the quote currency (CAD).

Pip value in CAD = Position size × Pip size

- Position size = 100,000 AUD

- Pip size = 0.0001 CAD per AUD

Pip value in CAD = 100,000 × 0.0001 = 10 CAD per pip

Step 3, convert CAD to USD using USD/CAD.

Pip value in USD = Pip value in CAD × (1 ÷ USD/CAD price)

- USD/CAD = 1.35

- 1 CAD = 1/1.35 USD

Pip value in USD = 10 × (1/1.35) = 7.41 USD per pip

Step 4, convert USD to EUR using EUR/USD.

Pip value in EUR = Pip value in USD ÷ (EUR/USD price)

- EUR/USD = 1.08

Pip value in EUR = 7.41 ÷ 1.08 = 6.86 EUR per pip

Quick reference checklist to calculate pip value for any pair

- Step 1: Set your position size in base units, for example 100,000 for 1 standard lot.

- Step 2: Set pip size, 0.0001 for most pairs, 0.01 for JPY pairs.

- Step 3: Calculate pip value in the quote currency, position size × pip size.

- Step 4: If quote currency equals your account currency, you are done.

- Step 5: If not, convert the quote currency pip value into your account currency using the relevant FX rate.

- Step 6: If you cannot convert in one rate, convert through USD as an intermediate.

Using a Pip Value Calculator Correctly (Inputs, Settings, and Interpretation)

Required Inputs for Accurate Pip Value

A pip value calculator only works if you enter the same variables your broker uses. Match the contract specs, the lot type, and your account currency.

- Currency pair: Select the exact pair you trade, like EUR/USD or GBP/JPY. Pip size changes on JPY pairs.

- Position size: Enter units or lot size. Use the same definition as your platform.

- Lot type: Standard, mini, micro, or units. This changes the result by 10x or 100x.

- Account currency: USD, EUR, GBP, etc. This decides whether the calculator must convert the pip value.

- Current rate: Use a live mid price when possible. If the calculator pulls its own price feed, verify it matches your broker.

- Pip definition: 0.0001 for most pairs, 0.01 for JPY pairs. Some calculators also show pipettes, which are one tenth of a pip.

Inputs and Settings, What Each One Changes

- Pair: Sets the pip size and the quote currency. Example, EUR/USD pip value starts in USD, USD/CHF pip value starts in CHF.

- Units or lots: Sets exposure. Double the position size, double the pip value.

- Account currency: Forces conversion when your account currency is not the quote currency.

- Rate source: Controls the conversion step. A small rate difference changes results, which matters on large size or tight stops.

- Contract size setting: Some calculators let you choose 100,000 per lot, 10,000, or 1,000. Match your broker’s lot definition.

Where Traders Go Wrong

- Wrong lot type: You enter 1 lot but the calculator assumes mini lots, or you enter 1 thinking it means 1,000 units. Your pip value can be off by 10x to 100x.

- Misread decimals: You treat a pipette as a pip. If the platform quotes 1.08543, the last digit is a pipette. Ten pipettes equal one pip.

- JPY pip size mistake: You use 0.0001 on USD/JPY instead of 0.01. This breaks risk sizing fast.

- Stale price feed: The calculator uses an old rate. Conversion pairs move, especially in fast markets. Update the price before you size a trade.

- Ignoring account currency conversion: You read the pip value in the quote currency and assume it is in your account currency. Confirm the final currency shown.

Interpreting Results for SL and TP Planning

Separate two numbers. Pip value tells you cost per pip. Total risk tells you what you lose if your stop hits.

- Pip value: Money gained or lost for a 1 pip move at your position size, in your account currency if conversion is applied.

- Total risk at stop loss: pip value × stop distance in pips.

- Total reward at take profit: pip value × target distance in pips.

| Item | Formula | What it tells you |

|---|---|---|

| Pip value | Value of 1 pip at your size | Cost per pip movement |

| Stop loss risk | Pip value × SL pips | Money at risk on the trade |

| Take profit value | Pip value × TP pips | Money you target to make |

Use pip value to set position size, then check margin requirements. Pip value and margin are different. Review margin vs leverage if you size trades close to your available funds.

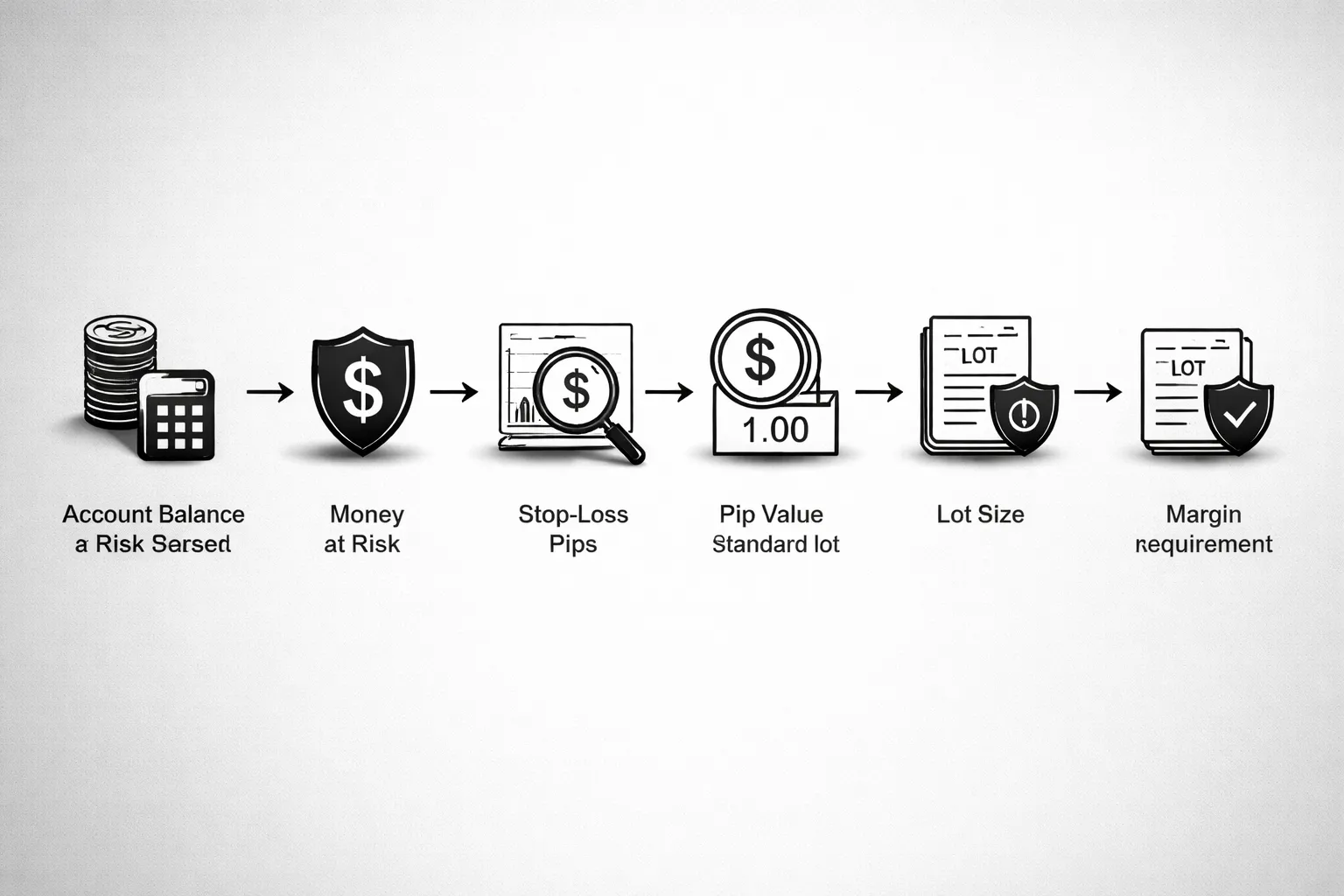

From Pip Value to Position Size (Practical Risk Management)

Convert risk per trade into position size

You size the trade from your stop loss. You do not size it from a gut feel.

Use this sequence:

- Step 1, set account risk in money. Account balance × risk % = money at risk.

- Step 2, convert stop loss to money per lot. Pip value per 1 lot × stop loss pips = risk per 1 lot.

- Step 3, solve for lot size. Money at risk ÷ risk per 1 lot = lot size.

Formula:

Lot size = (Account balance × Risk %) ÷ (Stop loss pips × Pip value per 1 lot)

If your pip value is already for a mini lot or micro lot, keep the units consistent. Do not mix pip value per 1 lot with a different lot unit.

Worked example, 1% risk with a 35 pip stop loss

Assume these inputs:

- Account balance: $10,000

- Risk per trade: 1%

- Stop loss: 35 pips

- Pip value for 1 standard lot on the pair: $10 per pip

Step by step:

- Money at risk = 10,000 × 0.01 = $100

- Risk per 1 lot = 35 × 10 = $350

- Lot size = 100 ÷ 350 = 0.2857 lots

Round to what your broker allows. Example: 0.29 lots. That equals 2.9 mini lots or 29 micro lots.

Quick check:

- Pip value at 0.29 lots = 10 × 0.29 = $2.90 per pip

- Stop loss risk = 35 × 2.90 = $101.50

Your rounding changed the risk. If you need tighter control, round down instead of up.

Leverage and margin, what they change and what they do not

Pip value comes from position size and the pair’s price mechanics. Leverage does not change pip value.

Margin is the deposit your broker requires to open the position. Leverage changes margin. Higher leverage lowers required margin. Lower leverage raises it.

Keep the separation clear:

- Position size controls your $ per pip and your stop loss risk.

- Leverage controls how much margin you must post for that position size.

- Margin level controls whether you can hold the trade without a margin call.

Process to avoid surprises:

- Size the trade from risk and stop loss.

- Calculate required margin for that lot size at your leverage.

- If margin is too high, reduce lot size. Do not widen the stop just to fit margin.

If you want the mechanics behind spot FX positions and contract sizing, read what is forex trading.

Pip Value in Different Markets (What Competitors Often Skip)

Gold (XAU/USD) and Indices: “Pip” Often Means “Point”

Outside spot FX, many platforms still say “pip”, but the product trades in points.

For gold and indices, your P and L depends on contract specs. You need three inputs:

- Minimum price increment, often called tick size or point value.

- Contract multiplier, how much one contract pays per 1.0 move.

- Quote currency and conversion, if your account currency differs.

Gold example logic. If XAU/USD ticks in 0.01 and your CFD multiplier is $1 per 1.00 move, then 0.01 equals $0.01 per contract. If your multiplier is $100 per 1.00 move, then 0.01 equals $1 per contract. Same chart, different pip value.

Index example logic. If an index trades in 1.0 point steps and your contract pays $1 per point, then each point is $1 per contract. If your broker offers $5 per point, each point is $5. Your “pip” is whatever your platform defines as the smallest step, then multiplied by the contract spec.

Cryptos and CFDs: Tick Size, Multiplier, and Platform Conventions

Crypto CFDs add one more problem. Symbols look similar, but sizing differs.

- Tick size can be 0.01, 0.1, or 1.0, depending on the broker and instrument.

- Contract multiplier may be 1 coin, 0.1 coin, or a fixed cash value per 1.0 move.

- Lot definition may be “1 lot = 1 BTC” or “1 lot = 1 contract” with its own multiplier.

Practical rule. Stop thinking in pips. Think in cash per tick.

Calculation you can use on any CFD:

- Value per tick = tick size × contract multiplier × number of lots

If your account currency differs from the quote currency, convert that tick value at the current FX rate. Your pip value calculator should do this step. If it does not, your risk will drift when the conversion rate moves.

Broker Differences: Fractional Pricing, Contract Size, and Symbol Formats

Two brokers can show the same price and give you different pip values. Check the spec sheet.

- Fractional pricing. One platform quotes EUR/USD to 5 decimals, another to 4. That changes how it labels a “pip” versus a “pipette”. Your cash risk stays tied to the true 0.0001 move, not the extra digit.

- Contract size variations. FX often uses 100,000 base units per lot, but some brokers offer mini lots as default, or use “1 lot” as 10,000. CFDs vary even more. Do not assume.

- Symbol formats. You might see XAUUSD, GOLD, XAUUSDm, US30, US30.cash, GER40, DE40, BTCUSD, BTCUSD.s. Suffixes often signal a different contract spec.

Do this before you trust any pip value:

- Open the instrument’s contract details.

- Confirm tick size and contract multiplier.

- Confirm lot size definition.

- Confirm your account currency conversion method.

Spreads change your effective entry and stop level, so they change your real cash risk. If you have not modeled that yet, read what is spread in forex.

Pros, Cons, and Limitations of Pip Value Calculators

Pros of Pip Value Calculators

- Speed. You get a cash-per-pip number in seconds. This helps when you screen many pairs and position sizes.

- Consistency. You apply the same math every time. You reduce variance from “mental math” and rushed decisions.

- Fewer manual errors. You avoid common mistakes like wrong lot type, wrong quote currency, or a missed decimal.

- Quick what-if sizing. You can change lot size, account currency, and pair to see how risk shifts before you place the trade.

Cons and Limitations

- Many calculators ignore spread and commissions. They output pip value, not your full trading cost. Your real loss can exceed your stop if you size without costs.

- They assume clean fills. Slippage can add or remove pips, especially around news and session opens. That changes your realized cash risk.

- Fast markets break assumptions. When liquidity thins, spreads widen and stops can fill worse than expected. The calculator stays static.

- FX rates move. If your account currency differs from the quote currency, pip value depends on the live conversion rate. A calculator uses the current snapshot, not the rate you will get at execution.

- Broker specs differ. Contract size, tick size, and lot definitions vary across brokers and CFDs. If the inputs do not match your instrument, the output is wrong.

- It does not cover overnight costs. Swap can matter on multi-day trades. Factor it in with forex swap fees.

Best Practice: Pair Pip Value With All-in Cost and Scenarios

- Compute all-in risk. Start with pip value, then add spread cost and commissions in your account currency.

- Stress test your fills. Run scenarios for slippage, such as 0.5 pip, 1 pip, and 2 pips worse than expected. Use the worst case for sizing when volatility rises.

- Recheck conversion rates. If you trade cross pairs or your account currency differs, refresh the rate before execution and again after the fill.

- Validate contract specs. If your pip value looks “off,” stop. Reconfirm tick size, contract multiplier, and lot size for that exact symbol.

Best Practices and Pro Tips for Accurate Pip Value Calculations

Use Mid-Price for Planning, Use Bid and Ask for Execution

Use the mid-price when you plan risk and position size. Mid-price gives a stable estimate and keeps your math consistent.

Use bid and ask when you execute. Your fill hits the bid when you sell and the ask when you buy. This changes the conversion rate and your pip value in account currency on cross pairs.

- Planning: mid-price is fine for sizing and stop distance.

- Execution: use the side you will trade, bid for sell, ask for buy.

- Post-trade: reconcile with your actual fill price and the conversion rate at the time.

Build a Personal Pip Value Cheat Sheet

Build a short table for the pairs you trade most and the lot sizes you actually use. Keep it next to your sizing rules. Update it when your broker changes symbol specs.

| Pair Type | Lot Size | What to Record |

|---|---|---|

| Major (USD is quote) | 0.10, 0.50, 1.00 | Pip value in your account currency at a typical price |

| Major (USD is base) | 0.10, 0.50, 1.00 | Pip value after converting from quote currency to account currency |

| Cross pair | 0.10, 0.50, 1.00 | Pip value using the exact conversion pair you will rely on |

| JPY quote pairs | 0.10, 0.50, 1.00 | Pip size used by your symbol, 0.01 or fractional pips |

- Store two numbers per pair, pip value at 0.10 lot and at 1.00 lot. Scale from there.

- Store the conversion pair you used, like EURGBP with GBPUSD for a USD account.

- Write the symbol name your broker uses, including any suffix.

Double-Check JPY Pairs and Non-USD Quote Currencies

Most pip mistakes come from pip size and currency conversion.

- JPY pairs: most use 0.01 as one pip, not 0.0001. Confirm whether your platform shows fractional pips as 0.001.

- Gold and indices: your broker may label ticks as pips. Check tick size and contract multiplier before you trust any pip value.

- Non-USD quote currencies: you must convert the quote currency pip value into your account currency. Use the live conversion rate, then recheck after the fill.

- Account currency differences: a EUR account trading USDJPY needs a different conversion than a USD account trading USDJPY.

If you trade with high leverage, small pip value errors can push risk past your limit and raise the odds of liquidation. Review your exposure rules alongside margin call vs stop out.

Validate Inside Your Platform Before You Place the Trade

Your platform can confirm the pip value it will use for margin and P&L.

- MT4: check the symbol specification fields in the contract specs, then confirm value changes in the trade panel when you change volume.

- MT5: open the symbol specification window and review tick size, tick value, and contract size. Compare against your calculator output.

- cTrader: use the trade ticket values and symbol details. Confirm pip value updates when you change lots.

- Match three inputs, symbol, lot size, account currency.

- Match three specs, pip size, contract size, conversion rate.

- Stop if any value changes when it should not. Fix the spec mismatch first.

FAQ

What is pip value?

Pip value is the money your profit or loss changes when price moves by 1 pip. It depends on the pair, your lot size, and your account currency. Pip value can change with the exchange rate when your account currency differs from the quote currency.

What is a pip vs a pipette?

A pip is the standard price step for most FX pairs, usually 0.0001. A pipette is one extra decimal place, usually 0.00001. On JPY pairs, a pip is usually 0.01 and a pipette is 0.001.

How do I calculate pip value for pairs quoted in my account currency?

If your account currency matches the quote currency, use: pip value = pip size × contract size × lots. Example for EURUSD in USD account: 0.0001 × 100,000 × 1 = 10 USD per pip.

How do I calculate pip value when my account currency is different?

First calculate pip value in the quote currency: pip size × contract size × lots. Then convert that amount into your account currency using the current conversion rate. Your pip value will move as that conversion rate moves.

Why does pip value change while my lot size stays the same?

Your lot size stays fixed, but the conversion rate can change. This happens when your account currency does not match the quote currency. Cross pairs and non-USD accounts see this often. Refresh your calculator inputs using the latest rates.

Is pip value the same as tick value?

No. A pip is a Forex convention. A tick is the platform’s minimum price step for any instrument. Some brokers set tick size equal to a pip, others use pipettes. For CFDs, tick value often matters more than pip value.

What contract size should I use?

Use your broker’s symbol specification. Spot FX often uses 100,000 units for 1 standard lot, 10,000 for 1 mini, 1,000 for 1 micro. Some brokers use different sizes for metals and index CFDs. Contract size drives pip value.

What is the pip value formula by pair type?

- Quote = account currency: pip size × contract size × lots.

- Account currency differs: (pip size × contract size × lots) × conversion rate.

- JPY pairs: use pip size 0.01 instead of 0.0001.

Does leverage change pip value?

No. Leverage changes margin, not pip value. Pip value depends on pip size, contract size, lot size, and currency conversion. Your P and L per pip stays the same even if your required margin changes.

Why does my calculator not match MT4 or MT5?

Check three inputs, symbol, lots, account currency. Then check three specs, pip size, contract size, conversion rate. MT4 and MT5 can display tick value, not pip value. Fix the spec mismatch first, then retest.

How does pip value affect position sizing?

You use pip value to convert your stop loss in pips into money risk. Risk per trade = stop pips × pip value × lots. If you size positions by risk, keep pip value updated before you place the trade.

Related: position sizing in forex.

Conclusion

Conclusion

Pip value turns pips into money. You need it to size trades, set stops, and compare risk across pairs.

- Update inputs first. Confirm pair, account currency, lot size, and current price.

- Match pip rules. Most pairs use 0.0001, JPY pairs use 0.01. Use points only if your platform does.

- Convert when needed. If your quote currency differs from your account currency, apply the correct conversion rate.

- Size by risk. Risk per trade = stop pips × pip value × lots. Solve for lots before you place the order.

Final tip. Save pip value for your most traded pairs at your standard lot sizes, then recheck after large price moves or account currency changes. If your margin use looks off after resizing, review margin vs leverage.

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

1 day ago -

What Are Pips in Forex? Definition, Examples & Why They Matter

1 day ago -

Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

1 day ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

1 day ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

1 day ago

-

- Example 1: EUR/USD pip value for 1 standard lot in a USD account

- Example 2: USD/JPY pip value and the special pip size handling

- Example 3: GBP/CHF pip value in a USD account (quote-to-account conversion)

- Example 4: AUD/CAD pip value in an EUR account (two-step conversion workflow)

- Quick reference checklist to calculate pip value for any pair

-

- What is pip value?

- What is a pip vs a pipette?

- How do I calculate pip value for pairs quoted in my account currency?

- How do I calculate pip value when my account currency is different?

- Why does pip value change while my lot size stays the same?

- Is pip value the same as tick value?

- What contract size should I use?

- What is the pip value formula by pair type?

- Does leverage change pip value?

- Why does my calculator not match MT4 or MT5?

- How does pip value affect position sizing?

-

- Example 1: EUR/USD pip value for 1 standard lot in a USD account

- Example 2: USD/JPY pip value and the special pip size handling

- Example 3: GBP/CHF pip value in a USD account (quote-to-account conversion)

- Example 4: AUD/CAD pip value in an EUR account (two-step conversion workflow)

- Quick reference checklist to calculate pip value for any pair

-

- What is pip value?

- What is a pip vs a pipette?

- How do I calculate pip value for pairs quoted in my account currency?

- How do I calculate pip value when my account currency is different?

- Why does pip value change while my lot size stays the same?

- Is pip value the same as tick value?

- What contract size should I use?

- What is the pip value formula by pair type?

- Does leverage change pip value?

- Why does my calculator not match MT4 or MT5?

- How does pip value affect position sizing?

-

What Is Forex Trading? A Beginner’s Guide to How It Works

1 day ago -

How Does the Forex Market Work? (Participants, Pricing & Execution)

1 day ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

1 day ago -

Spot Forex vs Futures vs Options: What’s the Difference?

1 day ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

1 day ago

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

1 day ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

1 day ago -

What Are Pips in Forex? Definition, Examples & Why They Matter

1 day ago -

Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

1 day ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

1 day ago