Spread vs Commission: Which Forex Account Type Is Cheaper?

Trading costs decide your break-even point. In forex, most of that cost comes from two pricing models, spread-only and commission-based. Brokers market both as “cheap,” but the cheaper option depends on your trade size, frequency, and the pair you trade.

This guide breaks down each model in plain numbers. You will learn what you pay per trade, how to convert spreads and commissions into the same dollar cost, and where the common “1 pip equals X” shortcuts fail. You will also see when a wider spread beats a commission account, and when tight raw spreads plus a commission win.

If you want the full menu of charges beyond spreads and commissions, read our forex broker fees explained guide.

Key Takeaways

Key Takeaways

- In het kort: Compare accounts in dollars per round turn, not in pips.

- In het kort: All-in cost equals spread cost plus commission, based on your position size.

- In het kort: The “1 pip rule” breaks when your lot size, quote currency, or pair changes.

- In het kort: A wider spread can be cheaper if the commission is high or you trade small size.

- In het kort: Raw spreads plus a commission usually win when you trade larger size or trade often.

- In het kort: Use average spreads, not minimum spreads, and include both sides of the commission.

- In het kort: Check the full fee stack, swaps and non-trading fees can beat spread differences.

Use one formula for every broker. Compute the all-in cost per trade, then compare accounts on the same trade size and the same pair.

Convert everything to cash. Spread cost depends on pip value, pip value depends on your lot size and the pair. Commission is already cash, but you must count both sides.

Do not rely on shortcuts. “1 pip equals $10” only holds for a standard lot on pairs quoted in USD. Change any input and the dollar cost changes.

Look at how you trade. If you trade small tickets, the commission can dominate the total cost. If you scalp or trade high volume, the tighter raw spread often offsets the commission.

Use realistic inputs. Use the broker’s average spread during your trading hours, not the advertised minimum. Add any per-lot minimum commission and any markups on raw spreads.

Cost is not only spread and commission. If you hold positions overnight, swaps can matter more than the entry cost. For the full list, see our forex broker fees explained guide.

Spread vs Commission Forex Fees Explained: The Two Main Pricing Models

How spread-only pricing is embedded into the quote

In a spread-only account, the broker charges you inside the bid and ask price you see.

If EUR/USD shows 1.10000 and 1.10010, the spread is 1.0 pip. You pay that cost when you enter. If you buy, you start 1.0 pip down. If you sell, you start 1.0 pip down.

The broker can widen or tighten that spread based on liquidity, volatility, and your trading hours. This is why the average spread matters more than the minimum spread on the marketing page.

How commission-based (RAW, ECN-style) pricing adds per-side fees

In a commission account, the broker shows you a tighter, often near-market spread. Then it adds a separate commission per trade.

Commission usually charges per side. You pay once to open, and once to close.

- Example: $3.50 per side per lot on EUR/USD, $7.00 round turn.

- Plus spread: raw spread might average 0.2 pips during your hours.

To compare apples to apples, convert commission into pips.

- On a standard lot, 1 pip on EUR/USD is about $10.

- $7.00 round turn is about 0.7 pips.

- Total average cost becomes 0.2 + 0.7 = 0.9 pips.

Also check minimum commissions and lot-size rules. Some brokers charge a minimum ticket fee. That makes small trades expensive.

Common account labels brokers use and what they usually mean

- Standard: spread-only. Wider spreads. No separate commission.

- Raw, Razor, Zero, ECN: tight spreads plus commission. The name varies by broker.

- Pro, VIP: either lower spreads or lower commission, often with higher deposit requirements.

- Micro, Cent: small contract sizes. Pricing can include wider spreads and minimum commissions.

Labels do not guarantee execution quality. Brokers can call an account “ECN” while still adding markups. If you want the execution-side differences, see our ECN vs STP vs market maker broker guide.

Typical misconceptions about “zero spread” marketing

- “Zero spread” does not mean zero cost. The broker often charges commission, or it widens the spread outside ideal conditions.

- “From 0.0 pips” describes the best moment, not your average. Your real cost depends on your trading hours and market moves.

- Raw spread can still include a markup. Some brokers add 0.1 to 0.3 pips and still call it raw.

- Commission can vary by instrument. Metals, indices, and exotics may have different rates and different pip values.

| Pricing model | What you see | What you pay | Best for |

|---|---|---|---|

| Spread-only | Wider spread, no commission line item | All cost in the spread | Simple pricing, larger trade sizes, fewer tickets |

| Raw spread + commission | Tight spread plus commission per side | Spread + round-turn commission | Active trading, scalping, cost tracking |

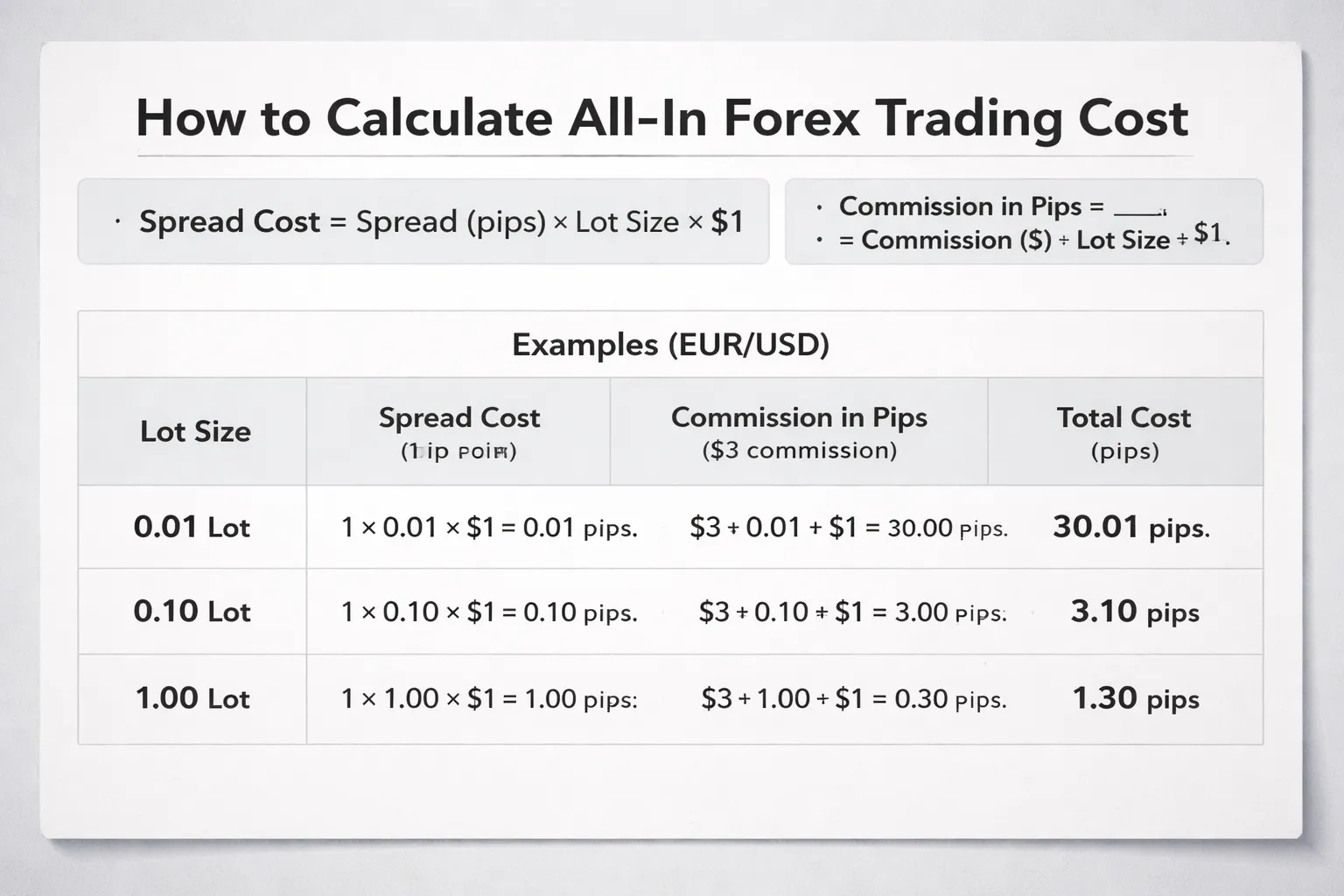

How to Calculate Your True All-In Forex Trading Cost

Turning spread into dollars, pip value basics by lot size

You pay the spread in pips. Your platform converts that into money based on your position size and the pair’s pip value.

For most USD-quoted pairs like EUR/USD, one pip is 0.0001 and the pip value is simple.

- 1.00 lot (100,000), about $10 per pip

- 0.10 lot (10,000), about $1 per pip

- 0.01 lot (1,000), about $0.10 per pip

Spread cost formula for these pairs: Spread cost ($) = spread (pips) x pip value ($/pip).

Example: a 1.2 pip spread on 0.10 lot is about 1.2 x $1 = $1.20.

Converting commission into pips for apples-to-apples comparison

To compare account types, convert commission into “pip cost” and add it to the spread.

Commission in pips formula: Commission (pips) = round-turn commission ($) / pip value ($/pip).

All-in cost in pips formula: All-in (pips) = spread (pips) + commission (pips).

All-in cost in dollars formula: All-in ($) = all-in (pips) x pip value ($/pip).

Round-turn vs per-side commission and why it matters

Brokers quote commission in two common ways.

- Per-side, you pay when you open and when you close.

- Round-turn, you pay one combined number for open plus close.

Use the same basis before you compare.

- If a broker shows $3.50 per side, your round-turn commission is $7.00.

- If a broker shows $7.00 round-turn, do not double it again.

If you mix them up, you will understate or overstate your true cost by 2x.

Worked examples for 0.01, 0.10, and 1.00 lot trade sizes

Assume EUR/USD. Spread-only account spread is 1.2 pips. Raw account spread is 0.2 pips plus commission $3.50 per side, so $7.00 round-turn.

| Lot size | Pip value (approx) | Spread-only cost | Raw + commission cost | Raw all-in (pips) |

|---|---|---|---|---|

| 0.01 | $0.10 per pip | 1.2 pips x $0.10 = $0.12 | (0.2 pips x $0.10) + $7.00 = $7.02 | $7.00 / $0.10 = 70.0 pips, 70.0 + 0.2 = 70.2 |

| 0.10 | $1.00 per pip | 1.2 pips x $1.00 = $1.20 | (0.2 pips x $1.00) + $7.00 = $7.20 | $7.00 / $1.00 = 7.0 pips, 7.0 + 0.2 = 7.2 |

| 1.00 | $10.00 per pip | 1.2 pips x $10.00 = $12.00 | (0.2 pips x $10.00) + $7.00 = $9.00 | $7.00 / $10.00 = 0.7 pips, 0.7 + 0.2 = 0.9 |

Key takeaway: commission-based pricing punishes very small trade sizes, because commission does not shrink the way spread cost does. If you want a wider view of other charges that can change your all-in cost, see our forex broker fees breakdown.

Which Is Cheaper by Trading Style (Scalping, Day Trading, Swing, Position)

Your trading style decides which pricing model hurts less. Entry cost is spread or spread plus commission. Holding cost is swap. The shorter you hold, the more entry cost matters.

High-frequency and scalping, when tight spreads usually win

Scalping turns costs into your main enemy. You enter and exit often. You need the lowest all-in spread you can get.

- Commission accounts usually win when the raw spread stays near zero on your pair and your trade size is at least 0.10 lots.

- Spread-only accounts often lose because a 1.0 to 1.5 pip typical spread is hard to overcome when targets are small.

- Watch the minimum commission. If the broker charges a fixed minimum per side, small scalps get crushed.

- Trade majors. EUR/USD and USD/JPY tend to show the clearest advantage for raw spread pricing.

| Scalper priority | Cheaper more often | Why |

|---|---|---|

| Lowest all-in spread | Commission-based | Raw spreads can stay tight during liquid hours |

| Very small size, micro-lots | Spread-only | Commission does not shrink smoothly at tiny sizes |

Intraday trading, balancing average spread stability and commissions

Day trading still cares about entry cost, but you take fewer trades than a scalper. You can choose either model, based on your pair and session.

- Commission accounts fit if you trade liquid sessions and want consistent pricing on majors.

- Spread-only fits if your broker offers a stable typical spread and you trade smaller sizes.

- Use typical spread, not minimum spread. Your real cost comes from the average you see during your trading hours.

- News spikes change the math. Raw spreads can widen fast, and commission stays on top of it.

Swing and longer holds, when swaps outweigh entry costs

When you hold for days or weeks, swap can beat your entry cost. A 0.3 to 0.8 pip difference at entry matters less than paying or earning swap every night.

- Pick by swap first. Compare long and short swap rates on your pair.

- Then pick by execution. Slippage on entries and exits can outweigh a small spread advantage.

- Commission vs spread matters least if you trade low frequency and aim for larger moves.

If you want the wider picture on swaps, commissions, and other line items that change your all-in cost, see our forex broker fees breakdown.

Small accounts and micro-lots, when commissions can become disproportionate

Small sizes change everything. Spread cost scales down with your lot size. Commission often does not scale cleanly, especially near broker minimums.

- Micro-lot trading often favors spread-only. You pay a small spread in dollars, and you avoid per-side commission minimums.

- Commission accounts can still work if the broker charges true pro-rated commission with no minimum, and you trade liquid pairs.

- Check your break-even size. Find the lot size where spread-only cost equals commission all-in cost, then trade above it if you want raw pricing.

| Trading style | Cheaper account type most often | What to check |

|---|---|---|

| Scalping | Commission-based | All-in spread during your hours, commission minimums, slippage |

| Day trading | Depends | Typical spread vs raw spread plus commission across sessions |

| Swing trading | Depends, swaps decide | Swap rates, triple swap day, execution quality |

| Position trading | Depends, swaps decide | Swap and financing terms, not the entry spread |

| Micro-lots, small accounts | Spread-only | Commission minimums, pro-rating rules, effective cost per $1k |

Pair Selection and Market Conditions: Why Your Instrument Choice Changes the Cheapest Account

Major vs Minor vs Exotic Pairs: Your Base Spread Changes the Math

Cost comparisons break fast when you switch instruments.

Majors like EUR/USD and USD/JPY usually carry the tightest raw spreads. A commission account often wins here because the spread starts near zero and your all-in cost stays low and predictable.

Minors and many crosses start with a wider natural spread. Your broker cannot compress it as much. The commission becomes a smaller part of your total cost, so the gap between account types shrinks.

Exotics often show the biggest spreads and the worst liquidity. On these pairs, the spread dominates. A cheaper commission rate rarely offsets a wide market spread and higher slippage risk.

- Majors: commission-based accounts often look cheapest on paper and in live fills.

- Minors: expect wider spreads, your commission matters less.

- Exotics: spread cost drives the result, focus on execution quality and stability.

Crosses and Wider Natural Spreads: When Commission Matters Less

Crosses like GBP/JPY, EUR/GBP, and AUD/NZD usually price through two legs and thinner liquidity than EUR/USD. That structure pushes the spread wider even on good brokers.

When the baseline spread is already large, a fixed per-lot commission becomes a smaller percentage of your cost. Your cheapest account can flip from commission to spread-only depending on the broker’s markup policy.

| Pair type | Typical spread behavior | Impact of commission | What to compare |

|---|---|---|---|

| Major | Often tight, stable in liquid hours | High impact, can decide the winner | All-in cost in pips during your trading hours |

| Minor, cross | Naturally wider, more variable | Lower relative impact | Spread distribution, not just the minimum |

| Exotic | Wide, can jump and gap | Often minor vs spread and slippage | Typical spread plus slippage on market orders |

Time-of-Day Effects: Spreads Follow Liquidity

Your cheapest account depends on when you trade.

Spreads usually compress during the London and New York overlap. They often widen during the late US session and early Asia session. They also widen around daily rollover and at weekly open and close.

- High liquidity hours: raw spreads tighten, commission accounts tend to look better.

- Low liquidity hours: spreads widen, the commission difference matters less, execution quality matters more.

- Rollover window: spreads can spike, your average cost can jump even if your commission stays fixed.

Run your cost test at the hours you actually trade. Do not use a broker’s best-case spread screenshot.

Volatility Regimes: Your “Average Cost” Shifts Month to Month

Costs change with volatility.

In calm markets, spreads sit near their typical levels. Commission accounts can produce a clean, low all-in number.

In high volatility, spreads widen and slip increases. Your realized cost can rise fast, even if the posted average spread looks fine.

- Calm regime: spread differences and commission rates drive the decision.

- Volatile regime: spread spikes and slippage can dominate, especially on crosses and exotics.

- News windows: compare worst-case fill costs, not just typical costs.

If you want to understand which broker setup fits your pair list and execution needs, read our guide on ECN vs STP vs market maker brokers.

Account Type Comparison Checklist: What to Verify Before You Choose

Compare Average Spreads, Not Minimums

Ignore marketing spreads like “from 0.0.” You pay the spread you get most of the time.

- Find the average spread for your main pairs across normal hours. Use the broker’s historical spread statistics if they publish them.

- Cross-check with independent trackers when possible. Verify the same account type and the same symbol naming.

- Check session behavior. Compare London and New York overlap vs rollover. A low average with frequent spikes can cost more than a higher, stable average.

- Record your pairs. Costs can flip between EURUSD, indices, gold, and crosses.

Confirm the Commission Details, No Gaps

- Rate. Get the exact amount.

- Currency. USD, EUR, GBP, or account currency. A “$7” commission can change after conversion.

- Per-side or round-turn. “$3.50 per side” equals “$7 round-turn” for the same lot size.

- Lot definition. Confirm what “1.00 lot” means for that symbol. Forex usually means 100,000 base units, but CFDs vary.

- Applies to which instruments. Some brokers charge commission on FX only, others on metals, indices, or crypto CFDs too.

| Item | What you need in writing |

|---|---|

| Commission amount | Numeric rate, no “from” wording |

| Charge basis | Per-side or round-turn |

| Volume basis | Per lot, per 100k, or per 1M |

| Commission currency | Billing currency and conversion rule |

| Instrument scope | Exact symbols or asset classes covered |

Check Minimum Trade Size, Step Size, and Commission Minimums

Your sizing rules change your effective costs.

- Minimum trade size. 0.01, 0.1, or 1.0 lot makes a big difference for small accounts.

- Step size. If you can only increase by 0.1 lots, you lose precision in risk control.

- Commission minimum. Some brokers set a minimum commission per ticket. This can punish small trades even if the headline rate looks low.

- Partial closes. Ask if the broker charges commission again on partial closes, and how they round volume.

Review Non-Trading Fees That Change Your Net Cost

- Deposit fees. Card fees and third-party payment fees can exceed a month of spread savings.

- Withdrawal fees. Check fixed fees, free withdrawal limits, and bank wire charges.

- Inactivity fees. Confirm the trigger time and the monthly amount.

- Platform fees. Some brokers charge for certain platforms, data, or “premium” features.

- Currency conversion fees. Funding and withdrawals in a different currency can add hidden cost.

If you want a complete list of line items to check, use our forex broker fees guide.

Validate Contract Specs, Pip Size, Tick Value, and Symbol-Level Pricing

You cannot compare costs if the contract specs differ.

- Pip size. Confirm 0.0001 vs 0.00001 pricing on majors, and 0.01 vs 0.001 on JPY pairs.

- Tick size and tick value. Costs and slippage scale with tick value, not your opinion of “tight.”

- Contract size per symbol. Metals and indices often use different lot sizes than FX.

- Symbol-level fee differences. Some brokers apply different spreads, commissions, or markups by pair, session, or instrument type.

- Execution rules. Confirm if the broker uses last look, requotes, or minimum distance rules on stops, since these change real fill cost.

Pros and Cons of Spread-Only vs Commission-Based Accounts

When spread-only pricing stays simpler and can cost less

Spread-only accounts bundle the broker’s charge into the spread. You pay once, when you enter. That makes your cost easy to see on the ticket.

- You place fewer trades. Lower frequency means you feel the spread less. A small difference in average spread matters less when you trade less.

- You trade small sizes. Many brokers scale commissions by lot. With micro-lots, some minimum commission rules can lift your effective cost.

- You hold trades longer. For multi-hour or multi-day trades, a slightly wider spread often matters less than swaps and slippage.

- You need simple accounting. One all-in number per trade helps if you track costs manually.

- Your broker’s spread is truly stable. Some brokers keep major pairs tight most of the day. In that case, “spread-only” can match or beat raw spread plus commission.

When commission-based pricing improves transparency and strategy fit

Commission-based accounts split costs into raw spread plus a stated commission. You see the fee line item. You can compare brokers faster.

- You scalp or day trade. Tight raw spreads can reduce break-even distance. That matters when targets are small.

- You trade during liquid sessions. Raw spreads tend to compress in peak hours. Your average all-in cost can drop.

- You trade majors. Commission models often price EUR/USD, USD/JPY, GBP/USD, AUD/USD more competitively than spread-only accounts.

- You benchmark execution. When the commission stays fixed per lot, you can isolate spread and slippage as execution quality signals.

- You run systematic rules. Strategy testing works better when you can model a stable commission and then stress-test spreads separately.

Risk trade-offs, cost predictability vs variable spreads

Neither model guarantees low cost. Your real cost depends on spread behavior, commission rules, and fills.

- Spread-only risk. The spread can hide markups that change by symbol and session. News can widen it fast. Your “all-in” cost becomes a moving target.

- Commission-based risk. The commission looks fixed, but raw spreads can spike. Some brokers also charge per side, per lot, and in account currency, so your effective cost changes with FX conversion.

- Minimums and tiers. Watch for minimum ticket commissions, “from” spreads, and volume tiers that you will not reach.

- Stop and limit fills. Wider spreads and fast widening can trigger stops sooner. Slippage can dominate both models in volatile markets.

If you want a complete checklist of charges beyond spreads and commissions, including swaps and non-trading fees, read forex broker fees explained.

Who should avoid each model based on behavior and constraints

- Avoid spread-only if you scalp, trade around news, or trade many tickets per day. Small spread differences compound fast. Widening spreads can erase edge.

- Avoid spread-only if the broker advertises “fixed” but applies frequent exceptions. Check the fine print for session rules and instrument exclusions.

- Avoid commission-based if you trade very small sizes and face minimum commissions. Your effective cost per pip can jump.

- Avoid commission-based if you cannot track per-side fees and conversions. Poor tracking leads to wrong expectancy and wrong position sizing.

- Avoid either model if your broker uses restrictions that distort fills. Last look, requotes, stop distance rules, and partial fills can matter more than the pricing label.

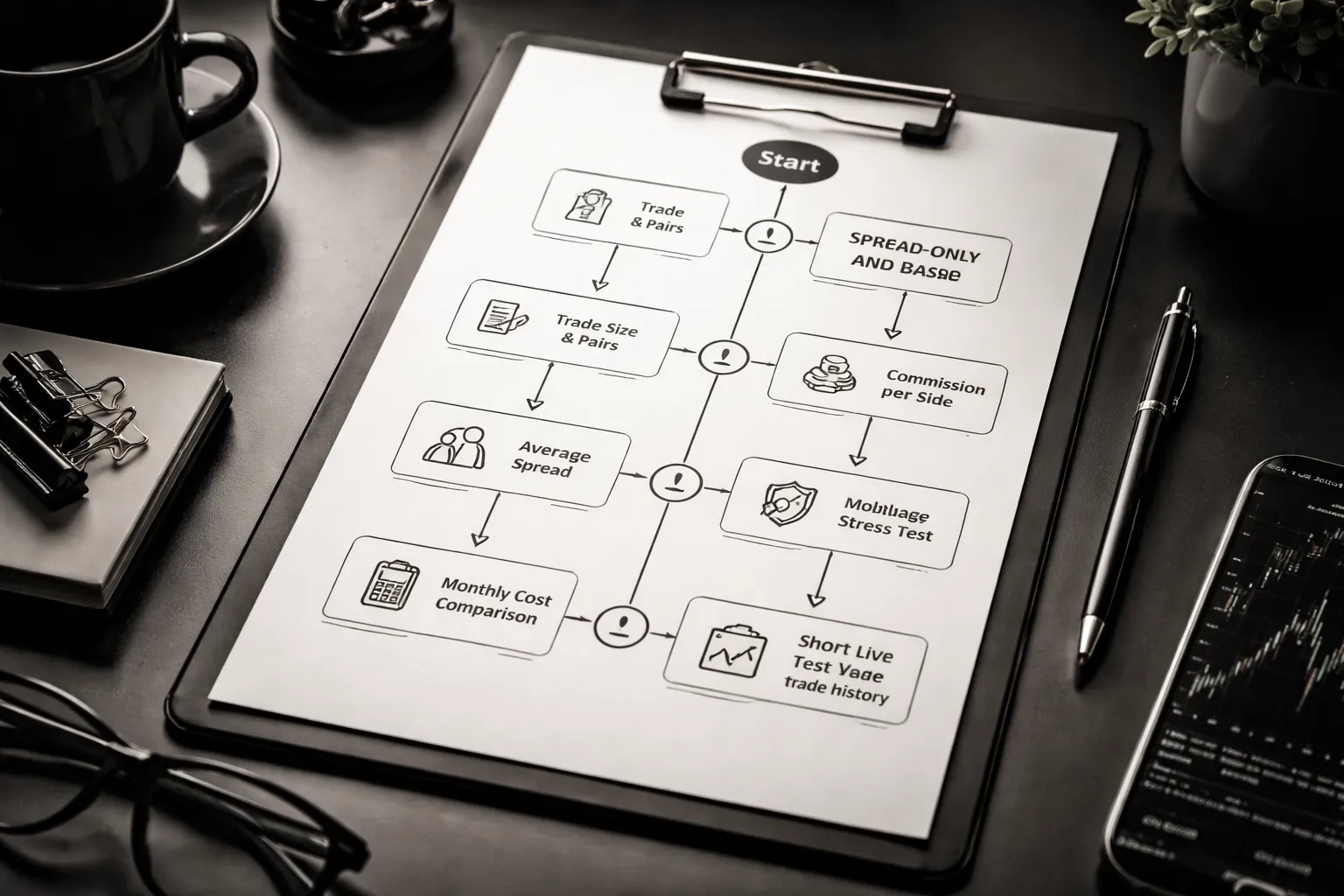

Practical Decision Framework: Choose the Cheaper Forex Account Type in 5 Minutes

Step 1: Define your typical trade size, frequency, and pairs

Write down your real trading profile. Use what you actually trade, not what you plan to trade.

- Account currency: USD, EUR, GBP, or other.

- Typical position size: lots per trade, average and max.

- Trades per month: count round turns, open plus close.

- Pairs you trade: list your top 3 to 5 pairs.

- Session and holding time: London, New York, Asia, scalps, intraday, swing.

- Order types: market, limit, stop. Note how often you use each.

Keep this simple. Your cost model depends on size, pair, and how often you cross the spread.

Step 2: Compute expected all-in cost per trade using your real inputs

Compare both account types using one unit. Use cost in pips and in your account currency.

- Spread-only account cost per round turn: spread in pips.

- Commission account cost per round turn: raw spread in pips + commission converted to pips.

Use this conversion for commissions:

- Commission in pips (round turn) = commission per round turn in account currency ÷ value of 1 pip for your position size.

| Input | What to pull from your broker | What you fill in |

|---|---|---|

| Spread-only spread | Average spread for your pair during your trading hours | X.X pips |

| Commission raw spread | Average raw spread for your pair during your trading hours | X.X pips |

| Commission fee | Commission per side per lot, plus any minimums | $X per side |

| Pip value | Your platform pip value for your exact size | $X per pip |

| All-in cost | Spread-only, raw plus commission | X.X pips and $X |

Rules that prevent bad math:

- Use average spread during your session, not the minimum.

- Use round-turn commission, open plus close.

- Convert everything to cost per round turn for one trade.

- If you trade small sizes, check for minimum commission. It can crush the commission account.

Step 3: Stress-test with widened spreads and realistic slippage assumptions

Your backtest cost is not your live cost. Stress-test both models with worse conditions.

- Widen spreads: add 0.2 to 1.0 pips to your average, based on your pair and session.

- Add slippage: assume 0.1 to 0.5 pips per side for market orders on liquid majors, more on crosses and news.

- Separate entry and exit: slippage can hit both sides. Treat it as a round-turn cost.

Then recompute all-in cost. If the “cheaper” account only wins in perfect conditions, it is not cheaper.

Step 4: Evaluate monthly totals and break-even points between account types

Turn per-trade cost into a monthly number. This makes the decision obvious.

- Monthly cost = all-in cost per trade in account currency × round turns per month.

- Break-even happens when spread-only monthly cost equals commission account monthly cost.

| Item | Spread-only | Commission-based |

|---|---|---|

| All-in cost per round turn | $X | $Y |

| Round turns per month | N | N |

| Estimated monthly cost | $X × N | $Y × N |

| Winner at your volume | Yes or No | Yes or No |

Also check non-spread costs that change the result:

- Swap and financing: important for swing trades, less for scalps.

- Deposit and withdrawal fees: can dominate costs for small accounts.

- Execution rules: last look, requotes, stop distance rules, and partial fills can erase a small pricing edge. If you need help mapping models to execution, see ECN vs STP vs market maker brokers.

Step 5: Run a short live test and compare realized costs in the trade history

Paper math helps. Live fills decide. Run a controlled test for each account type.

- Trade the same pair, same size, same session.

- Place at least 20 round turns. More if you scalp or trade news.

- Use the same order type mix. Do not change behavior to “fit” the account.

- Export your history. Capture spread at entry and exit, commission, and net P and L.

Compute realized cost per trade:

- Realized all-in cost = commissions paid + spread cost embedded in fills + slippage impact.

Pick the account that gives you the lowest realized cost at your size and frequency, with stable execution. If the data looks noisy, extend the test until the difference stays consistent.

FAQ

Is a commission account always cheaper than a spread-only account?

No. It depends on your pair, trade size, and execution. Compare all-in cost per trade using your fills. Add commission paid, spread paid at entry and exit, and slippage. The cheapest account is the one with the lowest realized cost, not the lowest advertised spread.

How do I calculate all-in trading cost in pips?

Convert commission to pips, then add the spread you actually paid. Formula: all-in pips = realized spread in pips + (round-turn commission in dollars / pip value per lot). Use your trade history, not the broker’s “from” spread.

What is a “round-turn” commission?

It is the total commission for opening and closing a trade. Brokers may quote “per side” commission. Double it to get round-turn. Example: $3.50 per side becomes $7.00 round-turn per standard lot.

Do spreads widen on commission accounts too?

Yes. Commission pricing does not lock the spread. Spreads still widen during news, rollovers, and low-liquidity hours. Your all-in cost rises even if commission stays fixed. Measure realized spread during your trading hours.

Which account is better for scalping and high-frequency trading?

Usually commission-based accounts win on majors if execution stays stable. You need tight realized spreads and low slippage. A spread-only account can still be cheaper if the broker internalizes flow well and gives consistent fills at your size.

Which account is better for small accounts and micro-lots?

Often spread-only accounts. Some commission accounts apply minimum ticket fees or round commission in ways that inflate cost on tiny sizes. Check the broker’s commission schedule for micro-lots and calculate cost on your typical trade size.

Are “zero spread” accounts really zero cost?

No. You still pay commission, and you may pay through slippage and wider spreads outside peak liquidity. Treat “zero” as a marketing label. Confirm the average realized spread and your round-turn commission from live fills.

Does leverage change spread or commission costs?

Leverage does not change the broker’s pricing. It changes your position size and risk, which changes your dollar cost per trade. If you trade larger lots because of leverage, you pay more total spread and more total commission.

How can I test account types without risking money?

Use a demo, then validate with a small live sample because spreads and slippage differ. Track entry and exit prices, time, pair, size, commission, and net P and L. Use a forex demo account to build the workflow before going live.

What matters more than spread vs commission?

Execution quality. A wider average spread can be cheaper than a tight spread with frequent slippage and rejects. Focus on realized all-in cost, fill speed, and consistency during your trading hours and around the events you trade.

Do swaps and overnight fees affect the spread vs commission decision?

Yes for swing and position trading. Swap can dwarf spread and commission over multi-day holds. Compare accounts on the same instrument for swap rates and triple-swap days. For intraday trading, swap often matters less.

Conclusion

Conclusion

Spread and commission pricing can land at the same total cost. Your cost depends on your lot size, your trade frequency, the pairs you trade, and when you trade.

Use one number to compare accounts, the all-in cost per round turn. Convert everything to pips or to your account currency. Include average spread, commission both sides, and swap if you hold overnight.

- If you scalp or trade high frequency: prioritize tight effective spreads, low commission, fast execution, and low slippage. Test during your real trading hours.

- If you day trade: compare average all-in cost across your main pairs, then verify it holds through the sessions you trade.

- If you swing or position trade: put swap on the table first. A bad swap rate can beat any spread or commission advantage over several days.

Final tip. Run a two-week side-by-side test on the same pairs and the same hours. Track realized spread, commissions, slippage, and swap. Pick the account with the lowest consistent all-in cost, not the best advertised number. If the broker’s pricing and policies look unclear, use a practical broker checklist before you fund the account.

-

- Step 1: Define your typical trade size, frequency, and pairs

- Step 2: Compute expected all-in cost per trade using your real inputs

- Step 3: Stress-test with widened spreads and realistic slippage assumptions

- Step 4: Evaluate monthly totals and break-even points between account types

- Step 5: Run a short live test and compare realized costs in the trade history

-

- Is a commission account always cheaper than a spread-only account?

- How do I calculate all-in trading cost in pips?

- What is a “round-turn” commission?

- Do spreads widen on commission accounts too?

- Which account is better for scalping and high-frequency trading?

- Which account is better for small accounts and micro-lots?

- Are “zero spread” accounts really zero cost?

- Does leverage change spread or commission costs?

- How can I test account types without risking money?

- What matters more than spread vs commission?

- Do swaps and overnight fees affect the spread vs commission decision?

-

- Step 1: Define your typical trade size, frequency, and pairs

- Step 2: Compute expected all-in cost per trade using your real inputs

- Step 3: Stress-test with widened spreads and realistic slippage assumptions

- Step 4: Evaluate monthly totals and break-even points between account types

- Step 5: Run a short live test and compare realized costs in the trade history

-

- Is a commission account always cheaper than a spread-only account?

- How do I calculate all-in trading cost in pips?

- What is a “round-turn” commission?

- Do spreads widen on commission accounts too?

- Which account is better for scalping and high-frequency trading?

- Which account is better for small accounts and micro-lots?

- Are “zero spread” accounts really zero cost?

- Does leverage change spread or commission costs?

- How can I test account types without risking money?

- What matters more than spread vs commission?

- Do swaps and overnight fees affect the spread vs commission decision?

-

Forex Lot Size Calculator: How to Use It to Size Trades Correctly

2 days ago -

How to Calculate Position Size in Forex (Position Sizing Formula + Examples)

2 days ago -

Forex Leverage Explained: How It Works, Pros, Cons & Examples

2 days ago -

Margin vs Leverage in Forex: What’s the Difference?

2 days ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

1 week ago

-

What Is a Lot Size in Forex? Lot Types + Quick Examples

1 week ago -

Forex Leverage Explained: How It Works, Pros, Cons & Examples

2 days ago -

What Are Pips in Forex? Definition, Examples & Why They Matter

1 week ago -

How Does the Forex Market Work? (Participants, Pricing & Execution)

1 week ago -

Forex Lot Size Calculator: How to Use It to Size Trades Correctly

2 days ago