Forex Leverage Explained: How It Works, Pros, Cons & Examples

Leverage lets you control a larger forex position with a smaller deposit called margin. It can boost gains, it can also multiply losses fast. Many retail traders lose money when leverage sits behind every tick.

This guide explains how forex leverage works, how margin ties into your trade size, and how to calculate leverage with clear numbers. You will see simple examples, including how a 1% move can hit your account at 30:1 or 100:1. You will also learn the main pros and cons, key risk controls, and how leverage connects to pips, spreads, and liquidation rules.

If you want to understand liquidation thresholds, read our margin call vs stop out guide.

Key Takeaways

In het kort:

- Leverage lets you control a larger position with a smaller margin deposit.

- Your profit and loss scale with the full position size, not your deposit.

- At 30:1 leverage, a 1% move in price can mean about a 30% change in your margin value.

- At 100:1 leverage, a 1% move can mean about a 100% change in your margin value.

- Margin level drives liquidation risk. If it falls below your broker’s thresholds, you face a margin call or stop out.

- Spreads and fees hit harder with leverage, because costs apply to the full trade size.

- Use hard limits. Smaller position sizes, conservative leverage, and pre-set stops reduce blowups.

- Market structure matters. Thin liquidity and fast moves can trigger slippage and faster liquidations. Read our Forex liquidity guide.

What Is Forex Leverage (Plain-English Definition)

What forex leverage means

Forex leverage lets you control a larger trade size than your cash balance would allow. Your broker sets a leverage ratio, like 30:1 or 50:1. That ratio determines how much margin you must set aside to open and hold a position.

Leverage does not change the market. It changes your position size. Your profit and loss then swing based on the full trade size, not your deposit.

Why leverage exists in FX markets

- FX prices move in small percentages most days. Major pairs often move well under 1% in a session. Without leverage, many short-term strategies would produce small dollar gains and losses.

- Capital efficiency matters. Leverage lets you post a smaller amount of cash as margin, and keep the rest available for other trades or as a buffer against drawdowns.

- It supports hedging and active risk control. Many participants size positions to manage exposure precisely. Margin-based trading makes that easier than fully funding every position.

Leverage vs. margin vs. borrowed funds

Traders mix these terms. Keep them separate.

- Leverage is the ratio between your position’s notional value and the margin you post. Example, 30:1 leverage means you can control $30 of notional with $1 of margin.

- Margin is the deposit your broker locks as collateral for the trade. It is not a fee. You get it back when you close the position, unless losses reduce it.

- Borrowed funds is a loose way to describe leverage. In spot FX and CFDs, you usually do not receive a cash loan in your account. You receive exposure, backed by margin, and your P&L is marked to market.

Think of margin as your good-faith deposit and leverage as the multiplier that turns that deposit into market exposure.

Key terms you must know

- Notional value, the full size of your position. Formula, lots x contract size x price. Example, 1 standard lot of EUR/USD is 100,000 EUR, roughly $100,000 notional when EUR/USD is near 1.00.

- Margin, the amount your broker requires to open or maintain that notional exposure. Formula, notional value divided by leverage. Example, $100,000 notional at 50:1 needs about $2,000 margin.

- Equity, your account balance plus unrealized P&L. Equity moves tick by tick as price changes.

- Free margin, equity minus used margin. This is your buffer before a margin call. When free margin hits zero, you are at the edge.

- Margin level, a safety ratio brokers use for margin calls and stop outs. Formula, equity divided by used margin, then multiplied by 100. Higher is safer. When it drops to your broker’s threshold, forced reductions start.

| Term | What it tells you | Simple formula |

|---|---|---|

| Notional value | How big your market exposure is | Position size x price |

| Used margin | How much collateral is locked | Notional ÷ leverage |

| Equity | What your account is worth right now | Balance + unrealized P&L |

| Free margin | How much room you have before trouble | Equity − used margin |

| Margin level | How close you are to margin call or stop out | (Equity ÷ used margin) x 100 |

Liquidity conditions can change how fast you hit these thresholds. Thin liquidity increases spreads and slippage, which cuts equity faster. See our Forex liquidity guide.

How Forex Leverage Works Step by Step

From deposit to trade, what happens when you open a leveraged position

1) You deposit funds. This is your account balance.

2) You choose a position size in lots. This sets the trade’s notional value.

3) Your broker checks margin requirement for that pair and size.

4) When you open the trade, the broker locks part of your equity as used margin.

5) The rest stays as free margin. You use it to absorb losses and open other trades.

6) Your trade starts with a small loss because you pay the spread.

7) Your equity updates in real time as price moves and costs accrue.

Key point: leverage does not change the market move. It changes how much notional exposure you control with a smaller margin deposit.

How P&L is calculated on notional size, not on your margin

Your profit and loss comes from the full position size. It does not come from the margin you posted.

- Notional value = position size x price.

- P&L = price move x position size, converted into your account currency.

Example: You buy 1 standard lot of EUR/USD (100,000 EUR). A 10 pip move is about $100 when USD is the quote currency. That is true whether your margin for the trade is $500 or $5,000. Only your free margin and risk of liquidation changes.

What changes when price moves against you, equity and usable margin dynamics

Losses reduce equity first. Used margin usually stays the same while the position is open.

- Balance stays fixed until you close the trade.

- Unrealized P&L moves with price.

- Equity = balance + unrealized P&L.

- Free margin = equity − used margin.

- Margin level = (equity ÷ used margin) x 100.

As price moves against you, free margin shrinks. Your margin level drops. At a broker-set threshold you hit a margin call or stop out, which can force position reductions or closures. Read our margin call vs stop out guide for the typical levels and mechanics.

How swaps, rollover, and spreads interact with leveraged positions

Leverage magnifies how much these costs matter because they hit your equity while your notional stays large.

- Spread: you pay it at entry. Wider spreads mean an instant larger unrealized loss and lower equity.

- Commission: if your account charges it, it reduces equity when applied.

- Swap or rollover: you pay or earn it each day you hold the position past the broker’s cutoff time. Negative swap reduces equity over time, even if price does not move.

- Weekend and holiday effects: many brokers apply triple swap on one day to account for non-settlement days.

Track these costs like you track price risk. With tight free margin, a spread widening event or a swap charge can push margin level through your broker’s limits.

Leverage Ratios and Margin Requirements (And How to Convert Them)

Reading Leverage Ratios (2:1, 10:1, 30:1, 100:1)

A leverage ratio shows how much position size you control with your margin.

- 2:1 leverage, you post 50% margin. A $10,000 position needs $5,000 margin.

- 10:1 leverage, you post 10% margin. A $10,000 position needs $1,000 margin.

- 30:1 leverage, you post 3.33% margin. A $10,000 position needs about $333.33 margin.

- 100:1 leverage, you post 1% margin. A $10,000 position needs $100 margin.

Higher leverage reduces required margin. It does not reduce risk. Price moves hit the full position size.

Margin Requirement Formula and Quick Conversions

Use one conversion. Keep it consistent.

- Margin requirement (%) = 1 / leverage

- Leverage = 1 / margin requirement (decimal)

Quick conversions you will see on broker platforms:

- 50:1 = 2% margin

- 33.3:1 = 3% margin

- 30:1 = 3.33% margin

- 25:1 = 4% margin

- 20:1 = 5% margin

- 10:1 = 10% margin

- 5:1 = 20% margin

- 2:1 = 50% margin

- 100:1 = 1% margin

- 200:1 = 0.5% margin

- 500:1 = 0.2% margin

Margin in money terms depends on position size and account currency. Platform calculators usually handle the currency conversion for you.

| Position size | Leverage | Margin % | Margin needed |

|---|---|---|---|

| $100,000 | 30:1 | 3.33% | $3,333.33 |

| $100,000 | 50:1 | 2% | $2,000 |

| $100,000 | 100:1 | 1% | $1,000 |

Broker vs. Regulator Limits (Why Your Leverage Differs by Region)

Your broker can advertise high leverage, but your account may not get it.

- Regulators cap retail leverage in many regions. Your maximum leverage depends on where you live and which legal entity holds your account.

- Broker risk rules can be stricter than regulation. A broker may lower leverage on smaller accounts, new accounts, or specific instruments.

- Different account types can change limits. Professional classification can raise available leverage, but it usually reduces protections.

Do not assume your leverage from marketing pages. Check the margin rate shown in your platform for the exact symbol you trade.

Instrument-Based Margin (Majors vs. Minors vs. Exotics)

Leverage is not one number. Brokers set margin by instrument because volatility and liquidity differ.

- Major pairs often get the lowest margin requirements.

- Minor pairs often need more margin than majors.

- Exotic pairs often need much more margin. Spreads can be wider and gaps can be larger. Review your spread costs before you size up.

Many brokers also change margin by conditions:

- News margin, brokers may raise margin before high-impact releases. Your free margin can drop even if price does not move.

- Weekend and holiday margin, brokers may raise margin before market close to reduce gap risk. This matters if you hold positions past cutoff times.

- Concentrated exposure margin, brokers may increase margin if you stack positions in the same currency or direction.

Plan for margin changes. If you run tight free margin, a margin hike can trigger liquidation without a large price move.

How to Calculate Forex Leverage, Position Size, and Pip Value

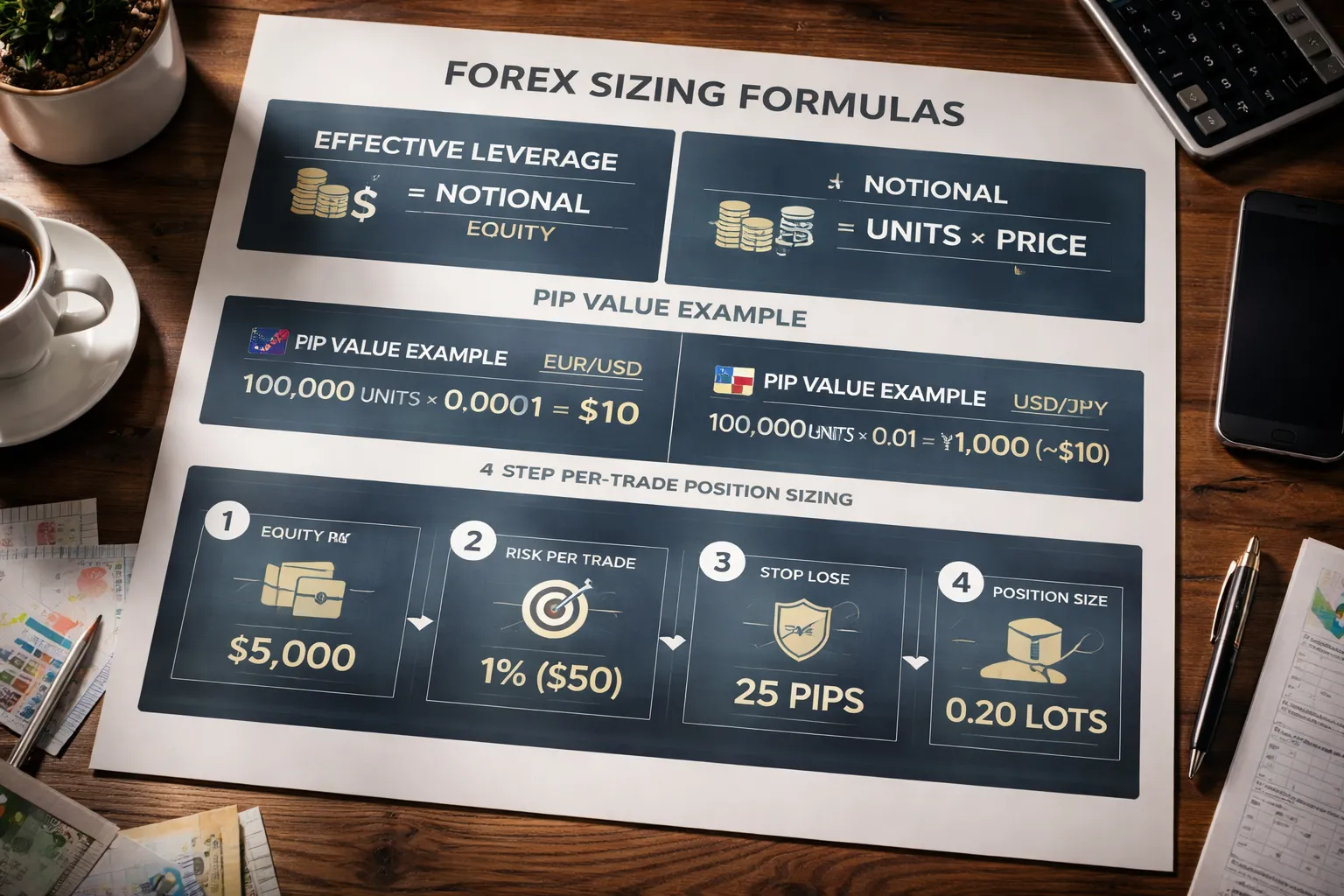

Effective leverage vs. maximum leverage

Maximum leverage is what your broker allows, like 1:30 or 1:500. It sets your minimum margin. It does not tell you how much risk you take.

Effective leverage is what you actually use. It drives your drawdowns and margin pressure.

Effective leverage formula: Effective leverage = Total notional exposure, divided by Account equity.

- If you hold $50,000 notional on a $5,000 account, your effective leverage is 10:1.

- If your broker offers 1:500, but you only use 10:1, you still trade with 10:1 risk exposure.

Track effective leverage across all open positions. It climbs fast when you stack trades in the same direction.

How to calculate notional position size (lots, units, price)

Your notional position size is the face value of the trade in the quote currency.

Notional formula: Notional = Units, times Current price.

- Standard lot: 100,000 units of base currency.

- Mini lot: 10,000 units.

- Micro lot: 1,000 units.

Example, you buy 1 standard lot EUR/USD at 1.1000.

- Units = 100,000 EUR.

- Notional = 100,000 x 1.1000 = $110,000.

If you need a quick refresher on lot sizes, use this guide on lot size in forex.

Pip value basics (USD quote pairs and non-USD quote currencies)

Pip value tells you how much money you gain or lose per pip move.

Most pairs use a pip size of 0.0001. JPY pairs use 0.01.

General pip value formula in quote currency: Pip value = Units, times Pip size.

Case 1, USD is the quote currency (EUR/USD, GBP/USD, AUD/USD):

- For 100,000 units, pip value = 100,000 x 0.0001 = $10 per pip.

- For 10,000 units, pip value = 10,000 x 0.0001 = $1 per pip.

Case 2, USD is not the quote currency (EUR/GBP, GBP/JPY):

First calculate pip value in the quote currency, then convert to USD using the current USD exchange rate for that quote currency.

- EUR/GBP, 100,000 units: pip value in GBP = 100,000 x 0.0001 = 10 GBP per pip. If GBP/USD = 1.2500, pip value in USD = 10 x 1.2500 = $12.50 per pip.

- USD/JPY, 100,000 units: pip value in JPY = 100,000 x 0.01 = 1,000 JPY per pip. Convert to USD by dividing by USD/JPY. If USD/JPY = 150.00, pip value in USD = 1,000 / 150.00 = $6.67 per pip.

Use this approach for any quote currency. Compute pip value in the quote currency, then convert to your account currency.

A simple risk-per-trade sizing method (percent risk and stop-loss distance)

This method sizes your position from your risk limit, not from your maximum leverage.

Step 1, set risk per trade: Risk dollars = Account equity, times Risk percent.

Example, equity $5,000 and risk 1 percent. Risk dollars = 5,000 x 0.01 = $50.

Step 2, define your stop loss in pips: Use a fixed invalidation level. Measure the distance in pips.

Example, stop loss distance = 25 pips.

Step 3, compute allowed pip value: Allowed $ per pip = Risk dollars, divided by Stop pips.

- Allowed $ per pip = 50 / 25 = $2 per pip.

Step 4, convert allowed pip value to position size:

- If the pair is EUR/USD, 1 mini lot is about $1 per pip, 1 standard lot is about $10 per pip.

- To target $2 per pip, you trade about 2 mini lots, or 0.20 standard lots, or 20,000 units.

Sanity check: Calculate your notional and effective leverage after sizing. If effective leverage looks high for your strategy, cut size.

Forex Leverage Examples (Worked Scenarios)

Example 1: 30:1 leverage on EUR/USD with a $1,000 account (profit and loss outcomes)

Account equity: $1,000.

Max notional at 30:1: $1,000 x 30 = $30,000.

Trade size: 30,000 EUR/USD units, about 0.30 lots.

Approx pip value: $3 per pip (since 0.10 lot is about $1 per pip on EUR/USD).

Margin used: $30,000 / 30 = $1,000.

- If price moves +10 pips: +10 x $3 = +$30, about +3% on your account.

- If price moves -10 pips: -10 x $3 = -$30, about -3% on your account.

- If price moves -50 pips: -50 x $3 = -$150, about -15% on your account.

Key point. Leverage magnifies results because your position is large versus your equity.

Example 2: Same account, different stop-loss size, how risk changes without changing leverage

Keep the same leverage cap and the same position size.

Account equity: $1,000.

Leverage used: 30:1.

Position: 30,000 units. Pip value about $3.

| Stop size | Risk in pips | Risk in $ | Risk as % of $1,000 |

|---|---|---|---|

| Tight stop | 10 pips | $3 x 10 = $30 | 3% |

| Wide stop | 50 pips | $3 x 50 = $150 | 15% |

Key point. Leverage stayed the same. Your risk changed because your stop distance changed.

Example 3: High leverage with small position sizing (why leverage doesn’t force high risk)

Assume your broker offers 500:1. You do not need to use it.

Account equity: $1,000.

Position: 10,000 units (0.10 lot).

Notional: about $10,000.

Effective leverage used: $10,000 / $1,000 = 10:1.

Margin used at 500:1: $10,000 / 500 = $20.

Pip value: about $1 per pip.

- 20 pip stop: risk is about $20, or 2%.

- 50 pip stop: risk is about $50, or 5%.

Key point. High available leverage only lowers required margin. Your position size and stop-loss set your real risk.

Example 4: Gap and slippage scenario (why stop-losses aren’t guaranteed in fast markets)

You buy EUR/USD with a stop-loss 20 pips away. You expect to lose 20 pips if the stop hits.

Account equity: $1,000.

Position: 20,000 units (0.20 lots). Pip value about $2.

Planned risk: 20 pips x $2 = $40 (4%).

Now price moves fast on news. Liquidity thins. Your stop triggers, but the fill comes 35 pips worse than your stop price.

- Actual loss: (20 + 35) = 55 pips x $2 = $110 (11%).

Key point. Your stop sets intent, not a guarantee. Slippage can turn a controlled loss into a larger one. Read more in our slippage guide.

Pros of Using Leverage in Forex

Capital efficiency

Leverage lets you control more notional value with less cash. You post margin, not the full position size.

Example. You buy 1 standard lot (100,000 units) in EUR/USD at 1.1000. Notional value is $110,000. With 30:1 leverage, required margin is about $3,667.

- Lower cash outlay. You can participate without tying up your full account balance.

- More room for risk controls. You can size positions based on your stop distance and risk per trade, while keeping extra cash as a buffer against drawdowns and margin swings.

- Cleaner allocation. You can separate trading capital from reserve cash, instead of forcing all funds into a single position.

Flexibility for hedging and portfolio management

Leverage makes hedging practical because you can open offsetting exposure without needing to fully fund both legs.

- Reduce net currency exposure. You can cut directional risk during events while keeping the trade structure in place.

- Manage correlation risk. You can trim or add exposure across USD, JPY, or CHF pairs without rebuilding your whole book.

- Keep liquidity. You can adjust positions fast, while leaving cash available for margin fluctuations and new setups.

Diversify across pairs while keeping cash available

Leverage helps you spread risk across pairs instead of loading one idea. Your account stays more liquid because you only post margin.

- Multiple small positions. You can run 3 to 6 smaller trades with defined stops instead of 1 oversized trade.

- Pair selection matters. Liquidity and spreads affect costs and slippage. Start with high-liquidity majors and see our best forex pairs for beginners.

- Operational benefit. You can rebalance faster when one pair hits a stop or when volatility shifts.

Access short-term moves where unleveraged returns are minimal

FX often moves in small daily ranges. Unleveraged returns can look tiny, even when you trade well. Leverage can make those moves meaningful in dollar terms.

| Move | Position size | Pip value (approx.) | P/L for 10 pips |

|---|---|---|---|

| EUR/USD +10 pips | 0.10 lot (10,000 units) | $1 per pip | $10 |

| EUR/USD +10 pips | 1.00 lot (100,000 units) | $10 per pip | $100 |

You still need strict sizing. Costs, spreads, and slippage hit harder when you trade short timeframes and larger size. Leverage helps the math, but it does not change the market.

Cons, Risks, and When Leverage Becomes Dangerous

Amplified losses and faster drawdowns

Leverage multiplies your exposure. It does not cap your losses.

Your profit and loss moves with position size. A small adverse move can damage your account fast when you trade large lots.

| Account equity | Position size | Pip value (approx.) | -50 pips P/L | Loss as % of equity |

|---|---|---|---|---|

| $1,000 | 0.10 lot | $1 per pip | -$50 | 5% |

| $1,000 | 1.00 lot | $10 per pip | -$500 | 50% |

A few losing trades at oversized risk can push you into a drawdown you cannot recover from with normal win rates.

Margin calls and stop-outs, how they happen

Your broker sets aside margin to keep your leveraged trade open. As price moves against you, your equity drops. Your usable margin shrinks.

- Margin call means your account no longer has enough free margin to support your open positions. Your broker warns you, limits new trades, or asks you to add funds.

- Stop-out means your broker starts closing positions to protect the margin loan. It often closes the largest losing position first. It can happen fast in a spike.

High leverage raises the chance that a normal pullback triggers forced liquidation. Learn the mechanics in margin call vs stop out.

Overtrading and psychological pressure

Leverage makes it easy to take more exposure than your plan allows.

- You scale up after a win and give it back on the next move.

- You add positions to recover losses and increase total risk.

- You tighten stops to avoid losses, then get stopped out by noise.

- You hold losers longer because the loss feels temporary, until it is not.

These are behavior problems. Leverage makes the consequences immediate.

Hidden cost magnification

Costs scale with size. Leverage lets you trade bigger size, so the bill grows.

- Spreads increase your breakeven distance. With larger lots, each pip of spread costs more.

- Commissions charge per lot. More lots mean higher fixed costs per trade.

- Slippage hits harder during fast moves. Your stop can fill worse than planned, and the loss grows with position size.

- Overnight financing can add up if you hold leveraged positions for days or weeks, especially in high rate differentials.

On short timeframes, spreads and slippage can dominate your edge. On longer holds, financing can turn a flat trade into a net loss.

Tail risks, volatility spikes, news events, and weekend gaps

Leverage becomes dangerous when price can jump. You cannot control fills during gaps and spikes.

- High impact news can move major pairs dozens of pips in seconds. Stops may fill far from your level.

- Liquidity drops around rollovers, holidays, and session changes. Spreads can widen and trigger stops or margin events.

- Weekend gaps can open beyond your stop. The platform may close you at the first available price, not your stop price.

In these conditions, high leverage can turn a planned small loss into a large one, or into a margin stop-out before you can react.

Risk Management: Using Leverage Responsibly

Set a maximum risk per trade

Leverage controls how fast losses hit your account. Your risk rule controls how large those losses can get.

Many traders cap risk at 0.5% to 2% of account equity per trade. It keeps a normal losing streak survivable and reduces the chance of a margin event.

- 0.5% suits high-frequency systems, news-sensitive pairs, or small accounts.

- 1% fits most swing and intraday approaches.

- 2% raises drawdown speed. Use it only with proven stats and tight discipline.

Risk per trade should set position size. Do not set size first and hope the stop will hold.

Place stops logically, not by arbitrary pips

Stops should sit where your trade idea fails. Use market structure, not a fixed number of pips.

- Structure-based stop, beyond a swing high or low, beyond a breakout level, or outside a range boundary.

- Volatility-aware stop, wide enough to survive normal noise, then sized so the account risk stays within your limit.

- Avoid round-number stops if they sit inside obvious liquidity zones.

Then size the trade from your stop distance and your risk cap.

Keep a margin buffer

High leverage breaks accounts through margin mechanics. Track free margin and margin level every session.

- Free margin is what you have left to absorb drawdown and spread widening.

- Margin level is equity divided by used margin, shown as a percent on most platforms.

- Set your own threshold before the broker does. Many traders reduce exposure if margin level drops near 200%, and stop adding risk long before 100%.

| Metric | What it signals | Action you control |

|---|---|---|

| Free margin shrinking | Less room for adverse moves and spread spikes | Cut size, close partials, avoid adding positions |

| Margin level falling | Rising chance of forced liquidation | Reduce exposure early, before broker thresholds |

Do not run your account near the edge. A wider spread can turn a stable position into a stop-out.

Adjust exposure for volatility

Volatility changes your real risk. Keep risk constant by changing size.

- Use ATR to estimate typical movement. If ATR rises, widen the stop or reduce size, often both.

- Use a news filter for scheduled releases that spike spreads and slippage.

- Reduce size when liquidity drops, when correlations rise, or when you hold multiple trades that behave like one trade.

Be stricter on pairs that spike more. This matters even more in thin markets and in less liquid instruments. See major vs minor vs exotic currency pairs if you trade beyond the majors.

Use limit orders, avoid thin liquidity

Market orders can fill worse than you expect. Leverage makes that worse fill matter.

- Use limit entries when you can. You control price, you reduce negative slippage.

- Use stop orders with caution in fast markets. They can gap through your trigger and fill far from your plan.

- Avoid thin-liquidity windows like rollovers, holidays, and session transitions. Spreads widen and stops trigger more often.

- Do not hold oversized risk into weekends if your broker does not guarantee stops. Gaps can bypass your stop price.

How to Choose the Right Leverage for Your Trading Style

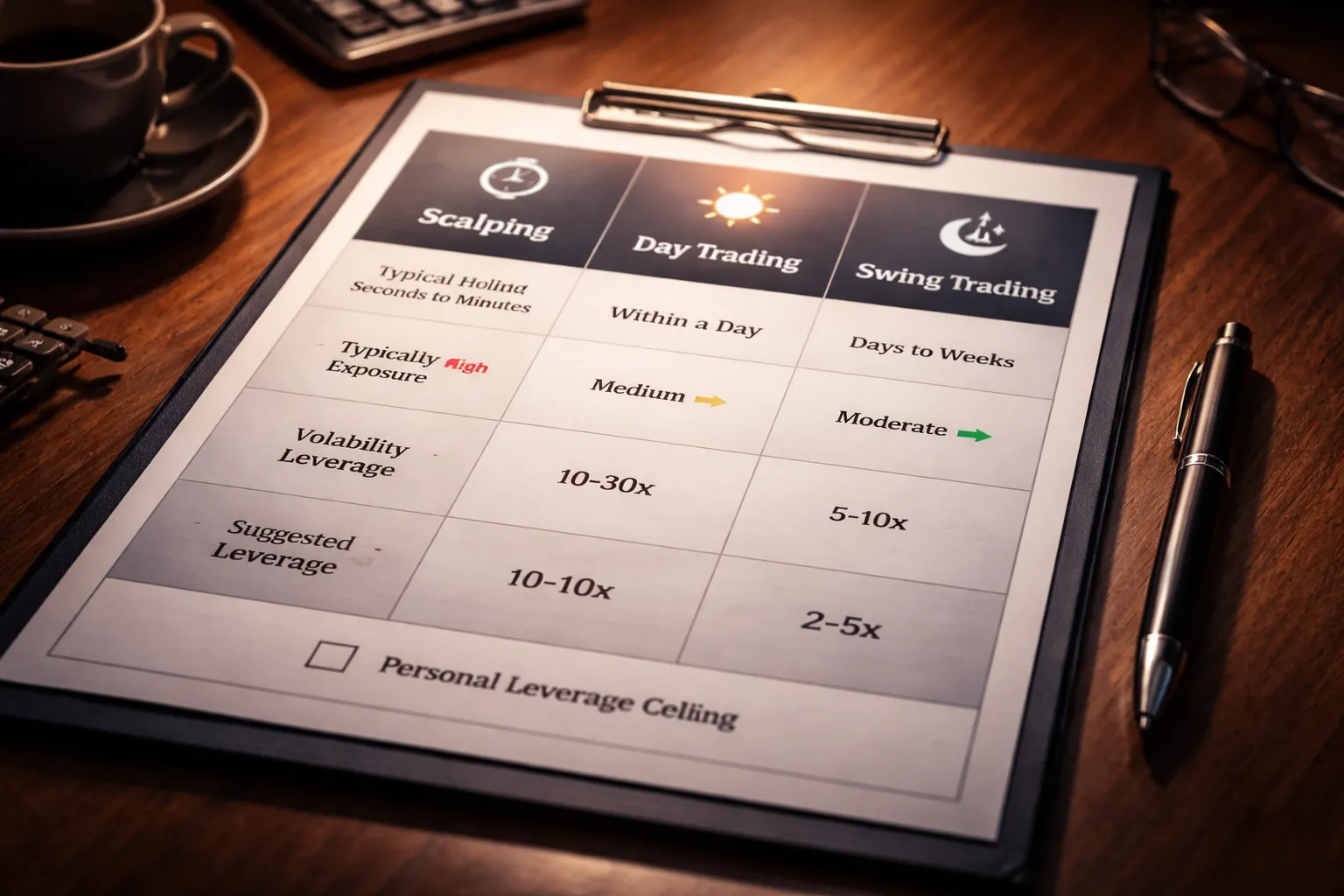

Match leverage to your holding time

Your trading style sets your exposure time. More time in the market means more chances for price to move against you. Set leverage so a normal adverse move does not force you out.

- Scalping: Spreads and execution matter more than leverage. You take many trades, so costs compound. Use low to moderate leverage. Keep position size small enough to survive sudden spread spikes and fast pulls.

- Day trading: You hold through intraday swings and news bursts. Use moderate leverage. Size so your stop distance fits normal volatility for the session, not your margin limit.

- Swing trading: You hold through multi-day ranges, rollovers, and gaps. Use low leverage. Wider stops and longer exposure make high leverage fragile. One gap can erase weeks of gains.

Choose leverage based on the pair you trade

Leverage multiplies the impact of volatility. Pair selection decides how violent that volatility can get and how stable your spreads stay.

- Major pairs: Often tighter spreads and deeper liquidity. That supports cleaner execution. You can usually run slightly higher leverage than on thinner markets, but you still cap risk per trade.

- Minor pairs: Spreads widen faster in news and off-hours. Assume worse fills. Use less leverage than you would on majors.

- Exotics: Wide spreads, sharp gaps, and poor liquidity. Stops can slip hard. Use minimal leverage or avoid them. Many accounts fail here because costs and volatility stack.

Account size realities that push you into excess leverage

Small accounts feel pressure to “make it worth it.” That pressure leads to oversized positions. Leverage makes that easy. It also makes drawdowns unrecoverable.

- Small balances amplify emotions. You widen risk to chase meaningful dollar gains.

- Spreads and commissions hit harder. A few losing trades plus costs can cut your equity fast.

- Margin looks like buying power. It is not. Your real limit is the loss you can take before you change your behavior or hit a broker threshold.

Fix the problem at the source. Lower your targets, trade smaller, or add capital later. Do not use leverage to force income from an underfunded account.

A checklist to set your personal leverage ceiling

- Define your max loss per trade. Pick a fixed percent of equity you can repeat without tilt. Many traders stay at 0.25% to 1%.

- Set your stop distance first. Base it on pair volatility and structure. Do not set it based on how much margin you have.

- Convert risk into position size. Use lot size, pip value, and stop distance to calculate units. If you need a refresher, read our guide on lot size in forex.

- Back into leverage from position size. If the position implies high leverage, reduce size. Do not “accept” the leverage because the platform allows it.

- Stress test your plan. Assume 2x normal spread at entry and exit, plus extra slippage. If that breaks your risk cap, your leverage is too high.

- Account for overnight and weekend risk. If you hold trades, cut leverage. Gaps ignore stops and spike margin usage.

- Set a hard leverage limit. Decide a maximum effective leverage you will not exceed, even on your best setup. Keep it the same across trades.

- Monitor margin level. Leave a large buffer. If one routine move can trigger a margin call or forced close, your leverage is too high.

- Review after 50 trades. If your drawdowns feel unmanageable, cut leverage. If execution costs eat results, cut leverage or switch pairs.

Common Mistakes and Myths About Forex Leverage

Myth: “Higher leverage means higher returns”

Leverage does not create an edge. It magnifies your position size.

Your return comes from price movement relative to your account size. That is sizing, not the leverage setting.

- Same trade, same risk, different leverage. If you risk 1% per trade, your result depends on your stop distance and position size. A 10:1 or 50:1 cap does not change the math if you size correctly.

- Higher leverage mainly changes your margin used. It lets you open the same position with less required margin. That can tempt you to oversize.

- Oversizing is the real problem. If you double position size, you double your gains and losses. Most blowups come from sizing too big, not from the broker offering 100:1.

Mistake: Confusing margin with a safe amount to lose

Margin is a deposit. It is not your max loss.

Your loss can exceed the margin posted if price moves to your stop, slips past it, or gaps.

- Margin used is not risk. Risk equals position size times stop distance, plus slippage and costs.

- Low margin does not mean low danger. High leverage lowers margin used. Your risk stays high if your stop is wide or your position is large.

- Watch margin level, not just margin used. If normal intraday noise can push you near a margin call, you sized too big.

Mistake: Ignoring correlation and stacking exposure across pairs

You can spread trades across pairs and still place one big bet.

Many pairs move together because they share the same drivers. USD risk, risk on sentiment, and carry flows.

- Same currency, repeated exposure. Long EURUSD and long GBPUSD both short USD. You concentrate USD risk.

- Correlated crosses can double count risk. Long AUDJPY and long NZDJPY often rise and fall together. Your JPY exposure stacks.

- One move can hit all positions at once. When correlation spikes, diversification disappears. Your margin level drops fast.

- Fix it with a portfolio view. Cap total exposure per currency. Treat highly correlated pairs as one position for risk purposes.

Mistake: Widening stops to avoid margin calls and increasing risk

A wider stop does not solve leverage. It increases loss size unless you cut position size.

If you widen stops while keeping the same lot size, you increase your dollar risk per trade.

- Stop distance drives position size. Pick your risk in dollars first, then set lot size based on stop distance.

- Margin pressure signals oversizing. If you need a wider stop just to keep a trade open, you took too much size for your account.

- Use the correct fix. Reduce position size, reduce number of open positions, or trade a less volatile pair.

- Track risk in pips and dollars. If you do not know your pip value, you cannot control leverage. Use a quick refresher on what pips are and how they translate into profit and loss.

Leverage Rules, Broker Policies, and Account Types

Typical retail leverage caps by jurisdiction

Your broker cannot offer unlimited leverage in many regions. Regulators set caps, and brokers must follow them.

- UK and EU (FCA, ESMA): Often capped at 30:1 on major FX pairs, 20:1 on non-major pairs, 10:1 on commodities, 5:1 on equities.

- Australia (ASIC): Often capped at 30:1 on major FX pairs, 20:1 on non-major pairs, 10:1 on commodities, 5:1 on equities.

- US (CFTC, NFA): Often capped at 50:1 on major FX pairs, 20:1 on non-major pairs.

- Offshore brokers: You may see 200:1, 500:1, or higher, with fewer protections and looser enforcement.

These are typical retail caps, not a promise. Each broker sets its own limits inside the rules. Some brokers cap leverage further by account size, instrument, or trading history.

Also note the difference between what you can select and what you can use. If margin requirements rise, your effective leverage drops even if your account setting stays the same.

Why leverage can change during major events

Brokers can raise margin requirements fast. That reduces the maximum leverage you can run. They do this to control gap risk and liquidity risk.

- News and scheduled events: Central bank decisions, CPI releases, jobs reports.

- Weekend and session gaps: Markets can reopen far from the last price.

- Low liquidity periods: Rollovers, holidays, late Friday, early Monday.

- High volatility: Sudden moves can break normal stop execution.

In practice, the broker may increase margin on specific pairs, widen the required margin only for new positions, or increase it for all open positions. If the new requirement pushes your margin level too low, you can get a margin call or forced liquidation.

Read the broker’s margin policy. Look for terms like dynamic margin, event margin, increased margin, and close-only mode.

Negative balance protection, what it does and doesn’t prevent

Negative balance protection aims to stop your account from going below zero. If a violent move or gap skips your stop and your losses exceed your deposit, the broker should bring your balance back to zero under its policy.

- It can help with: Gap risk, fast markets, and slippage that blow through your stop.

- It does not prevent: Stop-loss slippage, spread spikes, requotes, partial fills, or forced liquidation due to low margin.

- It does not fix: Oversizing. You can still lose your full deposit.

Coverage depends on where you live and which entity holds your account. Some offshore brokers advertise protection but apply exceptions in their terms. Confirm it in the client agreement and product disclosure.

Demo vs live trading differences in fills and slippage

Demos teach platform basics. They do not fully match live execution.

- Fills: Demos often assume perfect liquidity. Live markets can reject, partially fill, or fill at worse prices.

- Slippage: Demos may show less slippage. Live slippage rises during news, rollovers, and low liquidity.

- Spreads: Demo spreads can look stable. Live spreads can widen fast, especially around events.

- Latency: Your internet, broker routing, and server load matter live. Demos often feel faster.

- Stops and limits: In live trading, stop orders become market orders when triggered. They fill at the best available price, not your stop price.

Test your strategy on a small live account before scaling. Track average slippage, spread at entry, and spread at exit. If you cannot compute pip impact, use this refresher on what pips are.

FAQ

What is forex leverage in one line?

Leverage lets you control a larger position with a smaller deposit called margin. A 30:1 limit means $1 of margin controls up to $30 of notional value. Your profit and loss still move with the full position size.

Is leverage the same as margin?

No. Leverage is the ratio of exposure to equity. Margin is the cash your broker locks to open and keep the trade. Higher leverage lowers required margin, but it does not cap your loss.

How do you calculate leverage on your account?

Use effective leverage. Divide total open notional value by account equity. Example, $50,000 exposure and $2,500 equity equals 20:1. Track it per trade and across all positions.

How much margin do you need for a forex trade?

Margin equals notional value divided by leverage. A $100,000 position at 30:1 needs about $3,333 margin. Add a buffer for spread, slippage, and drawdown so you avoid forced liquidation.

What is a margin call and when can it happen?

A margin call happens when equity falls near the broker’s maintenance requirement. At that point the broker can close positions. Triggers differ by broker, but fast moves, wide spreads, and weekend gaps cause most events.

What leverage should a beginner use?

Use low effective leverage. Many beginners stay under 5:1 until they can size positions, survive normal volatility, and keep risk per trade small. High headline leverage does not mean you should use it.

Does higher leverage increase risk?

Yes. Higher leverage amplifies drawdowns and makes small price moves hit your stop faster. It also reduces margin buffer, which increases margin call risk during spread widening or slippage.

Can you lose more than your deposit with forex leverage?

Yes, in some cases. Sharp gaps or extreme volatility can fill stops worse than expected. With negative balance protection, losses usually stop at zero. Without it, you may owe the broker.

Does leverage change pip value?

No. Pip value depends on pair, position size, and account currency. Leverage changes how much margin you post for that position size. If you cannot compute this, use this position sizing guide.

Why does leverage feel different on demo vs live?

Live trading includes real spreads, execution delays, and slippage. Demo fills often look cleaner. With leverage, small fill differences matter more. Track spread at entry and exit, and average slippage in pips.

What is a simple leverage example?

You have $1,000 equity and open $20,000 EUR/USD. Your effective leverage is 20:1. A 1% move against you loses about $200 before costs. That is 20% of your equity, plus spread and slippage.

Conclusion

Leverage does one thing. It multiplies your exposure. It also multiplies your mistakes.

Margin is not a cost. It is collateral. Your real risk comes from position size, stop distance, and execution costs.

- Know your effective leverage on each trade, not just your account maximum.

- Plan the loss first. Set a stop, then size the trade so the stop-out equals your max risk per trade.

- Account for costs. Spread and slippage hit harder when leverage is high.

- Hold more free margin. It reduces forced exits during fast moves.

Final tip. Build every trade from position size, not from margin available. Use a sizing formula and treat leverage as a limit, not a target. See position sizing for the step-by-step math.

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

3 days ago -

What Is a Lot Size in Forex? Lot Types + Quick Examples

3 days ago -

What Are Pips in Forex? Definition, Examples & Why They Matter

3 days ago -

Forex Market Hours & Trading Sessions Explained (Best Times to Trade)

3 days ago -

What Is Forex Trading? A Beginner’s Guide to How It Works

3 days ago

-

-

- Example 1: 30:1 leverage on EUR/USD with a $1,000 account (profit and loss outcomes)

- Example 2: Same account, different stop-loss size, how risk changes without changing leverage

- Example 3: High leverage with small position sizing (why leverage doesn’t force high risk)

- Example 4: Gap and slippage scenario (why stop-losses aren’t guaranteed in fast markets)

-

- What is forex leverage in one line?

- Is leverage the same as margin?

- How do you calculate leverage on your account?

- How much margin do you need for a forex trade?

- What is a margin call and when can it happen?

- What leverage should a beginner use?

- Does higher leverage increase risk?

- Can you lose more than your deposit with forex leverage?

- Does leverage change pip value?

- Why does leverage feel different on demo vs live?

- What is a simple leverage example?

-

-

-

- Example 1: 30:1 leverage on EUR/USD with a $1,000 account (profit and loss outcomes)

- Example 2: Same account, different stop-loss size, how risk changes without changing leverage

- Example 3: High leverage with small position sizing (why leverage doesn’t force high risk)

- Example 4: Gap and slippage scenario (why stop-losses aren’t guaranteed in fast markets)

-

- What is forex leverage in one line?

- Is leverage the same as margin?

- How do you calculate leverage on your account?

- How much margin do you need for a forex trade?

- What is a margin call and when can it happen?

- What leverage should a beginner use?

- Does higher leverage increase risk?

- Can you lose more than your deposit with forex leverage?

- Does leverage change pip value?

- Why does leverage feel different on demo vs live?

- What is a simple leverage example?

-

-

What Is Forex Trading? A Beginner’s Guide to How It Works

3 days ago -

How Does the Forex Market Work? (Participants, Pricing & Execution)

3 days ago -

Forex Trading vs Stock Trading: Key Differences, Pros & Cons

3 days ago -

Spot Forex vs Futures vs Options: What’s the Difference?

3 days ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

3 days ago

-

How Does the Forex Market Work? (Participants, Pricing & Execution)

3 days ago -

Forex Lot Size Calculator: How to Use It to Size Trades Correctly

5 days ago -

What Is a Lot Size in Forex? Lot Types + Quick Examples

3 days ago -

What Are Pips in Forex? Definition, Examples & Why They Matter

3 days ago -

Is Forex Trading Legal in the United States? Rules, Regulators & What to Know

3 days ago